According to PropertyGuru, first-time home seekers and investors are prioritising property as Malaysia enters the recovery stage in Putrajaya’s 6-Phase Plan against the Covid-19 pandemic.

In its Malaysia Consumer Sentiment Study H2 2020 report, the platform stated that while the national Property Sentiment Index fell from 42 index points in H1 2020 to 39 H2 2020, young renters aged 22 to 29 years old are least likely to delay their property purchasing decisions.

“This is coupled with greater intent to purchase by investors, who are more likely to time their purchases according to price and market movements,” said PropertyGuru. The platform further highlighted that awareness and uptake of alternative financing programmes and digital tools have ample room to grow.

This was despite the fact that Malaysians cite home loan financing, property viewings and information sourcing as key challenges in the property decision-making process.

As a response to the challenges arising from the Covid-19 outbreak, property developers such as Mah Sing had digitalised their sales process and property viewings sessions. Group managing director, Leong Hoy Kim had stated the company had launched virtual reality show units

“Looking purely at consumer sentiment, however, some patterns are clear. One of these is that extended, enforced time at home has perhaps made renters and younger home seekers more appreciative of the benefits of owning their own property. Another is that investors are on the lookout for purchases, though these demographics differ in their approach to purchase timing,” said Sheldon Fernandez, country manager of PropertyGuru Malaysia.

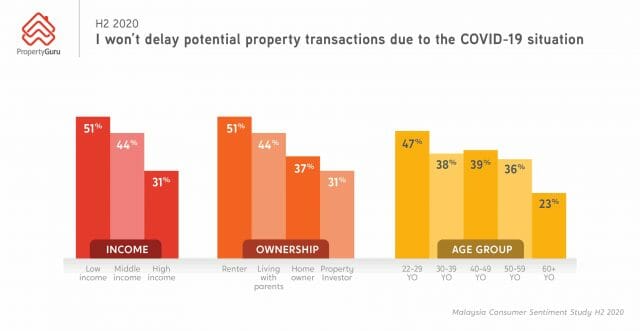

The study further showed that 51 percent of renters and 47 percent of respondents from 22 to 29 years of age say they would not delay property transactions due to Covid-19 and its impacts.

This compares to 23 percent of respondents aged 60 and above, underscoring the importance of home ownership to younger groups.

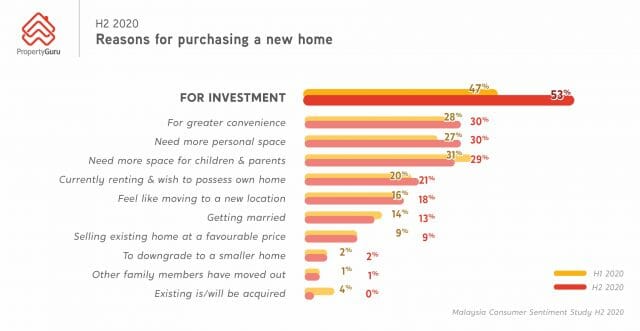

According to PropertyGuru, Malaysians are also citing intention to purchase for investment purposes post-Covid-19, rising from 47 percent of respondents in H1 2020 to 53 percent in H2 2020.

“Despite this increase in purchasing intent, investors are most likely to delay property purchasing decisions in the short-term among demographics surveyed. This can be attributed to their need to maximise returns, with purchase timing subject to projected price and market movements,” said Fernandez.

Prem Kumar, executive director at Jones Lang Wooton says, ““The current market scenario has unprecedented uncertainties, not only in Malaysia but also globally. Property market stakeholders are conscious of such uncertainties, besides the potential negative impact on property prices which has impeded decisions related to property dealings, be it purchase, sale or development. This situation could be evident during the entire moratorium period for loans which ends in September, and subsequent to which the market should have greater clarity.”

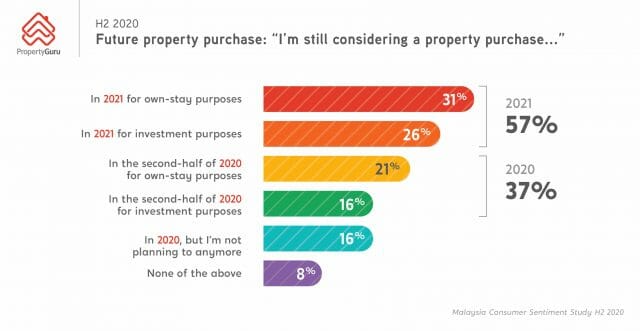

Backing his view, PropertyGuru found there is a healthy demand remaining H2 2020 with 37 percent of respondents citing purchasing intent by year-end and only a slim-majority (57 percent) prefer purchases in 2021.

Fewer than one out of five Malaysians have shared that they are not considering property purchases following the pandemic.

“The Covid-19 outbreak has accelerated the impact of structural issues which were already being faced by the property market. As such, it is not just a matter of managing the short-term market uncertainties, and it should be kept in mind that other non-real estate factors have a bearing on the market as well,” said Prem.

The report further highlighted that the issues more frequently faced by Malaysians included price uncertainty, delays in purchases and difficulties in viewing properties.

The study also found that only 26 percent of respondents would refinance their home loans, despite a historically low Overnight Policy Rate (OPR) following a series of revisions by Bank Negara Malaysia and the possibility of greater cash liquidity for approved applicants.