As digital payments become more and more widespread, Infinitium looks to

enhance usability and security through biometric authentication

The global explosion of digital and mobile payments is driving the need for a more secure authentication system. Technological advances continue to challenge banks and financial service providers to migrate to new authentication systems that meet the twin objectives of tightening payment security and improving user experience.

Enter Infinitium Group of Companies, a homegrown regional electronic payment solutions provider that believes biometric authentication may be the answer.

“ I n f i n i t i u m is a 21 year-oldcompany which was set up in 1997. We are known in the market today as an online payment specialist. We focus on key areas such as payment security, payment processing as well as authentications.”

Biometric Authentication is a security process that relies on the unique biological characteristics of an individual such as facial recognition and fingerprint scanning to verify the person is who he says he is.

Recently, Infinitium partnered with Korea’s Raonsecure, a leading provider of biometric mobile security based on Fast Identity Online (FIDO) standards to bring its FIDO-certified biometric authentication platform to Malaysia.

This paves the way for biometric technology as an emerging methodology for payments as it increases usability by providing better user experience, and stronger security through the reduction of fraud.

INFINITIUM’S SUCCESSES

Infinitium, by and of its own, has had a string of achievements to its name in the preceeding years, although it may be little known. The company has pioneered several first-to-market innovations that continue to drive the boom of e-commerce and mobile-commerce. For example, for card-notpresent (CNP) transactions, the all-familiar 6-digit code (One-Time-Password) consumers use to authorise transactions is a technology pioneered by Infinitium almost 10 years ago. The technology was recently patented. Nowadays, the likes of Tap & Pay and QR Pay probably ring a bell, but the technology behind it is where Infinitium’s domain lies.

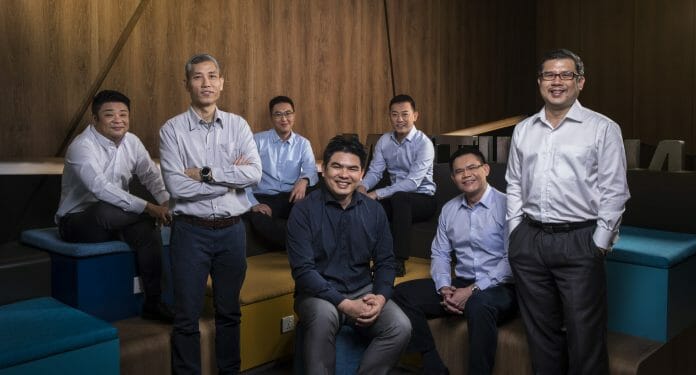

Business Today had a chat with Ho Ching Wee, founder and CEO of Infinitium Group of Companies to hear him speak about the company, its direction and its latest innovations, in particular, the adoption of biometric solutions for the e-payment space which the company is planning to launch in the first quarter of 2019.

WHAT IT MEANS TO THE LAYMAN

When you go online shopping today, typically, you will go to the website, pick the product you want, then key in your credit card, debit or prepaid card which will be in the form of Visa, Mastercard, Amex, Japan Credit Bureau (JCB) and Union Pay. These are the five different schemes which Infinitium supports.

HOW IT WORKS

When it comes to payment processing, the merchant will send the information to the acquiring bank, or the bank that processes credit or debit card payments on behalf of the merchant. Today, we provide payment gateways for acquiring banks where we process their online payments for them.

When it is their own card, these banks will process their own payments but if it is not their own card, they would send it to Visa, Mastercard, Amex, JCB, and so on. However, with Visa, Mastercard, Amex and JCB being schemes, they would then route it to the issuing bank.

The issuing bank in this case is the bank that issued the card to the card holder. When the issuing bank receives the information, the first thing they would do is to authenticate it such as whether you the card holder or not.

AUTHENTICATION SERVICES FOR BANKS

This is where the second part of what we do comes in. We provide authentication services on behalf of the banks. In Malaysia, there are fifteen banks that are using our solution.

Across the region, we operate in six different countries: Malaysia, Indonesia, Singapore, Philippines, Vietnam and India where there are fifty banks that we do authentication for.

This means, every month on average, we do about twelve million authentications.

Out of these fifty banks, there are about one hundred and eighty million cardholders, so any time this one hundred and eighty million buy online, chances are, they are using our

authentication service.

BIOMETRIC AUTHENTICATION

One of the current methods of authentication when you buy online is through the One-Time Pin (OTP) which has been the method for the last ten years. With so much development in the mobile space, and the growth of the millennial population in the workforce, doing most of their spending via their mobile devices, we will be introducing something new called biometric authentication.

The idea here is that instead of just receiving OTP over the smartphone, you can now use fingerprint or face recognition as a method of authentication. With biometric authentication, we will be verifying the algorithm sent to us in real time.

“There are four pilot banks testing this out currently. Two are in Malaysia and two in Indonesia. We hope that by Q1 2019, this will start to roll out and consumers in Malaysia can experience biometric authentication. This is one of the cool things we will be looking at.”