By Dr Afzanizam, Chief Economist Bank Islam

In the past 18 months or so, the trade war, primarily between the two economic giants – the US and China- has been the source for economic and market instability. The trade friction has led the business sentiments to weaken, resulting in lower fixed asset investment. Exports growth were contracting at fast clip across Asia. But the consumers were generally unperturbed, at least for now. Given such orientation, the US economic growth has been quite decent with GDP for the fourth quarter expanding at the rate of 2.1 percent, essentially above what is deemed as longterm growth trajectory of 1.9 percent. Further breakdown showed that consumers were the main underpinning factor with contribution to the overall economic growth totalling 1.2 percentage points. That’s more than half of the economy. However, investment has been a drag, subtracting 1.08 percentage points.

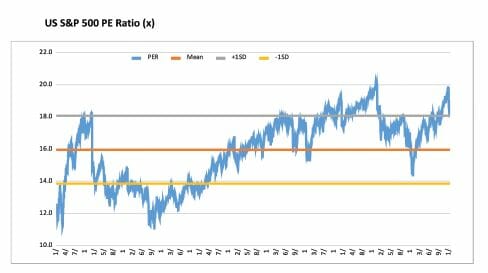

Against such a backdrop, the US economy is performing fairly good although one engine i.e. the consumer spending has been the main catalyst. So the US equities market were higher during the year despite the escalating trade tension which can vary in terms of the degree of aggression and hostility. The S&P 500 Index closed the year 2019 at 3,230.78 points. On January 2, 2020, it touched record high at 3257.85 points. The valuation was lofty nonetheless with Price-to-Earnings Ratio (PER) was well beyond the plus-one standard deviation. At one point, the prevailing PER stood at 19.8 times as of December 26, 2019, well above than the plus-one standard deviation PER of 18.0 times. Similarly, the Nasdaq Index which houses all the tech-heavy listed companies in the US went up to as high as 9,092.19 points as of January 2, 2020 with PER multiples of 25.0 times is way beyond the plus-one standard deviation of 23.2 time. And the US equities market have delivered the best returns globally last year.

Given this, it beg the question of how high can these indices go. Obviously, companies’ earnings have to grow more robust this year in order to compress the PER much lower. That will give the justification for the equity prices to move higher. However, the tell-tale signs may not be so supportive. Business community in the US has been increasingly cautious of its surrounding. The latest Institute for Supply Management (ISM) index for the manufacturing sector has declined to 47.2 points during the month of December from 48.1 points in the previous month. The index has been hovering below the 50-point demarcation line which separates the expansionary (above 50 points) and the contractionary (below 50 points) business environment. Based on the survey responses, respondents from the Computer & Electronics Products said that backlog orders were shrinking while players from Food, Beverage & Tobacco Products were seeing suppliers passing on costs associated with import tariff.

Similarly, the labour market in the US was not too rosy after all. According to the US Department of Labour (DOL), the four-week moving average for unemployment insurance (UI) weekly claims have risen to 233,250 as of December 28, 2019. The figure was the highest since January 27, 2018 when the weekly jobless claims stood at 235,750. Similarly, those who were unemployed and had been continuing to receive UI have also showed a rising trend with the four-week average rising to 1,711,750 on December 28, 2019 from the previous week level of 1,704,500. This would mean more Americans are seeking unemployment insurance claims and have remained in the programme.

The above scenario suggests that the US economy is expected to moderate. The most recent forecast by the US Federal Reserve in December 2019 showed that the US GDP is expected to record 2.0 percent growth in 2020, lower from an estimated 2.2 percent in 2019. The unemployment rate, on the other hand, is expected to go slightly lower from 3.6 percent in 2019 to 3.5 percent. However, the unemployment rate is envisaged to rise to 3.6 percent and 3.7 percent during 2021 and 2020 respectively. This indicates the Fed is increasingly cautious about the economic outlook. Judging from this, it would be difficult to say that the US equities market will continue to chart record high this year.

So where does that leave Malaysian equities? At the moment, there seems to be hope that our market would do well this year due to expected improvement in corporate earnings and commodity prices. At the same time, the government is expected to spend more following higher allocation for development expenditure and accommodative monetary stance by BNM. Despite that, major correction in the US markets, should it happen, could send the ripple effect to other markets in particular the emerging equities. This is given the fact that equities market across the globe are so interrelated and the US markets is obviously the primary driver. Therefore, invest wisely and keep a close tab on the US markets.