Digital financial platform, BigPay has launched it’s new feature for cash top-ups allowing users to reload their balance at all 7-Eleven stores across nationwide.

Since its launch in 2018, BigPay has grown to become one of the largest digital banking service in Malaysia with over 1.3 million users in the country. The new cash top-up option is part of the company’s mission to expand their regional market, making the service more approachable to their consumers.

Co-Founder of BigPay, Salim Dhanani said their central mission is ensuring that everyone has access to digital banking services and allowing cash to be seamlessly transferred to a BigPay account is a big step in that direction.

“7-Eleven has more locations than most banks have branches in Malaysia. This gives BigPay a unique advantage when it comes to providing financial services across the country,” Salim Dhanani said.

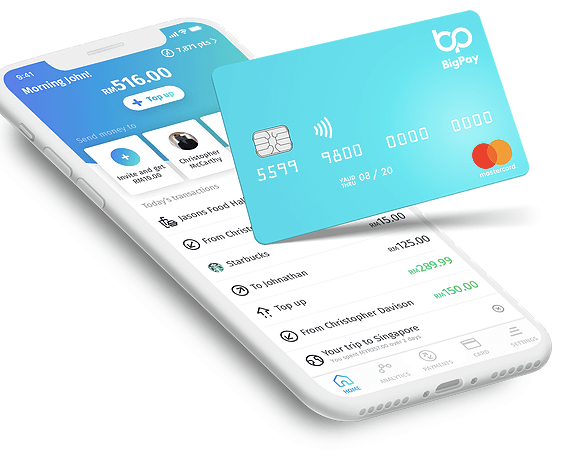

In line with their goals to democratise banking across Southeast Asia, BigPay has enabled its users to easily open an account from their mobile phones and make payments at any local or international merchant. They can also make free and instant money transfers to friends, split bills, manage expenses and track their spending – all via one integrated app.

“We aim to provide all consumers access to mainstream financial products usually only offered by retail banks, but at much lower costs and with unprecedented efficiency. We also want to remove physical and monetary barriers preventing people from better managing and using their finances. Our successes to date provide a robust foundation for us to solidify our footprint in new markets and product lines in the year ahead,” added Salim.

Big Pay expanded its services in Singapore in September 2020. The company also intends to grow in more ASEAN countries and has expressed interest in applying for a digital banking license in Malaysia and other markets.

As they actively evaluate the right approach, BigPay aims to launch a range of new products, including personal loans, insurance and wealth management in near future.