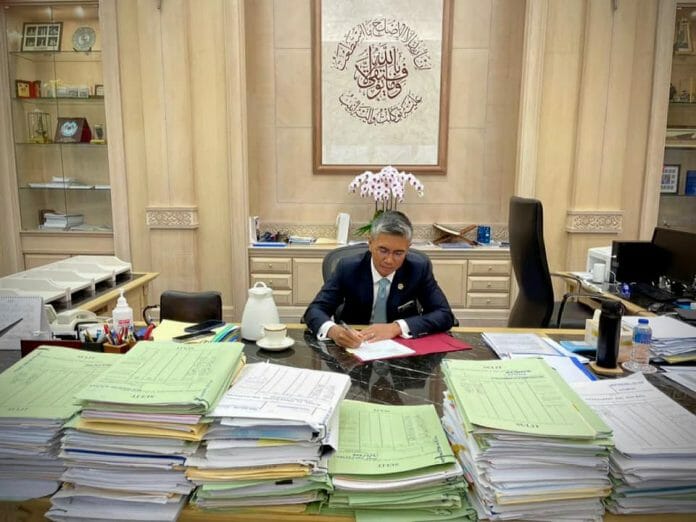

A total of 7,205 applications for the PENJANA Small and Medium Enterprise (SME) Financing programme have been approved as of March 12, involving a total loan value of RM1.36 billion. Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz said the government had allocated RM2 billion under this programme that prioritised SMEs that had never obtained bank loans previously.

Among the initiatives introduced right after the lockdown in 2020, the ones directed to businesses are seeing some fruitful returns. The government was cognisant of the repercussions this would impact and devised thoughtful measures that could assist these companies from going under.

Some of the measures like the Wage Subsidy Programme as of to date applications had reached a value of RM12.84 billion, a staggering figure alluding to the fact that many outfits were subscribing to the program. This effectively have kept staffs employed and households to function without major disruption. A winning program in our books, its probably the reason the government went ahead and introduced version 2.0 under the Prihatin Supplementary Initiative Package (KITA PRIHATIN), with RM1.09 billion being channeled to 72,531 employers giving them lifeline continue operating and retain another 619,821 employees.

Its a known fact SME’s are the backbone of Malaysia’s industrial output, SME soft loans funds administered by Bank Negara Malaysia for instance has thus far benefited 24,819 operators totaling to RM11.75 billion in approved applications. These were vetted and signed off by relevant banks appointed to disperse the loans, interest rates were kept at very minimal between 2 to 3.5 percent over a 7 year period tenure. This amount includes the Special Relief Facility, Automation and Digitalisation Facility, All-Economic Sector Facility, and Agrofood Facility funds.

A special allocation for bumiputra entrepreneur, the Bumiputera Relief Financing fund had been channeled to 670 SMEs involving a total of RM193.1 million and another RM200 million through Perbadanan Usahawan Nasional Bhd to assist Bumiputera SMEs affected by COVID-19, with funding of between RM100,000 and RM1 million giving struggling business owners additional support to ride the storm.

There are additional revisions available for MOF to tap into if the need arises, Tengku Zafrul has mentioned that the government is ever ready to assist businesses to bounce back. All facts point to numbers, Malaysia’s economy is on a positive track, international bodies like IMF has projected for a 6% growth this year with a higher rate in 2022. Based on reports released by LAKSANA on the stimulus packages, a speedy delivery of funds has been instrumental in getting the business humming again, downtime drastically reduced and with the vaccine rollout underway the side effects of the lockdown is minimising as months past by.