According to Bain’s and Facebook’s Riding the Digital Wave report, buying patterns of 8,600 digital consumers in six South East Asia countries over the Covid-19 outbreak saw 47 percent of consumers decrease offline purchases and 30 percent increase their online spending.

The cashless movement which saw a spike when Covid-19 struck countries and lockdowns came into effect also saw the rise of a new payment option, the Buy Now Pay Later (BNPL) service, an instalment payment solution for businesses and consumers.

“BNPL is defined by a service that is offered to merchants, giving their customers the choice of spreading out their purchases over time even without a credit card,” Chief Executive Officer (CEO) and Co-founder of Split, Dylan Tan tells BusinessToday.

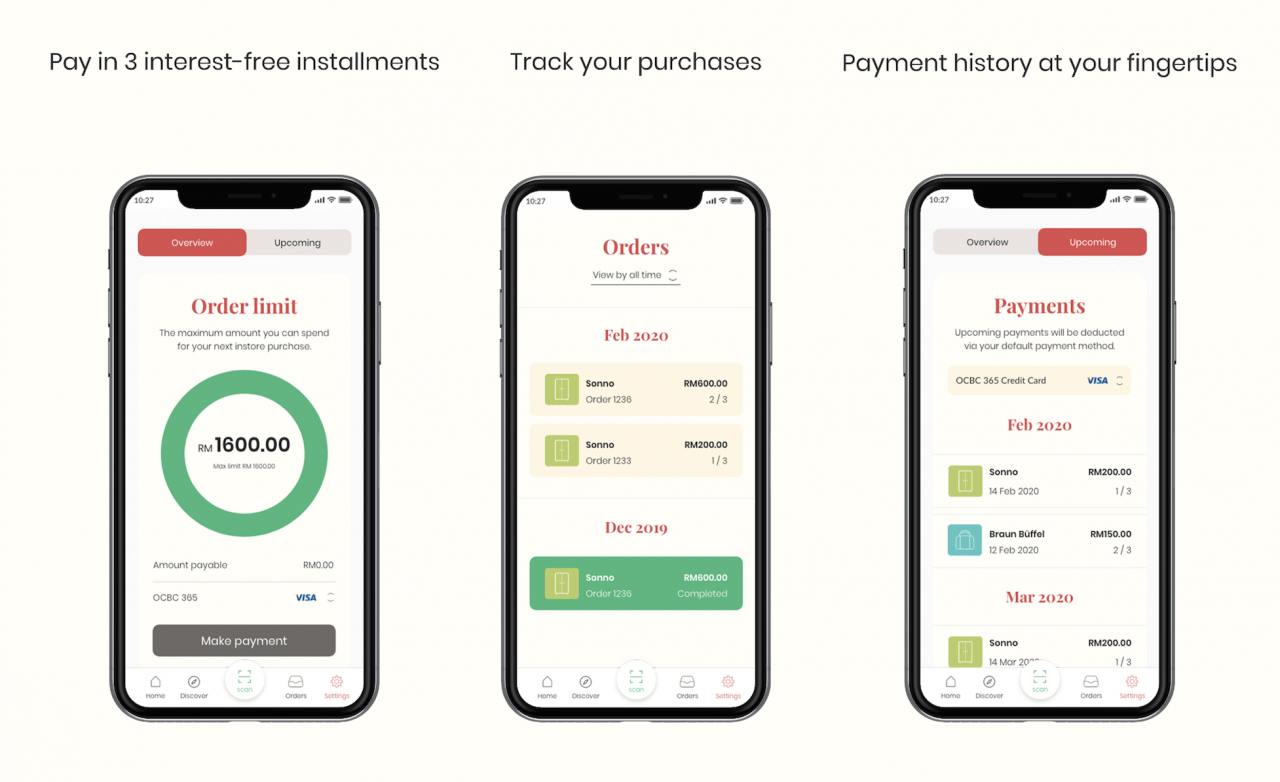

Industry player, Split, a BNPL fintech provider allows businesses to offer their customers the choice of paying in up to three interest-free instalments without a credit card.

Singapore-based hoolah operates under the concept of “Responsible Affordability” whereby the company allows customers to make an investment into quality products and lead the lifestyles they want or aspire but at the same time, makes sure they do not fall into debt.

Buy Now Pay Later (BNPL) service provider, hoolah has more than 300 merchants in Malaysia, from electronics, fashion, accessories to home and lifestyle, including brands such as Focus Point, Braun Buffel and Kenwood.

“In 2020, transaction volumes increased more than 64-fold even with the increase, there are instances where we reject transactions when we think people are moving towards the wrong direction,” CEO of hoolah, Stuart Thornton says.

Ride-hailing company, Grab has also entered the BNPL scene with PayLater as their own flagship initiative.

According to Grab’s PayLater FAQs, the service offers four payment options, instead of three like Split and hoolah, or pay by the end of the month option and with the same interest-free payments as well.

“Get updates every step of the way. From when a transaction has been made to when a repayment is successful. Made a refund in-store? We will let you know when you will get your money back,” Grab says on its take on transparency of PayLater.

From US to Australia to Asia

“There are some nuanced differences between the markets but one of the things we noticed is that millennial and Gen-Z consumers are very similar. The US, for that matter, had historical foundations of BNPL called Layby.

“This gave consumers the opportunity to reserve the item they wanted, pay a percentage and then come back a month later to pay the rest and get their product,” Stuart says.

