IOI Properties Group via its Singapore business Boulevard View Pte Ltd has successfully tendered for a parcel of land in prime Marina View Singapore for approximately RM4.68 billion.

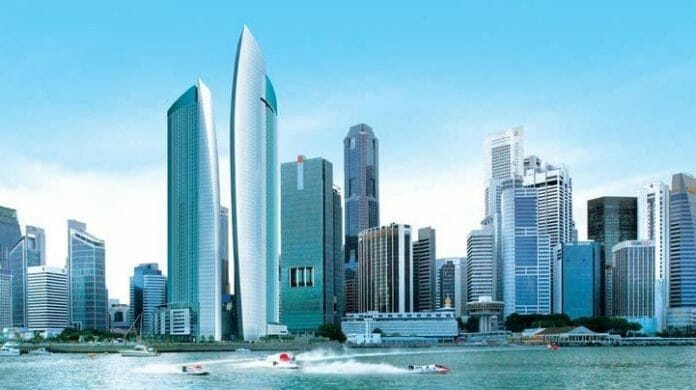

The 99 year leasehold land measuring 7,817.6 square metres was tendered by Urban Redevelopment Authority on behalf of the Singaporean government. Site of the located is within the Marina Bay area, which is Singapore’s major financial and business district. It is strategically located along Marina View and next to Shenton Way, which are the two (2) key roads within Marina Bay and the existing Central Business Development.

According to filing, the land is situated close to the IOI Central Boulevard Towers office development and other developments such as Marina One, Asia Square, Singapore Conference Hall, Marina BaySands and Marina Centre as well as various cultural, recreational and entertainment offerings, which makes it a strategic site for mixed-used development. A well connected area with the existing Marina Bay and Downtown Mass Rapid Transit (“MRT”) stations and the upcoming Shenton Way MRT station on the ThomsonEast Coast Line is within a two-minute walking radius.

The Marina Bay MRT station serves as an interchange for three lines, the existing Circle Line, North-South

Line and the upcoming Thomson-East Coast Line, hence providing the Land with a convenient access to the island-wide rail network.

Based on information published by the URA, the Land, which is a 99-year leasehold and measuring approximately 7,817.6 sqm with a gross plot ratio of 13 times, is estimated to yield more than 100,000 sqm of space for 905 private residential units, 540 hotel rooms, and 2,000 sqm gross floor area of commercial space.

Details of the proposed development to be undertaken on the Land has yet to be finalised at this juncture as the development plans are still at a preliminary stage. The Tender Consideration amounts to approximately SGD14,838.29 per sqm

IOI will satisfy the tender consideration in cash and it is expected to be funded via bank borrowings or internally generated funds.