The Organisation for Economic Co-operation and Development, and Bank Negara Malaysia indicates that Malaysians have little to no financial knowledge and practice a “myopic live for today” attitude when it comes to personal financial management.

Based on the Bank Negara’s Financial Capability and Inclusion Demand Side Survey 2018 (FCI Survey 2018) survey, one-third of Malaysians rate themselves to be of low knowledge in terms of finances, skewed to lower income households and 84 percent of Malaysians claim to save only for the short-term.

More than half expressed difficulties to raise RM1,000 as emergency funds and only 24 percent could sustain living expenses for at least three months or more if they lose main source of income.

Commenting on the issue, H2GO’s Head of Finance, Yeoh Cheong Wei says that the challenge lies in the excessive use of credit cards which has become so common in developed and developing countries.

According to Yeoh, the introduction of Free Interest Installment Plans among retailers and online platforms are also one of the reasons that will discreetly hit the maximum cash outflow threshold without one even knowing.

“Another prominent challenge is peer pressure. The youth are highly influenced by on-going trends on social media.

Due to which, over 3.9 billion people have access to Facebook, Instagram and Google and are exposed to advertisements. These advertisements are so advanced as it targets individuals based on their browsing trend, after which the content is targeted to ‘lure’ you to spend,” Yeoh says.

Helping the Youth Overcome Financial Literacy Challenges

In a conversation with 3M Malaysia’s Country Leader, GT Lim says that he is happy to know that the government has plans to increase Malaysian’s financial literacy awareness and access to financial management information, tools, and resources through the National Strategy for Financial Literacy 2019-2023

With these initiatives, Malaysians will have greater awareness to make sound financial decisions and practice good financial behaviour that will enable them to provide for current and future financial needs.

Lim says that the youth need to invest in themselves and start budgeting. “If they can invest the time, energy, and money to learn the skills needed, it will open more opportunities and increase career-earning potential.”

Vice President of V2T, Raymond Gabriel mentions that it is due to the shifting landscapes of youths’ behaviour and their way of thinking as generations evolve.

Youths need to learn about self-control and manage impulse spending. They need to evaluate how the spending is and decide if each expense is necessary, he says.

Both 3M and V2T has come together to work on the IMPIAN programme to help educate youths on financial literacy.

Supported by a grant of RM197,075.00 from 3Mgives, the primary social investment arm of 3M Company, the programme targets youths aged between 16-18 from multiple orphanages and non-profit organisations.

The programme conducted in partnership with non-profit organisation Vision 2 Transform (V2T), the IMPIAN programme provides entrepreneurship training and mentoring opportunities to over 40 young adults from five non-profit organisations to help them to get up on their feet and work towards financial independence.

“We want to break out of this negativity and prove that with the right opportunities, these youths are also entitled to a bright future as the rest of their peers,” Raymond expresses.

The IMPIAN programme has provided entrepreneurship training and mentoring opportunities to (Myskills Foundation, Rumah Kasih Harmoni Paya Jaras, Rumah Bakti Nur Syaheera, Sekolah Tahfiz Al-Kitab and Pusat Perkembangan Kemahiran Kebangsaan Serendah).

Lim believes that every youth deserves a chance, which is why IMPIAN was established and decided to collaborate with V2T for this initiative.

“We are happy to learn that the participants feel confident and motivated upon completing the training programme. Even if they were to use these skills to develop a side business while looking for full-time work, it would provide means for financial relief and allow them to grow their skills as well,” Lim expresses.

IMPIAN has achieved a successful 100 percent participation rate with zero dropouts and has increased the confidence of the participants by 97.5 percent and more are confident to start their own business upon finishing their training.

IMPIAN also provides new business ideas and future planning in which 75 percent of participants of them admits that they have more clarity on their future goals and visions after attending the training.

Additionally, the programme has seen improvements in financial literacy for 92.5 percent of participants acquired practical steps to better exercise their finances and admit to already using the concepts that were shared during the mentoring sessions.

3M is looking to develop more programmes like IMPIAN and provide new growth avenues for Malaysia’s youth.

“We work with a variety of NGOs to participate in international competitive grants by 3Mgives every year,” Lim says.

3M is hopeful to continue working with selected partners and organisations to run impactful projects that focus on aspects such as empowerment, financial literacy, and skill-building to support a diverse workforce for generations to come.

“We are currently working on an education programme and would-be sharing details of that soon,” GT Lim says.

“V2T is a national NGO committed to transform the lives of marginalised communities and bring displaced groups back on track through trademark programmes that focus on building income generation capacity and increasing financial literacy nationwide.

“Together with our sister company, People Systems Consultancy (PSC), we have trained over 48,000 individuals among the marginalised groups such as hardcore poor, refugees, and the indigenous community. Working with other partners we have worked with various marginalised groups such as indigenous communities, hardcore poor and single mums,” Raymond concludes.

