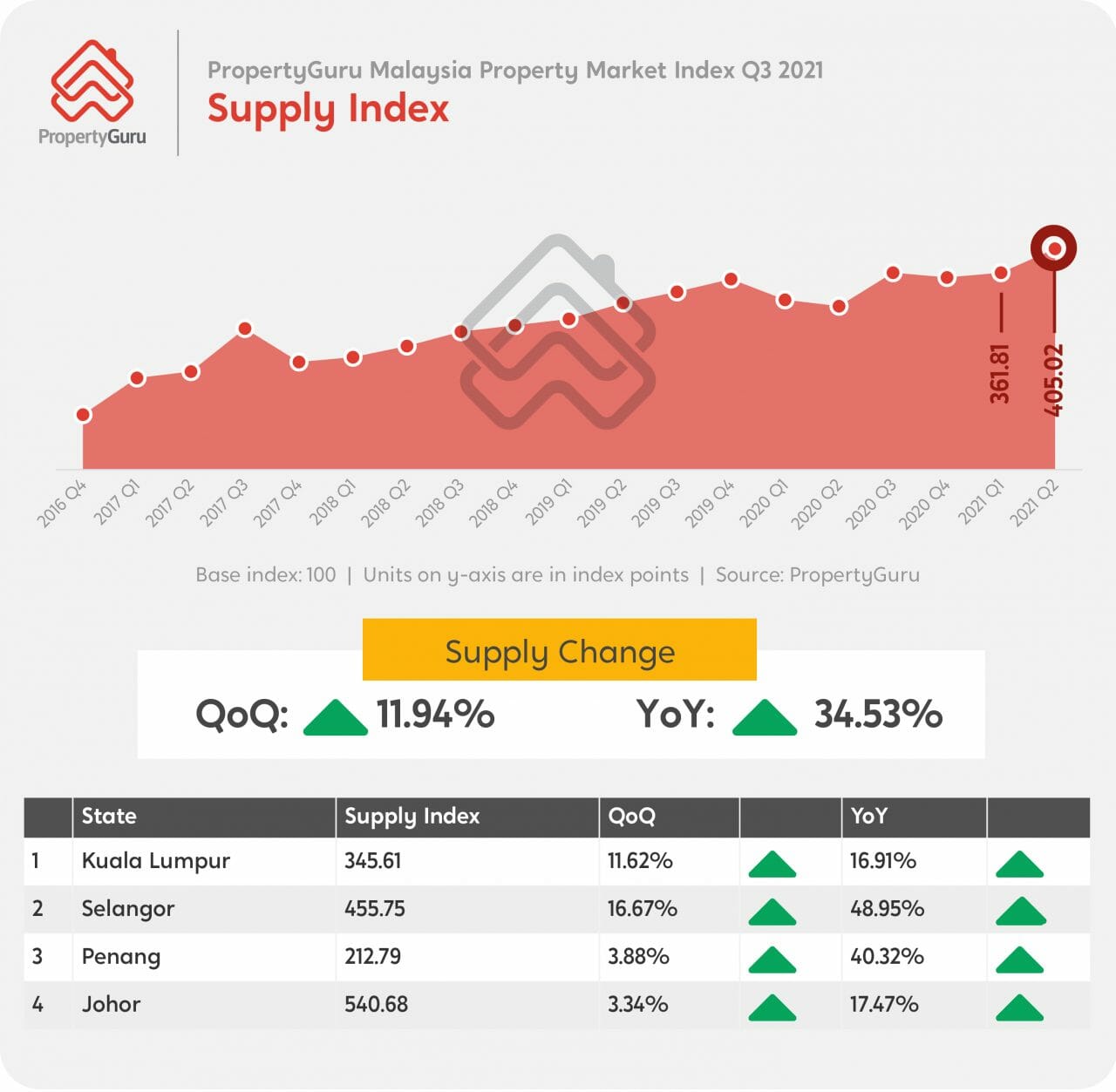

According to PropertyGuru’s latest Malaysia Property Market Index (MPMI) report, the overall property supply in the market spiked by 34.53% YoY and 11.94% QoQ in the second quarter of 2021. This data, which is tracked based on PropertyGuru’s extensive listings, represents the highest volume of YoY supply growth recorded in two years.

