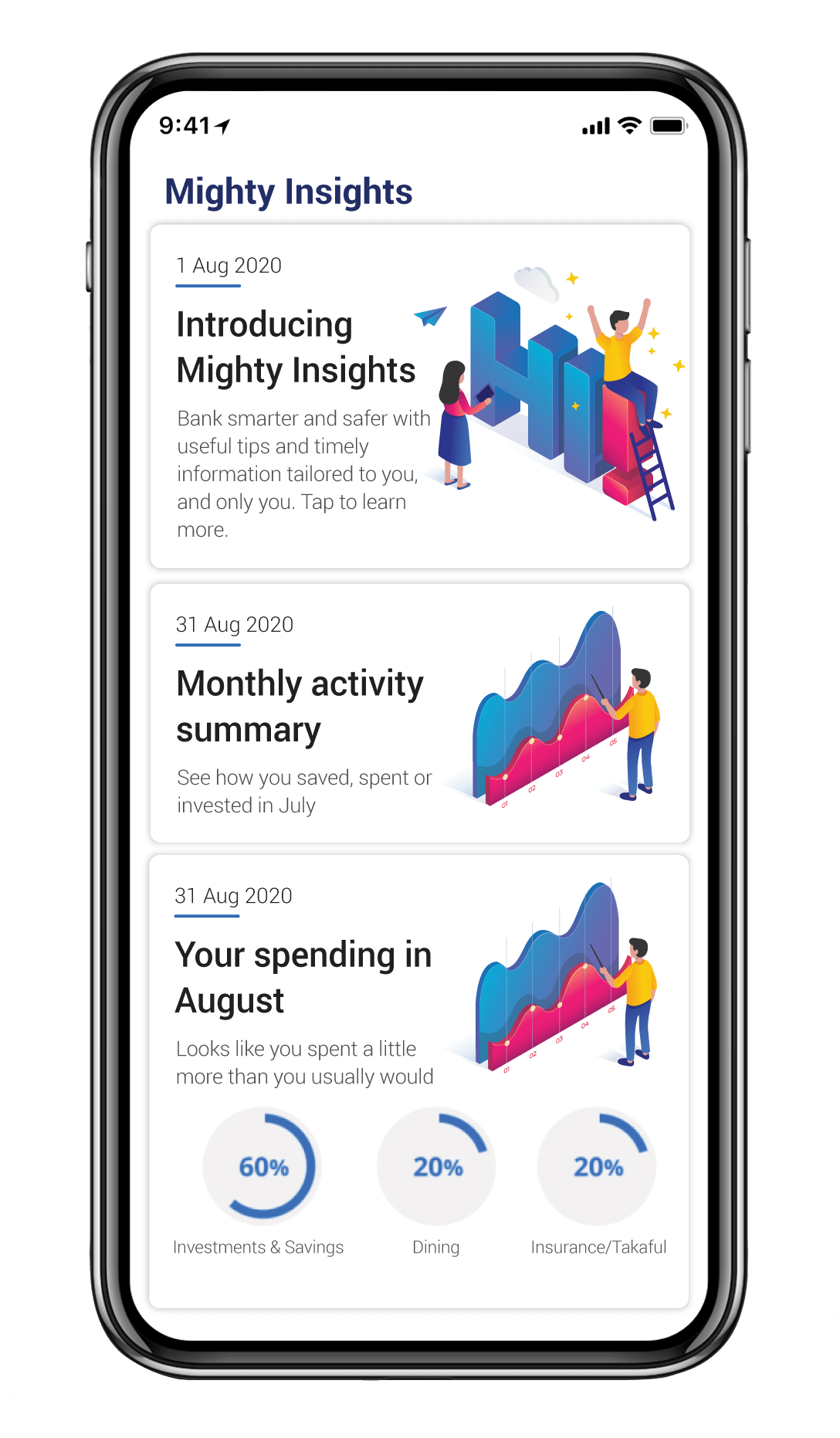

United Overseas Bank (Malaysia) Bhd (UOB Malaysia) has launched Mighty Insights, the country’s first artificial intelligence (AI)-based digital banking service to empower its customers to make wiser financial decisions via the bank’s all-in-one mobile banking app, UOB Mighty.

The Mighty Insights guides customers to relevant financial solutions that can help them meet their financial needs with the use of advanced data analytics, machine learning, and pattern recognition algorithms. It also enables customers to receive personalised insights based on their banking and spending patterns, empowering them to track and manage their savings and expenses effortlessly.

“With the help of these meaningful insights, customers can track their finances better and learn to anticipate their cash flow needs for the month. Mighty Insights also offers suggestions on how to increase savings and to reduce debt, helping our customers to gain greater control of their finances,” said Ronnie Lim, Managing Director and Country Head of Personal Financial Services, UOB Malaysia.

Mighty Insights customers who make regular payments for subscription-based services will be alerted when the upcoming payment is due, if subscription fees have increased, or even when their trial subscriptions are ending.

Additionally, customers can access a consolidated view of their average monthly expenses made on their cards for different spending categories over the past five months, and they will be alerted through Mighty Insights when a payment is made to a new merchant or if their current balance is not able to cover their usual expenses.

UOB Malaysia’s other enhancements to its UOB Mighty app include the incorporation of the DuitNow Quick Response (QR) code payment function so that customers only need to scan a QR code to transfer funds or to make payments simply and safely.

To make it easier for customers to pay through UOB Mighty, the Bank has redesigned the app’s user interface to ensure that payment-related features are at their fingertips. Customers are able to access the DuitNow payment function or the UOB Mighty Secure, a digital security token function on the UOB Mighty app.

The Bank has also launched Mighty Coupons on its mobile banking app under the Mighty Lifestyle section that offers dining, shopping and travel deals and cash rebates from various merchants every Friday.

“Consumers always love a good bargain and with Mighty Coupons, our customers can search for the latest dining, shopping and travel offers easily. The introduction of Mighty Coupons is in line with the Bank’s efforts to create products and services that match the lifestyle choices and preferences of our customers,” Lim said.