Now that 5 consortiums have received their license for Digital Bank operations in Malaysia, let us look at the mystery 24 parties who failed to excite the regulator with their propositions.

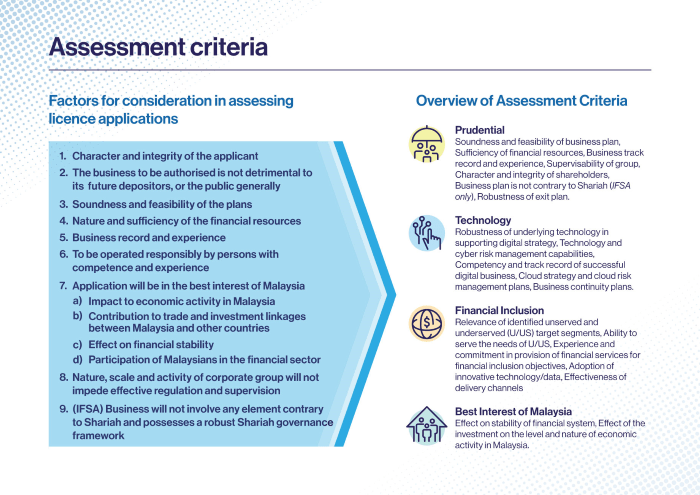

Accordingly Bank Negara has listed among others 9 criteria in choosing the applicants, they are:

Touch n Go -CIMB- perhaps this is a the biggest shocker, although we can’t confirm if the ewallet provider made a bid but the notion of it being excluded by Bank Negara is indeed perplexing. Touch N Go is among the largest e-wallet provider in terms of user base. In fact for the ePemula financial aid distribution to youths the Ministry of Finance listed TnG but omitted Boost. Backed by CIMB and technology partner Ant Financial, TnG is poised for expansion with a Digital Bank license, the failure to convince BNM will be a setback for the group. Unless if there is bigger things coming in this space!

Petronas- not sure why the oil giant was applying for the license when it should allow private corporate companies with experience in fintech and digital applications to compete in the area. The oil giant should stop hoarding every business it can get its hands-on and allow more upstarts to rise. While it can bid in the application since it has been dabling in ewallet with Setel, however with all its resources the Fortune 500 company has yet to formalise a clear path for the application.

Paramount- Star Media Group-RCE Capital – this is another weird combination, a property developer who purchased a stake in a P2P platform, a newspaper, and a finance company that is part of AmBank. This consortium consists of 5 entities whose details were not shared. Was it a case of throwing in the hat and see what happens?

Pertama Digital and Crowdo- Pertama is a public listed company that is managing consumer- to- government payments including managing bail for courts and an SME financing platform out of Indonesia. Both are mid-sized organisations that will be questioned on their long-term investment strategies for the heavy funding needed for a Digital Bank to thrive.

MPay Berhad- is a P2P lending platform and has stated that it is bidding for the license with additional partners like Trustgate Berhad and Crescent Capital, however, MPay does not have a resounding track record for its business ambitions.

MoneyMatch- an early startup that graduated from Bank Negara’s Financial Technology Regulatory Sandbox. The platform offers an international money transfer function with competitive rates. The central bank probably was not convinced on the depth and financial backing the company can muster. Bank Negara is looking at Digital Bank functioning like a traditional bank in terms of security and foundation.

iFast- Koperasi Angkatan Tentera Malaysia-THZ Alliancce- 99 Speedmart-Yillion- this 4 member group has Malaysia, China and Singapore representation. On paper, they have the know-how and background in digital banking but it’s the foreign entity mix that could have spooked authorities.

Greenpacket- M24 Tawreeq- Zico- Led by the affable CC Puan Greenpacket went in for the bid, but the CEO stepping down from the group, there is no guarantee his visions in the paper submitted can be realised.

Bigpay -MIDF-Ikhlas Capital- Bigpay under Capital A has been in a roller coaster mode ever since the pandemic. Starting off as an e-wallet it also offers cards for offline transactions, however, take-up has been slow and the low scale in user base could be the reason behind it losing the bid.

Angkasa- Bousead Holdings-Angakata Koperasi Kebangsaasn Malaysia Berhad is mainly involved in co-operatives managing about 10,000 co-ops. Lack of exposure to mass consumers and the need to impact greater Malaysia with the license must have been the drawback for BNM.

Bank Rakyat- was among the only Financial institution that went in alone for the bid, presumably eyeing the Islamic Digital Banking License but was not successful. They might make a comeback with murmurs on the ground on the lack of Bumiputera representation among 5 winning applicants. Politicians could hook Bank Rakyat back.

Genting- this is an odd mix. A casino and bank at the same time? Although it’s a rumour that the group was applying for the Digital Bank license, Bank Negara would not be considering issuing any such license to Genting for sure.

Others that failed but could form a partnership with the 5 that was awarded includes Tyme Bank from South Africa, MyMy and Sukaniaga, Razer Fintech, Johor State Government, Funding Societies, CN Asia Group, AMTD, Sunway Group, Sarawak State, PUC with Penang and Pahang State and MoneyMatch