Hong Leong Bank Berhad (‘HLB’ or ‘the Bank’) reveals the growing customer adoption of its digital platforms and unrelenting focus on driving the country’s cashless movement forward by providing convenience as a core value within its entire suite of digital-led cashless ecosystem solutions for consumers and businesses.

Among the leading digital financial services institutions in the region, HLB revealed that 64.4 percent of its customers are now utilising digital and mobile platforms for banking transactions as at the end of 2018, an increase of more than 20 percent from last year, lending strength to the Bank’s digital aspirations and focus on being digital-at-the-core.

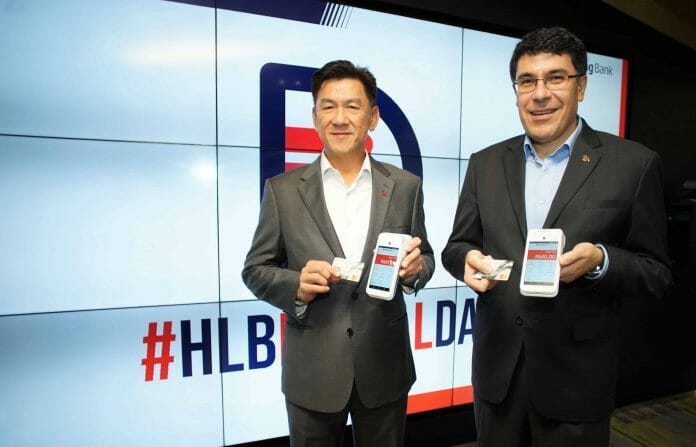

At the launch of the Bank’s third annual Digital Day, Domenic Fuda, Group Managing Director and Chief Executive Officer, said “The idank has been focused on delivering solutions that meet the needs, solve problems and remove frictions in the lives of its customers, be it the everyday consumers or business owners through digital transformation and innovation. Digital Day which marks the beginning of our Financial year, reinforce our commitment to enable digital banking for our customers through education, promotions and enablement in the areas of digital payments and cashless convenience.”

The focus to deliver simple, seamless and straightforward solutions to customers has seen the adoption of Internet and mobile banking, and other digital solutions, driving significant growth in cashless transactions across its entire customer base. “Where we normally would see younger users taking to technology, we have instead seen the growth coming from both younger and older users across all our digital products. We have also seen the average transaction value growing year on year as well as consumers come to trust and depend on these convenient solutions,” said Charles Sik, Managing Director of Personal Financial Services, Hong Leong Bank Berhad.

Speaking at a media session themed Bye-Bye Cash! No Cash No Problem: Cashless is Convenience, Fuda and Sik also discussed some of the findings of HLB’s internal research and trends in the industry at large.

For a cashless society to become a reality, there needed to be less focus on just transactional solutions that move money from physical cash to digital wallets. Instead, convenience, trust, security, and integration needed to be at the core of the general financial and digital payments space.

“Consumers are already making a conscious decision on how and what they use to transact, including when to still use some cash in their daily transactions. Consumers are increasingly aware that cashless is about convenience, peace of mind and ability to monitor where and what they spend on. We will continue to educate consumers and businesses in Malaysia on the benefits of embracing a reduction in cash usage and ultimately cashless transactions, by continuing to work with our partners to develop real and meaningful value-added propositions in the cashless ecosystem, that’s safe and easy for them to use,” Fuda explained.

Value-added Cashless Experience

As a further example of where digital payments embedded in the customer daily journey, the Bank is piloting a collaboration with WeEat, a WeChat mini programme for F&B solution in Malaysia where customers can order, pay and eat/enjoy their meals seamlessly, avoiding queues and long lines for order and payment.

This easy to use queue, order and payment solution can be used to manage both dining-in as well as take-outs, as WeEat will alert the customers when their food is ready for collection. Vendors can benefit from the analytical tools and data that can be used to analyse the performance of their business, from identifying hot items to rewarding loyal customers.

WeEat has been launched in DC Mall, Damansara City with selected vendors and, should the pilot prove successful, there are plan to introduce it to more vendors nationwide.

Apart from consumers and business, HLB is also looking at ways to enable communities, especially residential associations to become more digital and cashless. To this end, HLB is working with MyTaman to empower Taman Desa Resident Association (TDRA) to use WeChat Pay functionality at all merchants in the community, the first of such an effort in Malaysia.

Through this, consumers will also enjoy access to greater discounts and promotions, while merchants will enjoy greater hyperlocal marketing and sales benefits. The benefits of a HLB empowered community goes beyond promotions and sales however – the MyTaman app will see the creation of a community WeChat OA community account. This will allow greater inter-community communication for a greater sense of belonging, safety, and security.