Embracing new growth strategies in the face of major shifts and emerging technologies is becoming increasingly crucial for Malaysian companies to be able to compete locally and expand to ASEAN markets, according to a Standard Chartered thought leadership report.

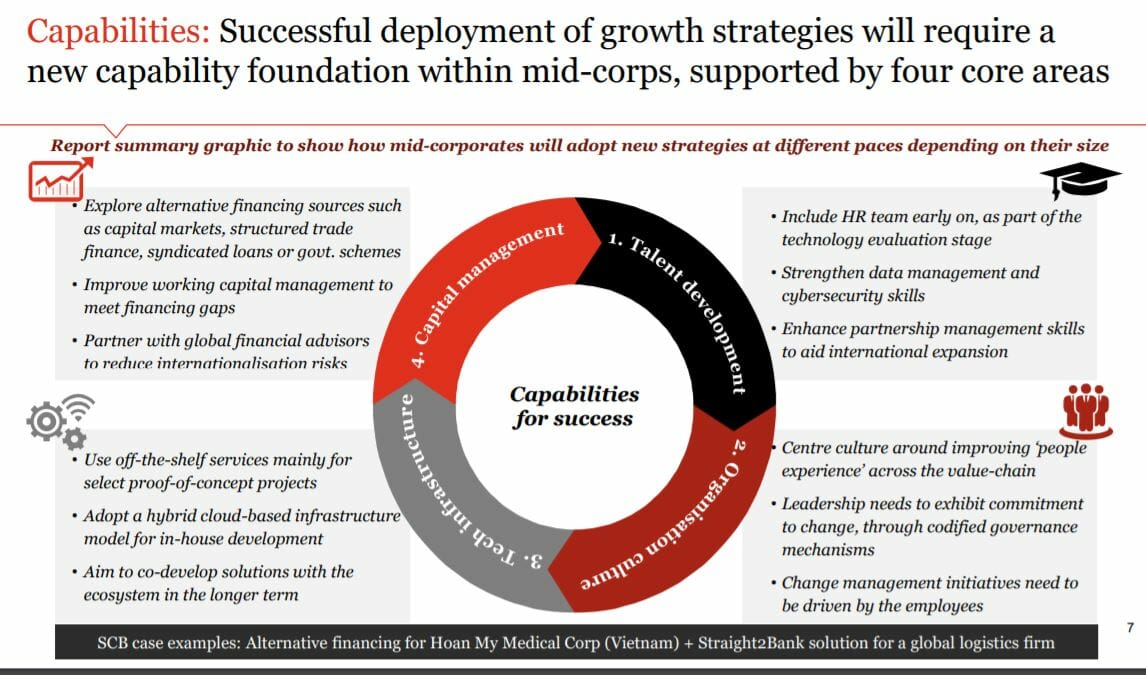

The “ASEAN – a region facing disruption” report also identifies talent, culture, technology,

and capital management as key enablers to support the development of these new

strategies.

The challenge for Malaysian mid-corporates going forward will be how to remain competitive, productive and relevant via three key growth strategies:

• Smart operations: New technologies such as industrial internet-of-things, 3D printing

and blockchain-enabled contracts can improve productivity, optimise supply chain, and

enable more efficient project execution.

• Digital go-to-market: Solutions including micro-segmentation, geo-targeting, and

augmented reality can make touchpoints across the customer journey more targeted and

personalised. They can also optimise the distribution functions to drive process efficiency

and flexibility.

• Cross-border expansion: New sourcing avenues, delivery of products to new market

segments, and entering partnerships can strengthen business growth.

Medium-sized companies account for 98.5 percent of Malaysia’s businesses, 89.2 percent of

which is comprised mainly from the Services sector and 5.3 percent from the Manufacturing sector.

Acting as key suppliers to established global brands and as fast-growing businesses competing for access to the end consumer, mid-sized companies will need to

play a major role in realising ASEAN’s future growth ambition.

As the world’s fifth largest economy, ASEAN will remain a high opportunity market. ASEAN’s

GDP rose to USD 2.89 trillion in 2018, and is expected to surpass the USD 4 trillion mark by 2023. Malaysia’s steady growth in trade with ASEAN is evidenced by its consistent top 20 ranking in the DHL Global Connectedness Index.

Specialised regional partners, including international banks with a well-connected network to finance investments and fund cross-border business expansions can act as growth catalysts to help mid-sized firms explore new sources of finance.

Abrar A. Anwar, Managing Director and Chief Executive Officer, Standard Chartered

Malaysia, said: “Mid-sized companies are crucial engines of economic growth and job

creation across ASEAN, and are increasingly active in global trade. These firms will benefit

from banks with multiple market presence to be able to navigate through new business

environments.”

He adds, “As Malaysia’s first bank with 144 years in the country, Standard Chartered has an unrivalled knowledge of the local market and understands the important role of mid-

corporates in growing the Malaysian economy and their banking needs. We have helped companies internationalise and grow through our network capabilities, market knowledge

and expertise – elements that are crucial for expanding businesses overseas.”

The Report is commissioned by Standard Chartered and carried out by PwC. Find out

more at http://www.sc.com/en/banking/asean.