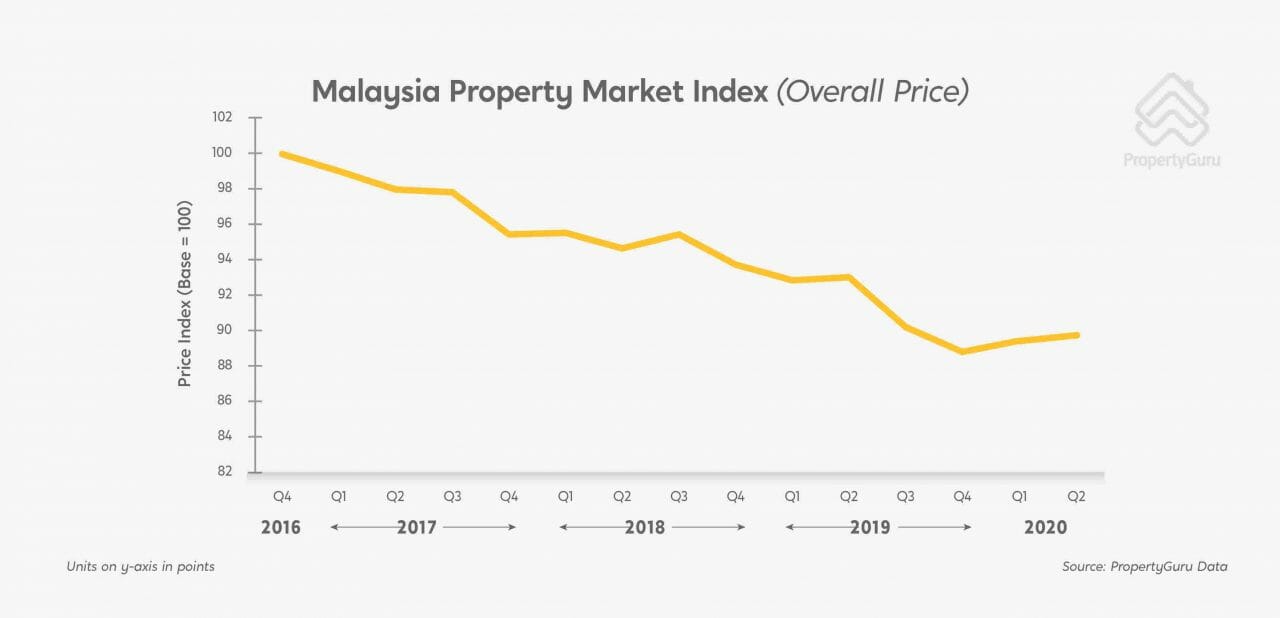

The PropertyGuru Malaysia Property Market Index, saw a 0.38 percent quarter-on-quarter gain in asking prices in Q2 2020. This was supported by recent Valuation and Property Services Department (JPPH) data, which cited a marginal increase of 0.40 percent in the Malaysian House Price Index (MHPI) over the same period.

Trends also point towards a resurgence of interest in central areas, with Bukit Jalil, Damansara and Kepong as prime hotspots, as well as strong month-on-month growth in online searches for affordable and mid-range properties.

However, these growth prospects may be derailed in the face of a potential second wave of Covid-19 clusters nationwide following the emergence of hotspots in Sabah and subsequent spread to other states.

