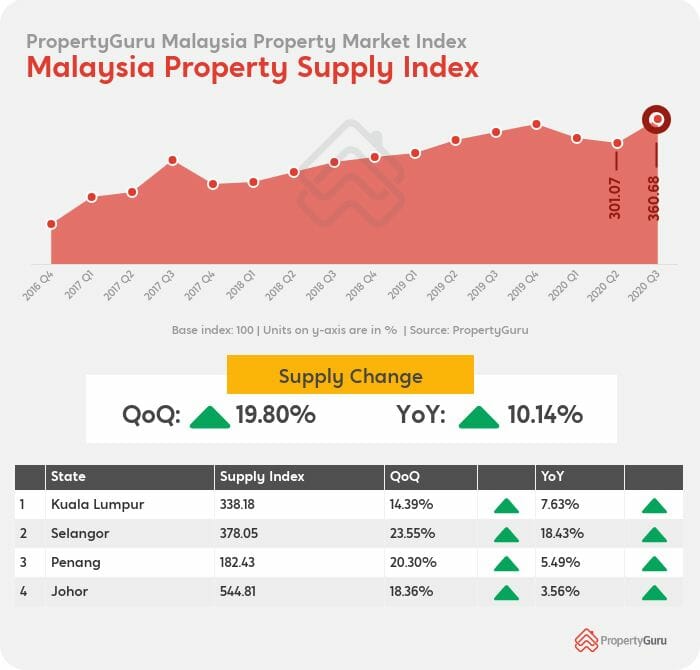

Based on the PropertyGuru Malaysia’s Property Market Index (MPMI) report overall new property supply rebounded and has increased by 19.80 percent this quarter.

A 10.14 percent growth was captured on a year-on-year basis, an indication of an upward moving trend. This inclination reflects the easing of the Movement Control Order (MCO) in the first half of the year, with the return of commercial activity.

“Overall, Selangor records the largest increase in supply of new properties by 23.55% this quarter. Market watchers continue to be confident of the state’s long-term prospect, despite it facing the second-largest overhang in the country,” said Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

The supply growth follows with Penang (20.30 percent), Kuala Lumpur (14.39 percent) and Johor (18.36 percent) rising quarter to quarter.

With 6,166 unsold completed units in the market, Johor is the state with the largest number of overhang properties in the country.

The state also registered the sharpest drop in asking prices. Nevertheless, the downward trending price might be favourable for Johor as it may appeal better to the domestic market, which has seen an increase in its online activity on the region’s properties.

“As for Kuala Lumpur, it is going through a challenging period with weakened interest from foreign investors leaving an unsold upmarket stock that is mismatched with local appetites and affordability range,” added Fernandez.

Based on NAPIC’s H1 2020 report, Malaysia’s residential overhang rose 3.3 percent to 31,661 unsold completed units worth RM20.03 billion during the first half of 2020, compared to the 30,664 units valued at RM18.82 billion over the same period last year.

All does not look bleak as there are factors in place to mitigate the risk of financial stability, whereby Bank Negara Malaysia (BNM) is extending 80 percent of loans for homes that are owner-occupied. The extension substantially reduces the likelihood of borrowers defaulting on their loans.

“Moving forward into 2021 with a climate of lower property prices, expect to see renewed interest and activity among younger buyers who have been actively saving for a property purchase, but have so far been priced out of the market,” said Fernandez.