GBG, a global technology specialist in fraud, location, and identity data intelligence has revealed in a research, Future-proofing Fraud Prevention in Digital Channels the impact of fraud trends and emerging fraud patterns across six countries.

The research is a study of fraud prevention practices by financial institutions, surveying a total of 324 financial institutions across Malaysia, China, Australia, Indonesia, Thailand, and Vietnam.

June Lee, GBG’s APAC Managing Director presented the research outcome which was conducted on respondents from different fields such as Auto Finance, Bank, Credit Union, Digital Bank, Fintech and, Wealth and Asset Management.

Based on the research, Financial Institutions (FI) in Malaysia are ahead of APAC in most mainstream digital products such as e-Wallet, e-Statement, e-Banking, instant bank account applications, and mobile banking apps. Additionally, the country is also catching up in the instant loan and instant credit card segment.

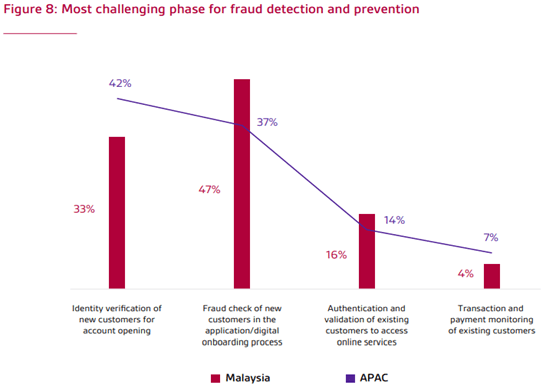

Among the steps in a customer’s transaction journey, almost 50 percent of FIs in Malaysia has observed fraud detection while digitally onboarding new customers was the biggest challenge.

That is reportedly 10 percent more than the APAC aggregate.

Apart from that, challenges in onboarding the unbanked includes the lack of data and unreliability in available data leaving more than 50 percent of Southeast Asia unbanked.

More than half of the respondents see cyber fraud prevention and identity verification as key challenges in driving digital transaction growth among others such as scaling fraud detection for transactions and maintaining brand reputation.

Despite the pandemic having taken a toll on the entire situation, it is not the only reason for the rise in such fraudulent observations. It is reported that Malaysia experienced RM153 million of losses as a result of cybercrimes in the first five months of 2019.

Scams, data breaches and stolen IDs were the most impacting factors for Malaysia FIs in 2019, with 74 percent, 70 percent and 67 percent of increase in frequency respectively.

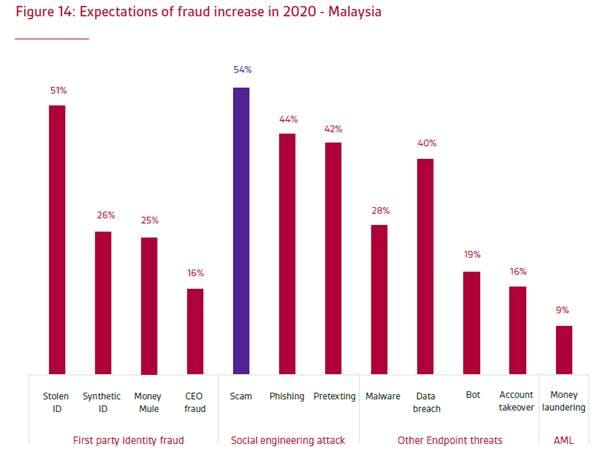

As for 2020, more than 50 percent foresee scams and stolen IDs to grow in Malaysia as compared to other social engineering attacks, first party identity fraud, endpoint threats and anti-money laundering. Among the other concerning frauds are phishing, pretexting and data breach.

Since fraudsters are becoming more creative in terms of hacking and attacking, June Lee, APAC Managing Director of GBG emphasised that the more we protect, the more we prevent.

“Looking at 2020-2021, the Covid-19 pandemic will continue to push people and businesses to take digital-first approaches to financial transactions.

Our research indicates that 21% of FIs in Malaysia have started to lay the groundwork in establishing end-to-end fraud management platforms. However, the expected growth in scams would require added layers of data intelligence to assess the digital tools which are used to onboard and transact with the financial organisations, as well as to obtain a better holistic view of the intent and integrity of the individuals.

Being agile in harnessing new fraud prevention technology will enable FIs to get ahead of escalating and fast-growing emerging fraud patterns and secure the digital trust of their customers,” she expressed.

According to GBG, it is notable that at least 60 percent of FIs in Malaysia have approved budget to invest in cyber fraud solutions this year but only about 20 percent of FIs are currently equipped. So, it is vital for FIs to have more fraud-related forums to talk about data sharing internally and externally, as well as identifying and exposing potential fraudsters to other institutes.