The fintech arm of airasia Digital, BigPay, is set to offer more financial services including credit to the B40 and M40 income groups, especially the unbanked and under-banked segments.

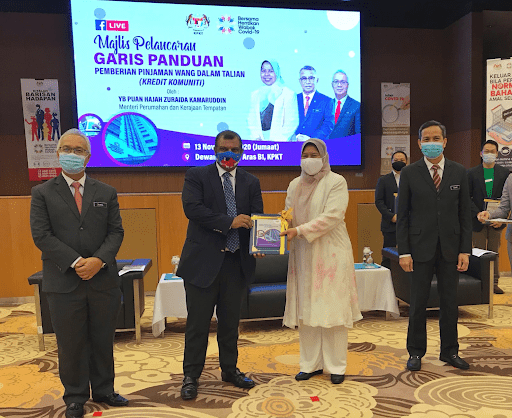

Having received its Community Credit Licence from the Ministry of Housing and Local Government Malaysia (KPKT), BigPay aims to start offering loans to small businesses, entrepreneurs and individuals at affordable rates via the BigPay mobile app (bigpayme.com) from early next year.

Tony Fernandes, Chief Executive Officer of AirAsia Group said, “This is groundbreaking for Malaysia, especially at this time and it is very exciting to see that we are able to offer lending services via BigPay’s digital app. I would like to also assure that BigPay will abide by all the conditions, laws and regulations provided by the Ministry in implementing and running the financial services.

“Nineteen years ago, Kamarudin (Executive Chairman of AirAsia Group, Kamarudin Meranun) and I started the airline with the slogan ‘Now Everyone Can Fly’. Fast forward to today, we are thrilled with BigPay’s achievement. It is a big day for us to receive the lending licence and now we are able to offer financial services to everyone including small and medium businesses (SMEs). AirAsia is always here to help the community and I am very happy to be able to offer the lending service to the people,” added Tony.