The surge in property supply in the country in Q2 2021 is likely driven by an increase of homes being put up for sale in the secondary market under the current economic climate. This upward trend in property supply is also observed across four key regions covered by the MPMI, namely Kuala Lumpur, Selangor, Penang, and Johor, which saw a YoY increase of 16.91%, 48.95%, 40.32%, and 17.47% respectively.

Sheldon Fernandez, Country Manager of PropertyGuru Malaysia shared, “The pandemic has caused many Malaysians to lose income whether it’s due to pay cuts, furloughs, or layoffs. While the introduction of a six-month moratorium on bank loan repayments will offer some measure of relief to some, those who are cash-strapped may still resort to selling their properties. As such, we may see more residential supply making its way into the secondary market, resulting from those who wish to cash out on their property investments to alleviate current financial burdens.”

Meanwhile, property supply volume from the primary market may be affected in the coming quarter, due to the recent implementation of a total lockdown nationwide in June 2021, which has disrupted the construction and property development sectors’ operations. Data from the National Property Information Centre (NAPIC) revealed that the number of newly launched residential units had already dropped significantly from 14,865 units in Q4 2020 to 5,919 units in Q1 2021.

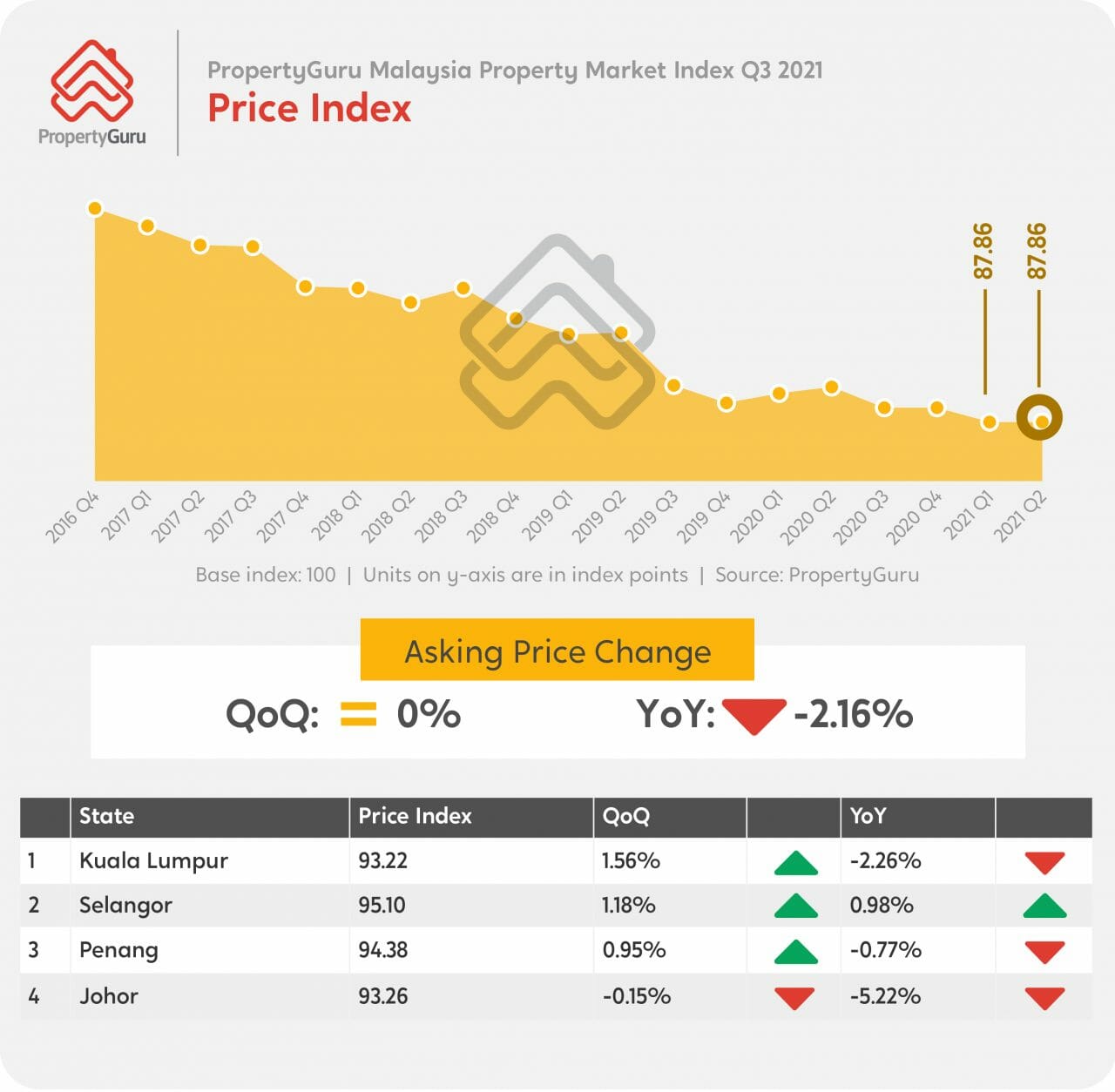

Property Asking Price Stabilizing at Current Low

The prolonged COVID-19 situation has significantly impacted the property market, as reflected in the asking prices of primary and secondary property markets tracked by the MPMI. The PropertyGuru Malaysia Property Asking Price Index has been on a declining trend since Q2 2020 with a YoY drop of 2.16%, coinciding with the onset of COVID-19 cases, and the implementation of Movement Control Order (MCO) restrictions. While certain sectors of the market initially showed some measure of resilience, the extended restricted environment, growing economic hardship, and weak consumer sentiment have contributed to sustained downward pressure on prices over the past four quarters.

