Its very difficult to start a business story without mentioning about the pandemic, in this case the medical industry which is at the centre of the storm is currently facing unprecedented pressure due to Covid-19 patients. However this scenario is mostly affecting the public hospitals, whereas the private facilities are running at low capacity due to peoples apprehension of going out.

But the situation is temporary and on the long run private healthcare are positioned comfortably to gain from the aftermath, as incomes continue to rise across the region whilst the quality of public healthcare remains relatively low. According to Fitch Solutions, spending on private healthcare is growing at a rapid pace on a regional scale, this will provide significant opportunities to providers of private healthcare that invest in the region. And this trend is expected to continue over a ten-year forecast period with a number of major markets across the region demonstrating rapid growth in expenditure on private healthcare.

These are some statistics on the rise of private healthcare spending by geography in USD based on 10 year forward compounding annual growth rate by percentage. Top of the list is Brunei Darussalam 4.49, Indonesia 7.62, Cambodia 6.90, Myanmar 3.99, Malaysia 6.64, Philippines 8.90, Singapore 7.99, Thailand 7.55, Vietnam 4.79.

Southeast Asia (SEA) is emerging as the bright spot for private healthcare provider investments, with increasing

demand for private health services supported by strong growth fundamentals and the inherent gap in public healthcare infrastructure. Growth drivers for private healthcare demand include rising economic development and incomes, an underdeveloped healthcare infrastructure, increased healthcare spending, changes in population demographics, more favorable government regulations and a thriving medical tourism industry in the region.

Countries such as Thailand, Indonesia, Vietnam and the Philippines are striving to provide universal healthcare coverage for all their citizens, which is straining the resources and service quality in public hospitals due to the accelerated uptake. Governments have been slow to address the need for significant investment in public hospital infrastructure and for a greater number of healthcare professionals. For example, public hospitals are often overcrowded and plagued with shortages of doctors, medical supplies and diagnostic equipment, which affects their ability to deliver high-quality care.

To expand healthcare offerings beyond the public sector, governments are providing incentives such as tax

holidays, and raising the caps for foreign equity ownership to encourage private healthcare providers to fill the demand/ supply gap.

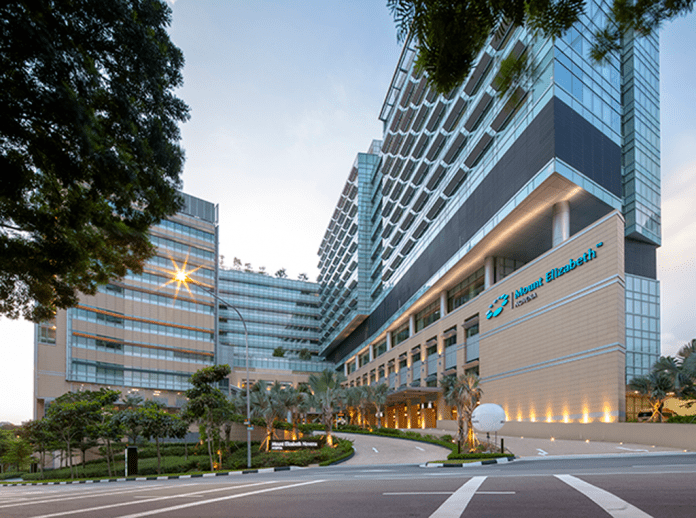

The growth of the highly lucrative medical tourism business has also resulted in an increasing number of private hospitals in the SEA region seeking international certifications such as JCI (Joint Commission International)

accreditation to expand patient capture beyond SEA. Thailand, Malaysia and Singapore have traditionally been the major destinations for medical tourism due to government healthcare promotion support, availability of internationally accredited facilities and staff, and high standards of care. Hospital group like IHH and KPJ who have been seeing low patient count, could expect a spike once borders open and medical tourism resumes.

There are certain aspects of the industry that will need to be addressed, key challenges include inadequate supply of doctors and nurses, uncertainty over patients’ willingness to pay, and inability to provide cost-effective healthcare delivery. Currently there is a shortage of doctors and nurses in the region, and local medical schools lack the capacity to meet the growing demand. Compared with the OECD average of over 30 doctors per 10,000 people, SEA countries have between two and 20 doctors per 10,000 people, with Indonesia being one of the big laggards in generating an adequate supply of physicians.

Source: World Health Organization (WHO), Fitch Solutions