MoneySave, a recognised market operator with Securities Commission Malaysia is introducing the 1st in World P2P Crowdfunding in the World with more than 20 Risk Reduction Incentives to SMEs or issuers seeking funding on its platform.

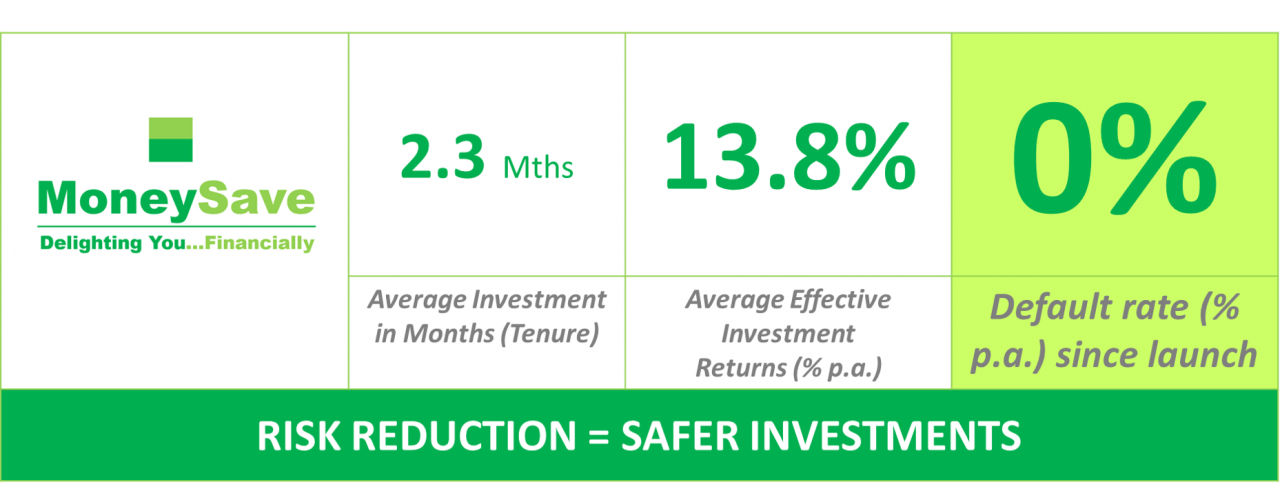

ZERO (0%) Default Rate

With its unique risk reduction incentives, MoneySave has been able to maintain an amazing ZERO (0%) Default Rate for the last 95 investment notes that it has hosted and disbursed. The investors yield was between 7.50%-16% p.a. with tenure of investments between 1-4 months only.

“We are here to complement the various government initiatives such as Malaysia’s Prihatin Rakyat Economic Stimulus Package (PRIHATIN), Bank Simpanan Nasional (BSN), Tekun Niaga Financing Scheme, Soft Loans for SMEs (SLSME), Penjana SME Financing, SME Bank, MARA, Special Relief Facility by BNM, Credit Guarantee Corporation (CGC), Syarikat Jaminan Pembiayaan Perniagaan (SJPP) Guarantee Scheme etc.”, said Moneysave’s CEO, Vincent Soh.

Crowdfunding for Digital / e-Commerce and Government or BURSA 100 Suppliers and Contractors

MoneySave focuses on the digital e-commerce supply chain and also the suppliers and contractors of Malaysian Government, Ministries, agencies and government linked companies (GLCs) as well as companies such Telekom Malaysia, Tenaga Nasional, Sime Darby, Maybank, Petronas, Axiata, Maxis, Public Bank and other as Top 100 BURSA companies.

“We are here to complement the various government initiatives such as Malaysia’s Prihatin Rakyat Economic Stimulus Package (PRIHATIN), Bank Simpanan Nasional (BSN), Tekun Niaga Financing Scheme, Soft Loans for SMEs (SLSME), Penjana SME Financing, SME Bank, MARA, Special Relief Facility by BNM, Credit Guarantee Corporation (CGC), Syarikat Jaminan Pembiayaan Perniagaan (SJPP) Guarantee Scheme etc.”, said Moneysave’s CEO, Vincent Soh.

Moneysave’s Risk Reduction Incentives?

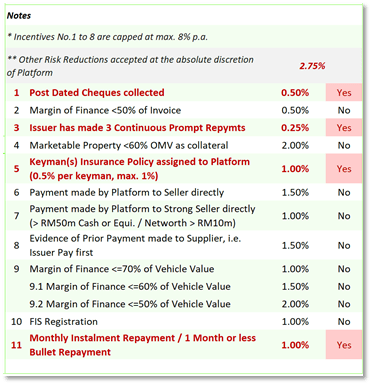

For SMEs or Investment Note Issuers, they are given up to 20 Risk Reduction Incentives to reduce their business and credit risks which range from 0.25% to 2.50% interest reduction per annum.

Click HERE for details.

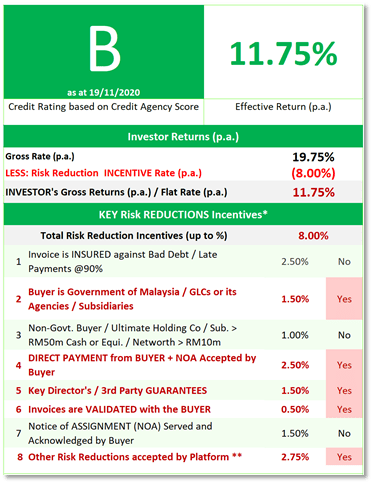

For example, a government supplier or contractor rated ‘B’ by a Credit Rating Agency that is priced at 19.75% p.a. would be given risk reduction incentives per following:

- 1.50% p.a. if its Buyer is the Malaysian or State Government or its bodies or agencies

- 2.50% p.a. if it managed to get the Government to pay direct to Moneysave when the invoice is due

- 1.50% p.a. for giving key director’s guarantee in event of default

- 0.50% p.a. for Invoice Validation by Moneysave with the Buyer

- 0.50% p.a. for Post Dated Cheques collected as security

- 0.25% p.a. for 3 continuous prompt repayments made

- 1.00% p.a. for assignment of 2 Keyman Live Insurance to the Platform in event of death or total permanent disablement of the company’s 2 keyman

- 1.00% p.a. as repayment is made in 1 Bullet Repayment in 1 Month

The above incentives are capped at 8.00% p.a., therefore for the above investment, Moneysave’s investors would enjoy an 11.75% p.a. annualised returns.

Not surprising, many of Moneysave’s lower yielding notes between 8-12% p.a. are usually subscribed faster (between 1-6 hours from live online hosting) than higher yielding 12-16% p.a. investments (1-4 days)

Click HERE to view Moneysave’s Risk Reduction Video in KCLAU.com on Youtube.

On Nov 3, Moneysave P2P Crowdfunding Platform also announced the fastest Malaysian P2P Crowdfunding of Potboy a leading Malaysian online grocer. The record was achieved in 95 seconds starting from the time the Investment Note was hosted online to 100% subscription.

Click HERE to view the 95 secs Record Breaking achievement on Youtube.

With its tagline of “Delighting You… Financially”, Moneysave aspires to be the top fintech / P2P Crowdfunding Platform in Malaysia and Asia specialising in the Supply Chain Financing of Trade Invoice / Receivables Financing where Issuers or Small Medium Enterprises (SMEs) come to Moneysave’s platform to seek financing by selling their Trade Invoices or Trade Receivables or Trade Payables (Purchase Order Financing) at a margin of up to 85% of the invoice value. For example, an Invoice Value of RM100k can be funded up to RM85k. The tenure of funding is short term between 30-180 days only.