Funding Societies, a peer-to-peer (P2P) financing platform in Southeast Asia, has become the first P2P financing platform in the region to launch a partner-driven digital financing solution, Silk Road.

Launched in May 2020, Silk Road enables customised and seamless information sharing via a digital portal, thereby creating a frictionless and expedient experience for users. This allows greater convenience and lowers the cost in managing the financing process through a single dashboard. Silk Road is currently being utilised by car dealers to obtain financing through Funding Societies’ platform but can also be extended to multiple other use cases or partners.

Wong Kah Meng, Co-founder and Chief Executive Officer of Funding Societies Malaysia, said, “Despite a slowdown in the overall automotive sector amid the Covid-19 outbreak and the country’s restrictions on business activities in the first half of 2020, the used car segment, on the contrary, has seen impressive growth. Acknowledging this trend, through Silk Road, we aim to further uplift the local used car industry by providing a fast, simple and seamless platform and financing solution for dealers to expand their business, leveraging on the current growth wave.”

He added, “By integrating Silk Road with our dealer financing offering, we are able to enhance the experience for SMEs and our partners through the aspects of transparency, accountability and speed, as compared to more traditional methods involving physical documentation or informal methods such as e-mail and messaging applications like WhatsApp. Going forward, dealers only need to upload their invoices online before receiving their approval within 24 hours.”

Despite an established used car segment in the country, used car dealers often face numerous issues when it comes to obtaining capital to expand their businesses, mainly because traditional financing avenues do not usually cater to used car dealers that are sole proprietors or partnerships, which are seen as too small for banks to serve profitably.

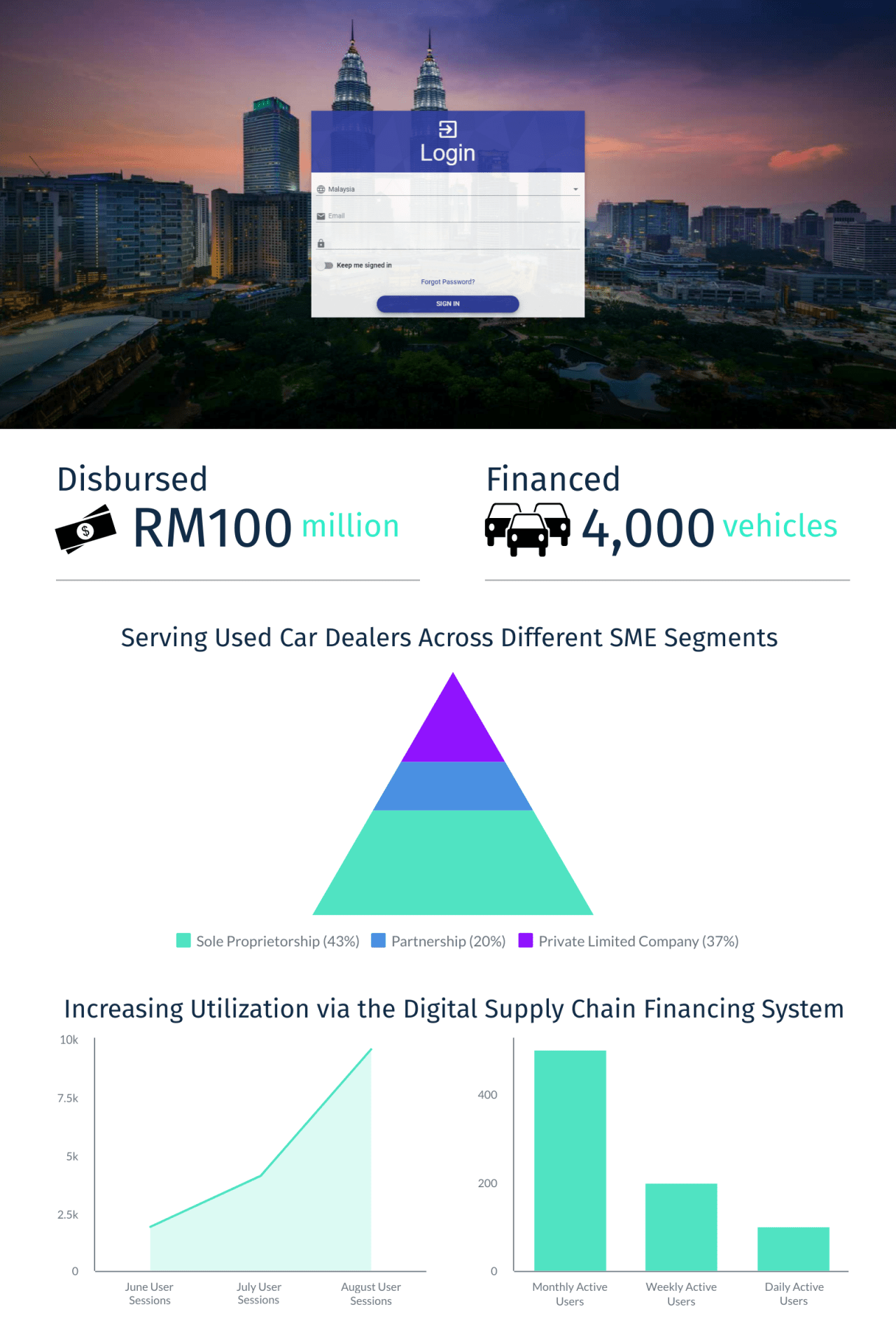

Since launching Silk Road, Funding Societies has recorded a total of 16,500 sessions (user usage), peaking at 9,550 sessions in August alone. This symbolizes the quick adoption of the system and dealer financing product by dealers. As for the dealer financing product, the platform has successfully disbursed RM100 million across 4,000 notes as of August 2020. In addition to used car bidding platforms, Silk Road also enables used car dealers to finance vehicle purchases from verifiable open market sources, and finance the settlement of outstanding amounts to banks for vehicles which are pending to be sold to a subsequent buyer.