Imagine if you could track your spending, make payment on the spot, do instant peer to peer transfer, mobile reloads and pay bills with just an app?

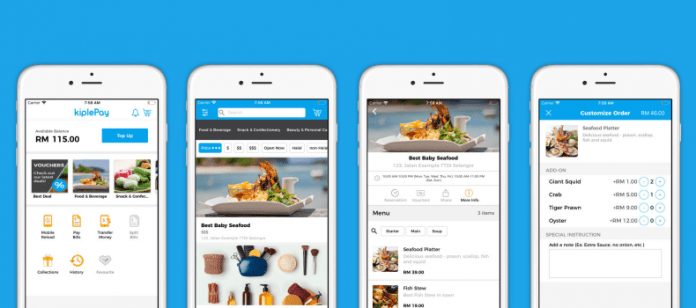

Wonder no more, as there’s a mobile app called kiplePay, by Webonline Dot Com Sdn Bhd (a subsidiary of Green Packet Bhd), that allows you to make financial transactions online in real-time so consumers wouldn’t have to worry about leaving their wallet at home. With the app, users are able to make on-the-spot payments, instant peer to peer transfers, mobile reloads and pay bills while getting instant cashbacks or rebates.

“The name ‘Kiple’ is based on the words ‘keep’ and ‘ripple’, highlighting the fact that you can keep your money but still have the ability to use it whenever you want to while watching the ‘ripple’ effects of your transactions increase the value of your existing currency,” explains Kay Tan, Chief Executive Officer of Green Packet Bhd.

For those needing help managing their finances, the app also allows you to track your spending by putting up reminders and saving targets on the go.

With the thought that most millennials prefer digital payments over cash compared to any other age groups, more and more businesses are now accepting e-cash payments. That is why kiplePay ensures that the data and finances of the users are as secure as it can be.

“No payment goes through until and unless you approve the transaction with your fingerprint or a six-digit security pin. We have layered security features for different types of transactions, with another layer of added security to address app repackage attacks,” assures Tan.

Being one of the first to launch the unique Pay@Table feature in the digital payment market, kiplePay is also a proud enabler and avid supporter of Bank Negara’s blueprint of reducing cash in circulation and increase the overall electronic payment usage and transactions.

“Since we are targeting more than 800,000 user downloads by the end of 2018, we also have a number of very interesting features coming up this year. But I wouldn’t want to ruin the surprise now,” he adds.

By Tara Yean This article was originally published in Business Today May 2018 issue.