Malaysia’s 4Q21 GDP growth expanded 28.9%, saar, leaving overall GDP growth lower than its expectations at 3.6% oya (J.P. Morgan: 4.9% oya, Consensus: 3.3%), which leaves overall GDP growth for 2021 at 3.1% year on year and sits at the lower end of the official 3-4% target range.

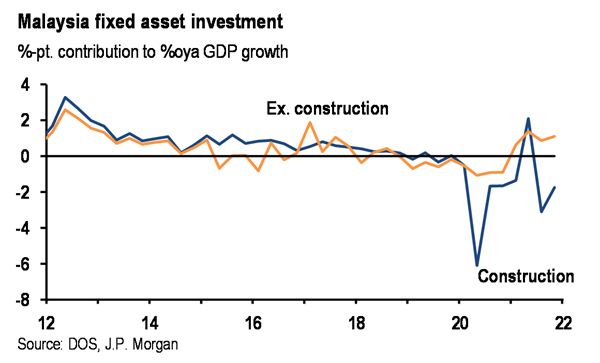

Broad easing in containment measures lifts private spending last quarter, FAI growth lags. The relaxation of containment measures under the National Recovery Plan last quarter supported robust private consumption spending expansion of 28.3% quarter on quarter, saar. This mirrors the rebound in the services-related activity of 14.5% quarter on quarter, saar, in 4Q21, a reversal from the previous quarter’s double-digit contraction. The recovery in fixed investment activity, however, remains modest, up 3.8% q/q, saar, with construction-related activity exhibiting a more pedestrian pace of recovery.

JP Morgan believes solid recovery lies ahead as economy, monetary policy tightening likely in 3Q22. Despite the latest spike in Omicron-related COVID-19 cases in Malaysia, mobility restrictions have remained loose which speaks to the country’s strong vaccination progress. Improving labour conditions, the resumption of major infrastructure projects alongside an imminent border reopening in the coming months will likely set the stage for a strong growth recovery this year.

That said, it added Bank Negara struck a slightly cautious tone, noting that the balance of risks around growth this year remain tilted to the downside on account of slower global growth, a deterioration in supply chain disruption, and the potential emergence of vaccine-resistant COVID-19 variants. In its view, as the economy continues on its path of recovery, labour conditions outside the goods-producing sectors are likely to catch up this year alongside the broader resumption in services, in turn guiding core prices higher, albeit at a gradual pace, in line with the central bank’s assessment. Thus, JP Morgan continues to expect monetary policy tightening of 25bp each in 3Q22 and 4Q22.

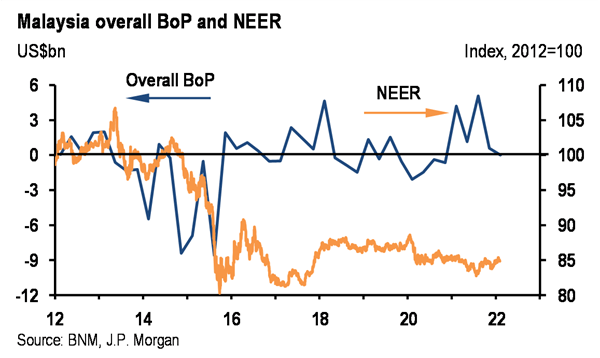

Malaysia’s 4Q21 balance of payments narrowed to US$0.8 billion from US$4.9 billion last quarter, with the bulk of the narrowing due both to a marginal US$0.4 billion deficit in the financial account and US$2.4 billion outflows in the errors & omissions (E&O) line item even as the current account surplus widened to US$3.6 billion from US$2.8 billion in 3Q21 (first chart). Excluding E&O, the overall BoP recorded a larger US$3.3 billion surplus.

The overall current account recorded a larger surplus due mainly to a larger goods balance which reflects stronger the expansion in both manufactured and commodities-related exports, which offsets the widening in the income deficit. While we expect buoyant commodity prices to be a tailwind for the goods balance, the resumption in economic activity could provide an offset leading to an overall narrowing in the current account surplus in the coming quarters.

The financial account flipped back into a modest deficit last quarter of US$0.4 billion, due mainly to outflows recorded in the other investment account which Bank Negara noted was due to interbank lending abroad by the domestic banking system and a rise in residents’ deposit placement abroad.

Meanwhile, net FDI inflows recorded a US$2.3 billion surplus last quarter as the net portfolio account registered a modest US$0.7 billion surplus, the latter on account of stronger non-resident portfolio investment inflows into the domestic debt market (second chart). The broad stabilization in non-portfolio capital flows speaks to the central bank’s better FX management, manifesting in a broadly stable NEER.