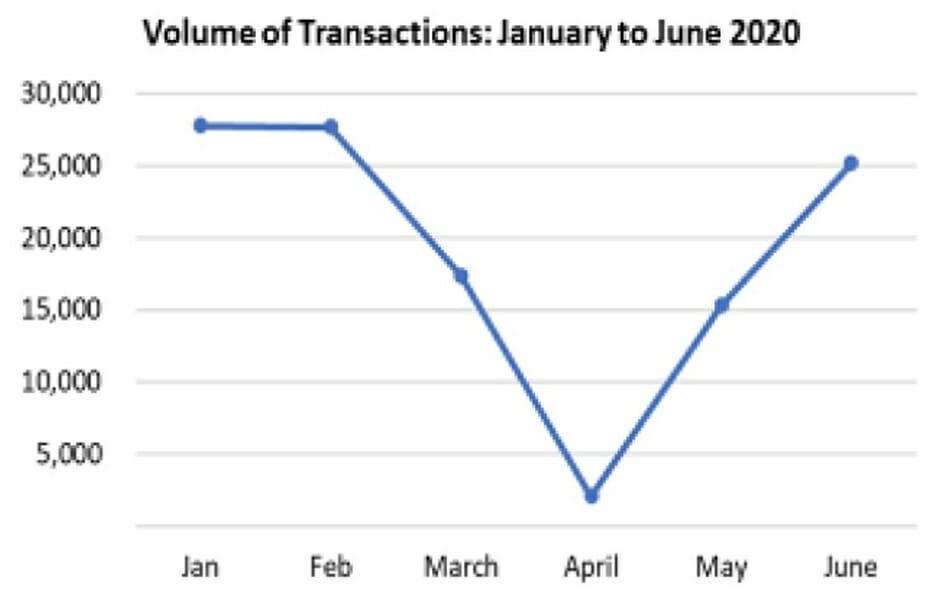

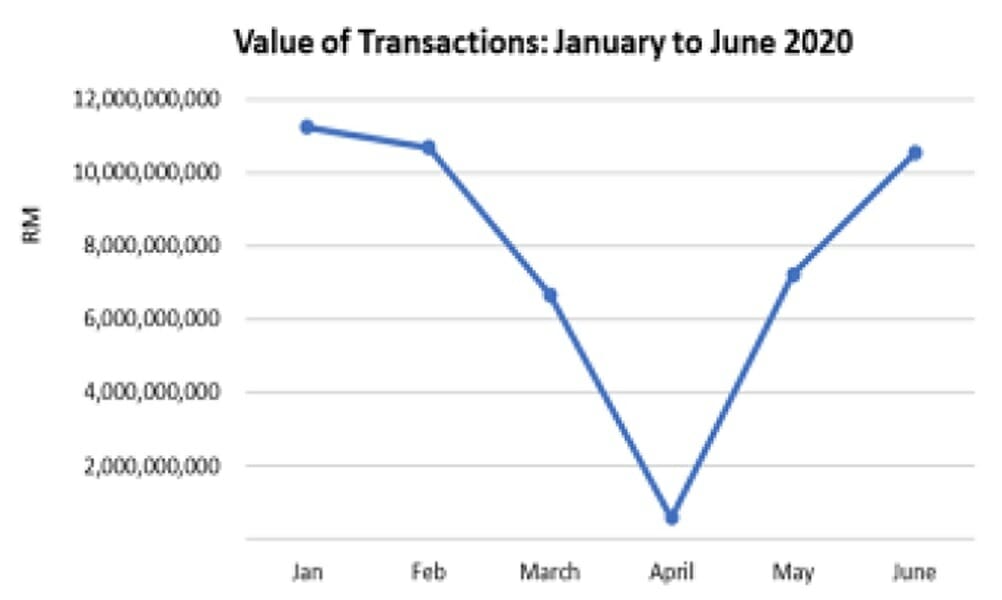

“The National Property Information Centre’s H1 2020 data quantifies the impact of Covid-19 on the market, with a 27.9% drop in transaction volume and 31.5% drop in value. This compares to 32.3% and 47.6% declines respectively during the 1998 recession and Nipah virus outbreak, in line with our projections of those figures as the worst-case scenario post-pandemic,” said Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

“JPPH MHPI data also supports PropertyGuru Malaysia Property Market Index findings, which saw marginal QoQ drops in asking prices of 3.10%, 2.52%, 1.76% and 0.97% respectively in Johor, Kuala Lumpur, Penang and Selangor in Q2 2020. Notably, transaction volume and value have rebounded since the initial impact of Covid-19, showcasing V-shaped recovery curves, though transactions have yet to reach pre-pandemic levels.”

This recovery is reflected in renewed home seeker interest among Malaysians following the initial Movement Control Order (MCO), with a significant increase in searches for properties in the RM501,000–RM700,000 (56 percent rise month-on-month), RM301,000–RM500,000 (39.6 percent rise MoM) and RM151,000–RM300,000 (31.5 percent rise MoM) ranges in August.

In addition, demand in urban areas and established hotspots, which saw a decline in the early stages of the Covid-19 pandemic as property seekers and work-from-home trends emphasised decentralisation, has revitalised.

Selangor, Kuala Lumpur and Johor showed the most improvement, with month-on-month increases in property searches of 45.7 percent, 33.7 percent and 22.4 percent respectively.

Additionally, terrace homes showcased the least volatility in H1 2020, with a 7.2 percent month-on-month increase in demand in September. Home seekers searching for terrace homes preferred Kepong (141.6 percent growth MoM), Petaling Jaya (48.3 percent) and Bukit Jalil (46.2 percent), with Klang (41.6 percent), Damansara (16.9 percent) and Kuchai Lama (6.7 percent) popular as well.

“Current market stability and sentiment can be attributed to strong and timely government measures, such as the reintroduced Home Ownership Campaign, as well as a deeply favourable lending environment led by interest rate revisions following Overnight Policy Rate cuts by Bank Negara Malaysia,” said Fernandez.

“What’s most notable about recent industry data is that price movements have been minimal relative to projections. For example, the MHPI declined by 9.4% in 1998, compared to the 0.4% gain in the second quarter this year. While this leaves room for cautious optimism when it comes to market outlook, the acid test for property in Malaysia will come in the next few quarters,” said Fernandez.

“This is when the economic consequences of the outbreak and an increasingly severe projected recession will make themselves felt, along with the prospect of a second wave of Covid-19 cases from Sabah. Impacts here are already being seen in reported drops in visitor footfalls throughout malls in Klang Valley, following the emergence of clusters associated with returnees from Sabah.”