Malaysia experienced a decline in the demand growth for banking and finance executives during April, as per the latest Monster Employment Index. The country recorded a one percent year-on-year upturn for the month, which is significantly lower than the 15 percent growth number it recorded in March.

The Monster Employment Index (MEI) is a monthly gauge of online hiring activity across Singapore, Malaysia and the Philippines, tracked by Monster.com. It comprises data for overall hiring activity in each country, as well as specific data in the banking and finance sector.

Singapore’s BFSI industry also experienced a slight decline in monthly demand growth, recording 26% year-on-year demand rise in April, compared to 28% y-o-y in March.

The same was also true of the Philippines, which reported 13% year-on-year growth in April, down 2 points from March’s 15% number.

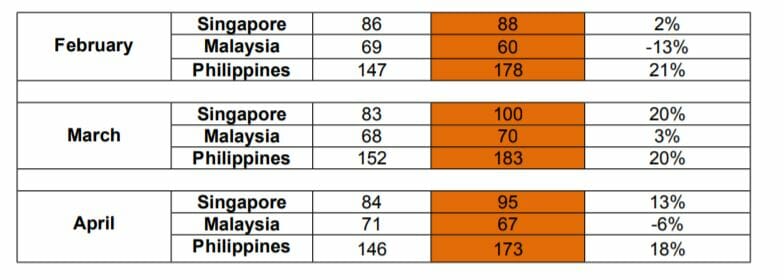

When looking at finance & accounts roles, the Philippines experienced the most notable increase in demand in April, with an 18 percent year-on-year growth for the month. This was followed by Singapore, which saw 13 percent annual demand growth in April. On the flip side, Malaysia witnessed a decrease in demand between April 2018 and April 2019, noting a six percent decline for the month. This figure was lower than the previous month during which the occupation saw a three percent year-on-year rise.