Late last year, the Australian Securities and Investments Commission (ASIC) released a report on the BNPL industry which revealed the substantial growth sector had experienced. The number of BNPL transactions increased from 16.8 million in the 2017-18 financial year to 32 million in 2018-19, representing an increase of 90 percent.

“BNPL in Australia and New Zealand are fairly mature ecosystems dominated by a small number of large and typically publicly-listed players like Afterpay and Affirm.

These markets typically have “banked” populations where adults already have access to credit cards, but the rising trend for BNPL there is associated with young consumers,” Dylan tells BusinessToday.

Stuart and Dylan share a similar opinion when it comes to the BNPL landscape in Asia which is relatively small in comparison to BNPL services in other parts of the world.

hoolah’s CEO opines that people never experienced a service like BNPL before in Asia, although there are card instalment plans which are entirely a different process. Meanwhile, Dylan highlights that the BNPL ecosystem in general is still in its infancy in this region.

However, with new entries by players in the region, BNPL services are likely to expand in Asia as major fintech companies like Grab, GoJek, Razer and Oriente have all jumped at the opportunity.

In Singapore, an October 2020 consumer survey by Finder found that an estimated 1.1 million people, or 38 percent of the population, have used a BNPL service, suggesting that the trend is gathering steam in Asia amid Covid-19 uncertainties

“The people have leapfrogged some of these consumer finance vehicles and seeing digital payments take the lead and we can see that in Orchard Road in Singapore where the vendors are using or have used a BNPL service indicating the service is a healthy payment method there,” Dylan says.

hoolah’s transaction volume had increased sevenfold over the past six months as e-commerce boomed. The company added that the number of partnered retail stores jumped 280 percent to 1,000 between October 2019 and October 2020.

The increase in numbers shows that merchants are eagerly adopting BNPL options and new generation of consumers are ready to integrate their services into their lifestyle.

“The next generation are also changing their habits, beliefs and behaviours. They are more adept at using digital but also more thoughtful about responsible spending and are likely to be driven by globalisation, social media and improving wealth,” Stuart emphasises.

Covid-19 Accelerates BNPL

Split’s CEO thinks that the change was compounded by consumers being somewhat uncertain about the future and had to budget their spending accordingly. BNPL is the tool that enabled them [consumers] to do that.

He also believes it is also a merchant-driven trend, where businesses were looking for innovative ways to reach and convert customers without offering unsustainable discounts.

“I ventured into BNPL because of Covid-19. Split was previously a travel payments startup and our business were decimated overnight in early 2020, due to the Covid-19 outbreak. Thankfully, we pivoted shortly after, when we discovered that there was a massive unmet demand for BNPL in retail and e-commerce,” Dylan says.

During the outbreak, hoolah saw a significant increase in purchases using hoolah for home furnishing, sports gear and beauty items as consumers invested in their new work from home lifestyle.

“There is the necessity of making purchases to adapt to the new normal, and people are perhaps more thoughtful about price and appreciate the importance of personal cash flow. With BNPL, they get to manage their monthly budgets by paying just one third of their purchase,” Stuart tells BusinessToday.

The Surge of Digital Consumers

According to e-Conomy SEA 2020, by Google, Temasek, and Bain and Company, Asia-Pacific is forecasted to be the fastest-growing region owing to increasing Internet users.

40 million new users joined Southeast Asia’s digital economy in 2020 alone, bringing the total number of Internet users in the region to 400 million.

Co-founder of Spilt comments that, from a merchant’s perspective, consumers would want to be able to reach the widest coverage of customers that BNPL can give them, not a subset of the population.

The merchant proposition for BNPL and e-commerce/financial services players is clear in that BNPL does not rely on users to be on a specific marketplace or a specific e-wallet to give them the ability to pay later.

“More importantly, for Split, we intend to stay ahead of the curve by ensuring we create a localised product in the markets by continuously listening to our customers and merchants and figuring out how to serve them even better,” Dylan says.

On the other hand, hoolah wants to connect merchants with consumers across Asia and enrich the consumer’s lifestyle as the company further expands into new categories such as experiences, services, insurance, and accommodation in using technology.

“We have invested in building a bank-grade infrastructure that is robust and secure. Within our tech stack is our own proprietary risk decision engine, built and operated by our Chief Technology Officer, Jason Van.

He previously spearheaded the technology for a global BNPL company and has deep technical expertise in creating and implementing systems that are considered benchmarks in the industry for managing fraud and resilient payments,” Stuart says.

BNPL is a new kind of credit transaction that makes consumers receive the luxury of getting the desired items first and pay little by little according to the time given by the intermediary app that the new generation of the consumers welcomes with open arms.

“In my opinion, however, the biggest problem lies in the model itself: credit card limits are often generous in the multiples of monthly gross salaries but the revenue model for credit cards relies on compounding interest and late fees when consumers miss repayments,” Dylan said.

Split is designed so there is no incentive to encourage excessive spending, nor do we have a revenue model that profits when Malaysian miss payments. If someone misses a payment, they are prevented from making any further purchases until the payment is made.

“We see this to encourage consumers to be more disciplined in their spending and we hope that our alternative payment method can ease the burden of financial commitments as Malaysians continue to navigate their way through this outbreak,” Dylan says.

hoolah’s BNPL reduces the impact of the price for consumers by splitting their purchases into three monthly repayments at no additional cost. “Our business model is very much a B2B2C model – we do not make money off the consumers. It is from a merchant’s perspective that they invest in the four outcomes: getting customers to come to their store, drive sales conversion, increase in basket size, and repeated customers,” Stuart concludes.