CBRE Research latest report, Asia Pacific Investor Intentions Survey 2020 observed a shift in buying intentions, investment strategy and sector focus.

Some of the key findings in the survey rising from the Covid-19 outbreak included impact on investor intentions. According to CBRE, more investors intend to moderate their purchasing however investment appetite remains healthy where 77 percent of investors will be as or more active this year.

CBRE stated that the Covid-19 outbreak has cast a shadow over the global economy and has prompted a down revision to Gross Domestic Product (GDP) growth which has also led to rise in uncertainty.

This in return prompted many investors to shift into a wait-and-see mode and delay investment decisions, which is expected to negatively impact short-term investment activity.

While Hong Kong and China are likely to register a significant decline in transaction volume during the first quarter of the year due to travel restrictions and cancellation of site visits, CBRE does expect investment activity to pick up once the outbreak is contained.

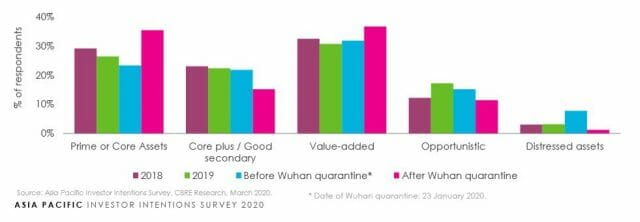

The survey responses received after the Wuhan quarantine had also displayed a higher preference for prime core assets. According to CBRE, this indicates a stronger demand for properties providing stable income streams.

The outbreak had also impacted property companies leading to more than 500 filling for bankruptcy in 2019. The disruption to business activity and a slowdown in residential property sales as a result from the outbreak is likely to prompt highly leveraged Chinese developers to turn more flexible towards pricing as they seek to offload non-core assets.

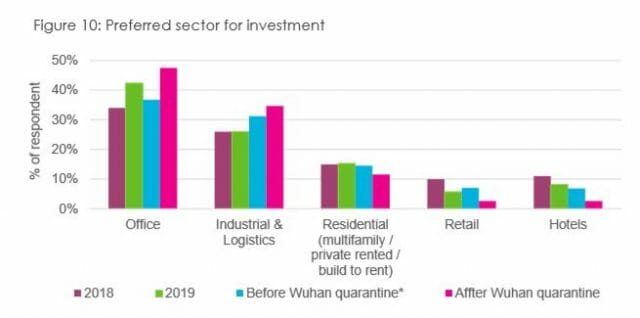

Furthermore, offices remain to be the most preferred sector for investment, proving to be a more prominent trend after the Covid-19 outbreak as demand is domestic driven or supported by low vacancy and a lack of new supply in selected markets.