Pandemic impacted Small Medium Enterprises were given lifelines in terms of loans during the pandemic, the various aids provided by the government sustained the businesses during the darkest period of their time. It was during this period that banks played a crucial in dispersing financial support to those in need and helped the industries to muster on despite the relentless challenges business owners faced due to the intermittent lockdowns.

Among those who played a pivotal role was Maybank which had actually extended some RM20 billion worth of Repayment Assistance to over 26,000 Small-and-Medium Enterprises and has been continuously making its services available for these SME’s.

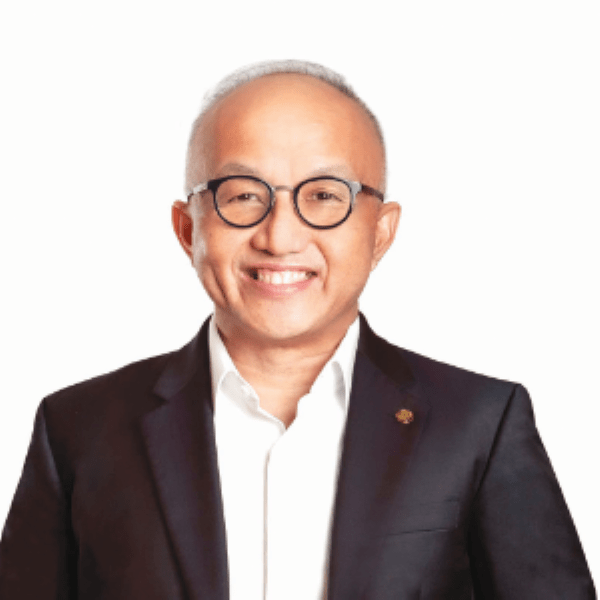

Group Chief Executive Officer, Community Financial Services, Dato’ John Chong stated that Maybank currently serves almost 60% of all SMEs in the country, continues to accept Repayment Assistance applications under the PEMULIH programme. He added that the total number of SME loans/financing currently under Repayment Assistance represents 8% of Maybank’s total Malaysia consumer and small to mid-sized business loan/financing portfolio based on the outstanding balance.

Microenterprises makeup 78% of SMEs in Malaysia, and may often lack credit history or collaterals to qualify for financing, understanding their plight, Maybank’s SME Digital Financing offers Microenterprises and SMEs quick and easy financing from RM10,000 to RM250,000 through the online application as the bank ramps up its digital initiatives.

According to Dato John from application to approval, the process can be completed in as fast as 10 minutes, with disbursement as fast as 1 minute. In total, the Bank has approved RM1.87 billion loans/financing to more than 15,000 SMEs via SME Digital Financing, since its launch in September 2020.