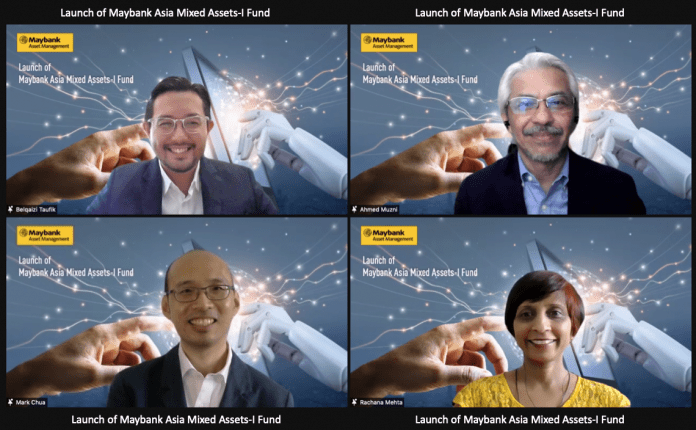

Maybank Asset Management Sdn Bhd (MAM) launched Maybank Asia Mixed Assets-I Fund (MAM-AI) which is suitable for investors who seek capital and income growth.

The fund has a high-risk tolerance, and is comfortable with an Islamic fund’s exposure, investment policy, and approach.

The Fund is MAM’s first Shariah-Compliant mixed assets fund that combines the expertise of our experienced Fund Managers and the latest Quant Investing technology to provide the best outcome for the Fund.

MAM-A.I. will feed into the Maybank Asian Growth and Income-I Fund (Target Fund), which is managed by Maybank Asset Management Singapore Pte Ltd. The Target Fund is a Singapore-registered open-ended unit trust constituted in Singapore.

To achieve its investment objective, the Fund will invest a minimum of 90% of the net asset value (NAV) in Class I – USD of the target fund and a maximum of 10% of the Fund’s NAV into liquid assets.

“With the rapid technological advancements, investors now have access to the enhanced intelligence and learning power of Quant Investing combined with active management by our Fund Managers to achieve optimal portfolio diversification. With this early mover advantage, investors can access markets in Asia to potentially achieve better returns.”

“Quant Investing reduces the influence of human emotions and emphasises mathematical and statistical analysis to determine the value of a stock, bond or other assets. It can pick up trends quickly and capitalise on market inefficiencies based on quantitative data.

“With this Fund, investors can now get the best of both worlds in terms of portfolio diversification and potential higher and consistent return,” Ahmed Muzni Mohamed, Chief Executive Officer of Maybank Islamic Asset Management Sdn Bhd, says.