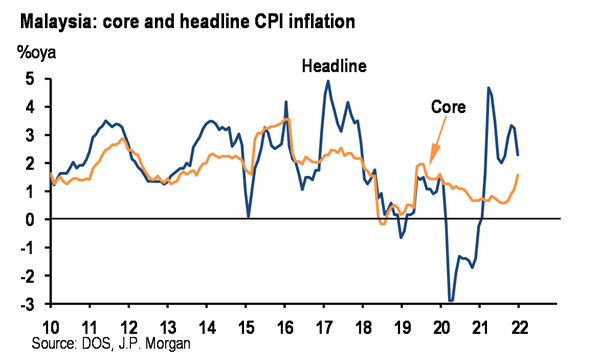

Malaysia’s consumer prices rose 0.3%m/m, sa, leaving overall headline CPI in line with JP Morgan’s expectations at 2.3%oya. Core prices, which exclude the most volatile fresh food items and administered prices of goods and services, ticked up 0.5%m/m, sa, leaving core CPI at 1.6%oya.

Headline CPI inflation expanded at a 4.9%3m/3m, seasonally adjusted annual rate (saar) pace last month as underlying core price momentum picked up more materially to 2.3%3m/3m, saar, the strongest sequential expansion since December 2018. Food prices rose 0.2%m/m, sa, and 6.2%3m/3m, saar, reflecting price increases of meat and fresh vegetables likely reflecting lingering supply-side disruption. Transport prices rose 0.4%m/m, sa, last month, with retail pump price increases modest relative to the movement in underlying crude oil price. Service-oriented categories, such as restaurant & hotels and culture & recreation, extended their price gains, up 1.0%m/m, sa and 0.7%m/m, sa, respectively.

Core prices creeping up, monetary policy normalization is likely to begin in 3Q22. As Malaysia continues to move toward endemic equilibrium, mobility restrictions have been broadly eased, paving the way for recovery in the non-manufacturing sector over coming quarters even as external demand is likely to slow this year.

Looking ahead, JP Morgan expects labour conditions outside the goods-producing sectors to catch up this year alongside the broader resumption in services, in turn guiding core prices higher. Its current forecasts pencil in monetary policy hikes of 25bp each in 3Q22 and 4Q22, although it notes that a faster-than-expected acceleration in underlying core price momentum in the coming months raises the bias for an earlier move.