Local demand will result in greater investment in Asian storytelling and production

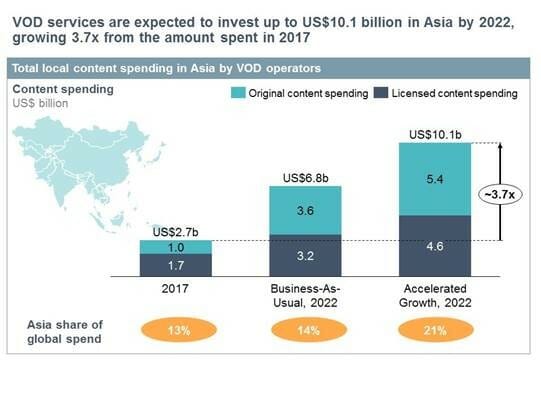

According to a report released by strategy and economics consulting firm AlphaBeta, titled “Asia-On-Demand: The Growth of Video-on-demand Investment in Local Entertainment Industries,” video-on-demand (“VOD”) services are expected to invest up to US$10.1 billion (RM42.4 billion) in Asia by 2022, growing 3.7x from the amount spent in 2017. The study also found that Asian consumers of VOD services continue to show a strong appetite for local content; prompting industry players to focus on becoming more locally relevant.

Around US$4 billion of this expected investment will be in the form of foreign direct investment by global players. Additionally, the economic impact VOD players will have is expected to be more than 3x the amount spent on investment. This is especially when considering direct spending within the industry on core operations (e.g. equipment, transport, catering, marketing, hospitality, etc.), which in turn drives indirect spending by suppliers (e.g. camera lenses, catering, transport fuel, etc.), and induced spending from workers employed spending their wages in the economy. Up to 736,000 jobs could also be created by this spending in 2022; and there may be spillover benefits to other industries, such as tourism, music, or merchandised products.

At the same time, the study found that the number of paying subscribers in Asia is expected to double in five years, and that viewers in Asian countries have a strong appetite for high quality local content. To meet this growing demand, VOD services will have to become more locally relevant; driving investment to develop more high quality local content to attract and retain subscribers.

Commenting on the report, Konstantin Matthies, AlphaBeta Engagement Manager said, “Given its nascency, the economic impact of VOD services in Asia – particularly in the entertainment industry – has received limited attention to date. This research aims to fill this gap by providing a fact base on the industry’s potential value. The report further identifies best practices, alongside key policy actions to ensure Asian countries can capture this opportunity.”

He added, “As the VOD industry grows in Asia, demand for locally relevant content will drive players to spend a meaningful part of this investment in stories from the region. This is contrary to perceptions that VOD’s easy access to foreign (i.e. Hollywood) content would reduce local demand and dilute cultural values. With strong consumer demand for local content, VOD players will have to increasingly provide high-quality local content to align with these preferences.”

The report outlines seven key findings:

- Video-on-demand (VOD) services are expected to invest up to US$10.1b in Asia by 2022.

- Demand for local content will drive investment, with an emphasis on quality over quantity.

- VOD makes it easier for Asian entertainment to reach over 450 million people globally.

- The economic impact is expected to be 3x the amount VOD players spend on content.

- Further benefits to local industry could be realized in the form of financing production hubs, skills upleveling, low-cost distribution, and global partnerships.

- Different Asian countries have the opportunity to specialize and capture value at different points of the content production value chain e.g. VFX or physical production hubs.

- Over 80% of VOD executives cite a welcoming investment environment, supportive regulations, and high-quality content production infrastructure as key to driving content investment.

The report also outlines several recommendations for Asian policymakers to take full advantage of the VOD industry as a runway for innovation and investment:

- Adopting a collaborative approach with VOD players.

- Creating flexible regulation.

- Investing in the local ecosystem.