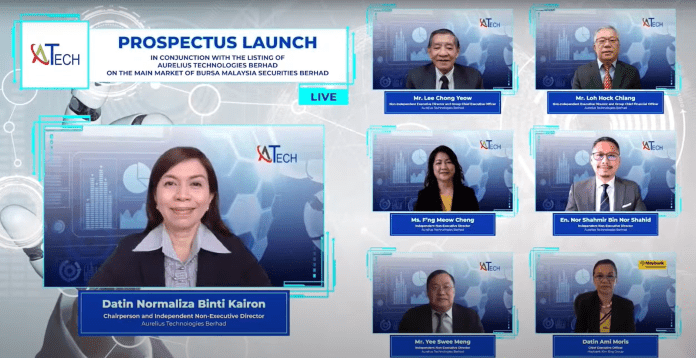

Aurelius Technologies Bhd, a provider of electronics manufacturing services for industrial electronic products en route to a listing on the Main Market of Bursa Malaysia Securities Bhd launched its prospectus for the IPO today.

ATech offers a comprehensive range of EMS to multinational corporations across 11 countries covering Asia Pacific, Americas and Europe.

These services include engineering support services, prototyping, board assembly, mechanical assembly and test for communications devices, Internet of Things devices, electronic devices and semiconductor component modules used by the telecommunications, transportation, power management and IoT industries.

With a long track record of 28 years, ATech has built a business based on long-term client partnerships. All top five customers are foreign companies or subsidiaries of US public-listed companies.

The company is expected to raise RM104.73 million in proceeds from the IPO, of which RM40.0 million would be used to acquire new machinery and equipment, RM29.52 million for repayment of borrowings, RM28.13 million for working capital and RM7.08 million for listing expenses.

“Our IPO will enable us to speed up the execution of our plan to grow, strengthen and leverage our core competency of providing EMS for industrial electronics products as well as continuing our expansion into the production of IoT modules that we started offering in early 2020.”

“We are also expanding our production facilities with the construction of a new factory adjacent to our existing plant in Kulim Hi-Tech Park. The new factory will enable us to add floor space to grow the semiconductor component modules production, to cater for Lithium-Ion battery pack production and our existing EMS operations. We will have a total of 15 SMT lines by the end of 2023 from both the new factory and additions to the current factory. These new SMT lines will increase our annual capacity by 198.7% for the financial year ending (FYE) 31 January 2024 from FYE21 to meet the expected increase in demand from our customers,” says the Executive Director and Chief Executive Officer of ATech, Lee Chong Yeow.

For FYE21, communications and IoT products contributed 89.5% to the Company’s revenue, electronic devices contributed 9.4% and semiconductor components contributed less than 1%. The top three countries by revenue contribution for FYE19 to FYE21 were the USA, Malaysia and Singapore, which collectively accounted for 93.6%, 92.7%, and 89.3% of the total revenue.

Maybank Investment Bank Bhd, which is part of Maybank Kim Eng Group, is the Principal Adviser, Sole Bookrunner and Sole Underwriter.