However, a point of consolation is that house prices may have already plateaued at its lowest point, given that existing building costs allow very little room for further drastic dips. Illustrating this, the MPMI found that the Price Index saw no quarterly change between Q1 2021 and Q2 2021, holding steady at 87.86 points.

In three of the four key markets covered by the MPMI, positive growth was observed for asking prices in the second quarter of the year, indicating some form of price stabilisation for Kuala Lumpur, Selangor and Penang. Asking prices moved upwards by 1.56% QoQ in KL, 1.18% QoQ in Selangor, and 0.95% QoQ in Penang. Johor was the only state that registered negative growth, dipping slightly by 0.15% QoQ in Q2 2021.

“With the uncertainty surrounding the new Delta variant of the virus and the rising infection rates across the country which has led to a fresh wave of lockdowns, we believe that the property sector outlook will remain gloomy for the rest of the year. Looking ahead, any significant signs of recovery to the property sector can only be expected once the nation is better positioned to achieve herd immunity with the ramp-up of COVID-19 vaccination, resulting in a more liberal economic environment,” said Sheldon.

To support homebuyers looking to purchase property as well as contribute to the recovery of a negatively impacted property market, the government has extended the Home Ownership Campaign (HOC) incentives until 31st December 2021, which will help to keep demand alive among financially-sound home seekers and investors.

Sheldon remarked, “We expect property asking prices to stabilise at the current low, before gradually moving upwards again in tandem with the progress of the national vaccination programme, as well as when lower new infection rates are recorded. As such, savvy investors and home seekers may see the current climate as an opportune moment to purchase prime property at attractive prices, while taking advantage of low interest rates and financial incentives offered by developers and the government through the HOC.”