I feel strongly about writing on the concept of family wealth which can be linked to the notion of family office. However, before I dabble into family wealth and family office, I believe it is important for readers, particularly financial planners, to understand the basics of a family enterprise system. Why do we need to understand the family enterprise system? A simple reason is that the source of wealth and well-being for a family involved in business comes mainly from the assets and profits of the operating business.

The study of family business is actually a recognised academic field and discipline. In many countries around the world, family enterprises are key contributors to economic development and employment. Based on several reports churned by international private organisations, it is believed that no less than 70 percent of large companies and SMEs in Malaysia are family-controlled and owned. I think it is important to correct a mistake commonly made by Malaysians with regards to the term ‘enterprise’.

In Malaysia, the word ‘enterprise’ seems to be associated to a sole proprietor or partnership type of business. This is because when a business owner registers his or her business at the Companies Commission of Malaysia, he or she may be requested to use the term ‘enterprise’ in the name of the business. For example, “XYZ Enterprise”. It is very common to have the name of the sole proprietor ending with ‘enterprise’ as the business name, for instance, “Yusof Lestari Enterprise” or “YL Enterprise”. The fact is instead of ‘enterprise’, the sole proprietor or partnership can use ‘Ventures’, ‘Services’, etc. in its business name. Actually, the term ‘enterprise’ refers to any form of business establishment including those which are family-owned. Therefore, in this article, the terms ‘family business’ and ‘family enterprise’ are used interchangeably.

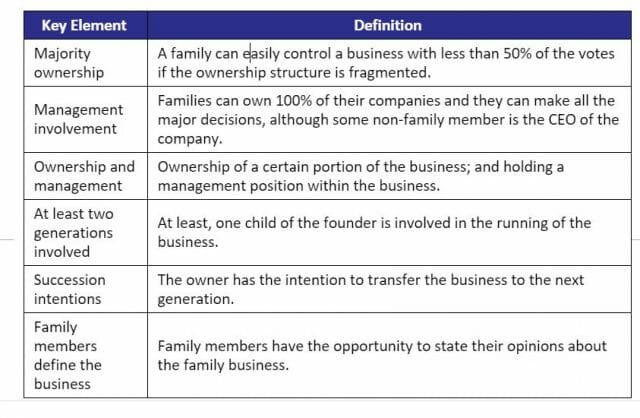

Dr. Leilanie Mohd Nor, CEO of BinaPavo, articulates there are several key elements influencing the definition of family business. The key elements with different types of family business definition is described in the table below.

Two elements that seem to be important are the intention to transfer the business to the next generation, and the statement by owners and managers that they themselves perceive the business as a family business. Some researchers and scholars regard the willingness to transfer the family business to the next generation as one of the key aspects in family business definitions. Thus, a question can be asked. Is a sole proprietor a family enterprise? Based on the key elements mentioned above, technically, a sole proprietor is not a family enterprise because the business is owned by an individual. Hence, if there is intention to pass over or transfer the business to the next generation, the owner should convert the sole proprietor into a partnership or a private limited company. The latter is encouraged for the purpose of longevity, wealth management and strategic planning for the family.

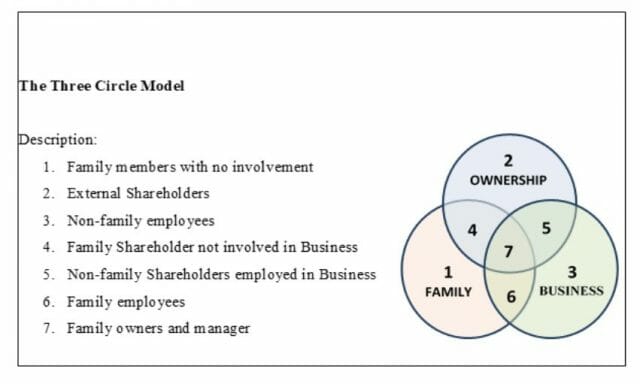

A globally established way of describing a family business is through the three-circle model of family business. This model was formulated by Professor John Davis and Professor Renato Tagiuri at Harvard Business School fourty years ago. Over time, the model was validated through research and case studies, refined and gain international popularity among industry practitioners. The model represents family business as consisting three complex and overlapping subsystems of ownership, family, and business.

The three overlapping subsystems can change after a couple of generations. Over time, families become larger, the ownership system grows larger and the business gets bigger. Even when all the subsystems change, the three circles still work. To financial planners and advisors, the three-circle model of family business is helpful to identify and determine the issues and challenges within any of the circles and how any change will affect the overall super system. For instance, the birth of a new family member can affect the planning and needs within the ownership and business subsystems.

Governance systems (corporate/business governance and family governance) within the three overlapping subsystems can also be distinguished using the three-circle model. Because family enterprises are comprised of several overlapping subsystems (family, enterprise, ownership, governance and generational), there are often conflicting goals and values. Wealth management and financial planning will become complex and to a certain degree complicated in the context of these overlapping systems if there are conflicts and disagreements.

In subsequent articles, I will discuss on the impacts of family, business, ownership, governance and generational subsystems on wealth management, investment, financial planning and philanthropic activities in building family business legacies.

Contributed by Dr Mohar Yusof, Founder and President of BinaPavo