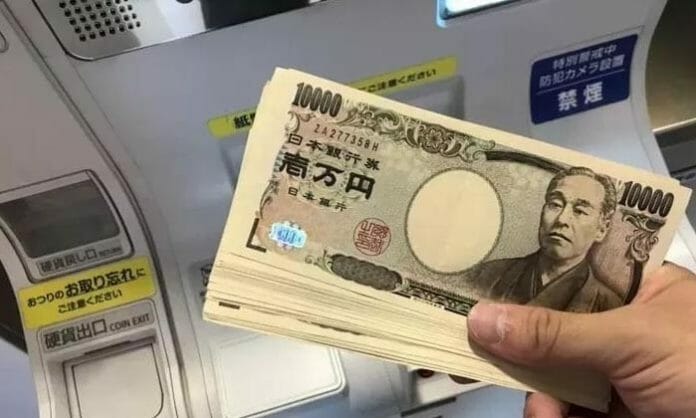

Japan reported a trade deficit of 412 billion Yen in March. As part of an ongoing trade struggle.

A wonder the currency has been under tremendous and continuous pressure as global food and energy prices reach toward the stratosphere. There are not many Japanese authorities can do.

GDP registered 1.1% in the fourth quarter but has been flat for the past decade. Retail Sales are negative and consumer confidence is plummeting. The economy is bouncing back in some sectors but has not gained broad-based traction. With the latest global supply-chain and inflation shocks only making matters worse.

While the government and Bank of Japan can do little more to solve the nation’s woes, surprisingly, all of a sudden, they may not have to.

The collapse of the Yen may prove to be the best thing that has happened to Japan this century.

It can be the catalyst to turn the whole economy around. To get everything moving forward rapidly in fact. With the lower currency will come further inflationary pressures, inflation has already begun to rise but remains modest at 0.9%. There is room to the upside. So the usual negative of currency collapse, inflation, is in this case actually a positive. The falling Yen will also go a long way toward returning the nation to a trade surplus. Though supply-chain disruption will continue to hamper things.

What all the government’s advisors and all the nation’s economists could not do, the lowly Yen may well achieve.

How far can it fall?

The truth here is perhaps not that much lower. The main driver of the prospect of a low being put in place soon is the huge speculative short positions that are now well established. It is very adept at talking its currency up while allowing it to fall further. Any news item or reason at all to buy Yen would trigger a massive short-covering rally.

This is how this collapse of the Yen will end. The timing or level is more problematic. Japan is not new to the game of competitive currency depreciation.

A long-term chart of USDYEN quickly reveals that a move as high as 135.00 is certainly possible. Overcoming years, perhaps 150. As I said though, any sharp immediate reversal at any time could now trigger a short positions profit-taking rally. Perhaps back to 122.50.

From there, the Yen would remain weak, however, and this is why we should view the collapse of the Yen, as laying a path at last for a sustained national economic recovery.

It has been a long time coming.

Market insights and analysis from Clifford Bennett, Chief Economist at ACY Securities