Educate, encourage and unlock

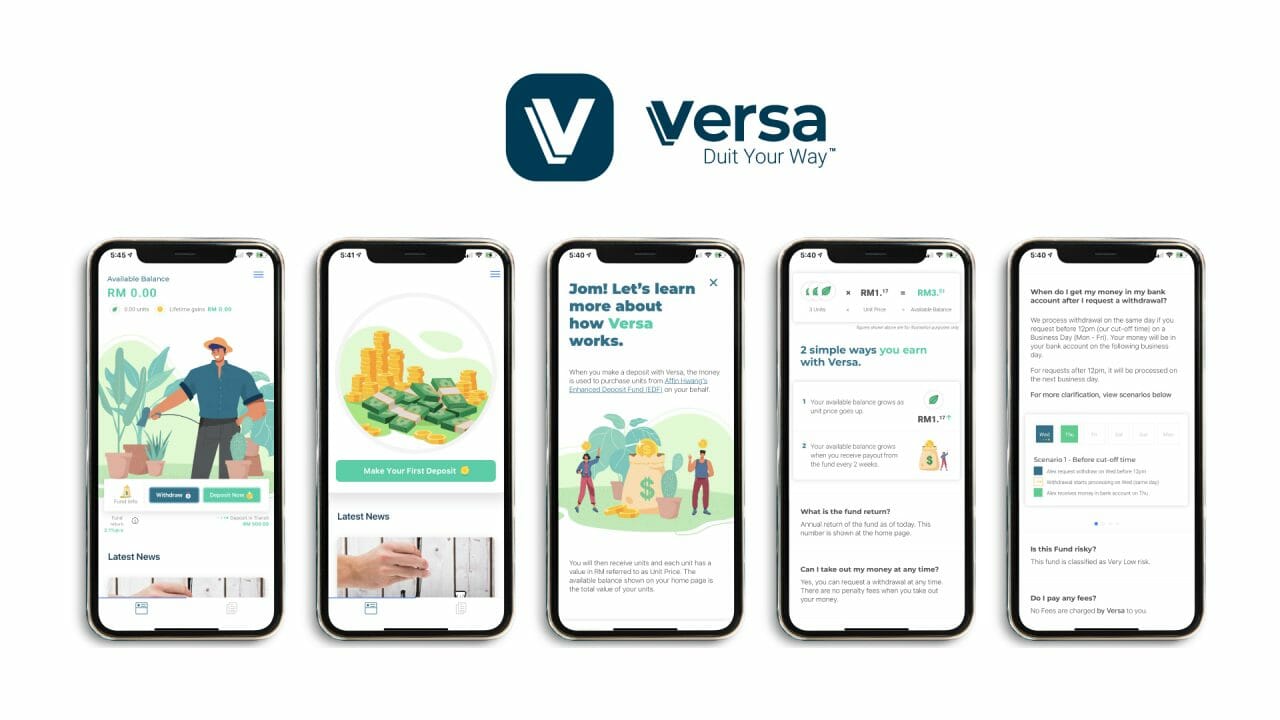

The digital cash management platform, Versa, on the other end is on a mission to encourage and educate Malaysians on better ways to manage their finances and unlock the potential of their idle cash.

From the digital financial point of view, Chief Executive Officer (CEO) of Versa, Teoh Wei-Xiang says education about financial literacy at the earlier stages of their [youth] lives are critical to provide them with enough exposure to be financially savvy and independent once they step out into the real world.

Ultimately, they would be motivated to learn if they know what is in for them and that main challenge is to go through to them.

To compel the youth to be financially literate, understanding their interests is key and the process needs to be incentivised to keep them interested as well.

“The more we grow up, the more we realise the importance of being financially literate — to be able to effectively manage our personal finance, including budgeting and investing.

Despite it being a crucial survival skill, financial literacy is not something that is taught in schools or discussed enough amongst household members,” he says.

Versa is a digital cash management platform that earns users interest that is on-par with Fixed Deposit (FD) and gives users the power to withdraw their funds anytime they wish, without penalties.

Academic Director of Dwi Emas International School, CJ Lim however is not satisfied with the solutions of financial literacy among youth. The future prospect of financial independence young people is far from ideal in the country.

“One of the best solutions is to provide a financial literacy programme in all schools. Running a long-term sustainable nationwide financial literacy campaign in all schools, colleges and university is vital to curb such challenges.

Once young people have developed basic financial literacy, they can then move on to level up by sharpening their good money habits through financial education,” CJ says.

He stresses that if solutions are implemented progressively, consistently, and successfully, in about five years’ time or longer, there will be light at the end of the tunnel for a more financially independent young nation.

EMIR Research’s Research Analyst, Sofea Azahar remains doubtful on the future because if there is economic uncertainty, debt accumulation will likely continue to increase.

Financial anxiety will persist and should there be no effort to educate the young people about sound financial management.

“Concurrently, jobs with appropriate salaries should be provided for the youngsters to sustain daily needs and avoid taking too much debt that is unsustainable,” Sofea says.

Joining in, the Managing Director and Country Head of Personal Financial Services at UOB Malaysia, Ronnie Lim points out that financial education must go beyond teaching individuals how to save and adopt prudent spending habits.

“With the current outbreak, if the youth continue to be financially illiterate, it will lead to poor financial decisions such as overspending, which would lead to poor financial well-being. But seeing how the fresh graduates and university students are more tech savvy than ever, we foresee that they can gain financial independence faster than other generations,” Ronnie tells BusinessToday.

The Managing Director also sees that the Covid-19 outbreak has a significant impact on Malaysians so the more reason why young people should step up and focus on gaining financial independence as early as possible.

Versa’s Teoh says its vital for Malaysians to factor in the outbreak into their financial planning. While this applies to everyone else, he says the journey to financial independence has been derailed for many young adults. “Some of them could still be doing fairly well depending on the sectors they are in, but many are still facing the uncertainty of losing their jobs. Now, the priorities have shifted, and many are starting to see the importance of saving and investing wisely, to prepare for whatever is coming next,” he says.