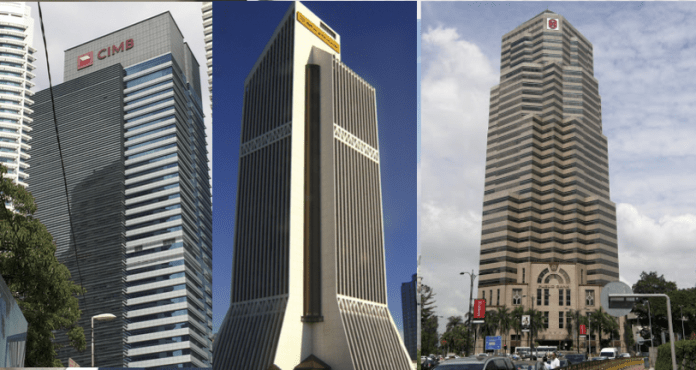

CGS CIMB has made an “overweight” call on banks with its top picks being Hong Leong Bank, Public Bank Bhd, and RHB Bank Bhd

During the monetary policy committee (MPC) meeting on 11 May 22, Bank Negara Malaysia (BNM) raised the overnight policy rate (OPR) by 25bp to 2%.

It said that this was a surprise (which is positive for banks) to us, as our economist expected BNM to sustain the OPR during today’s MPC meeting and raise the OPR by 50bp in 2H22. With this, our economist increased his expectation for the magnitude of the OPR hike in 2022F from 50bp to 75bp (to an OPR of 2.5% at end-2022F, instead of 2.25% previously).

The stockbroking firm said that the OPR hike would help to offset the negative impact from the higher taxation under Cukai Makmur in FY22F and supports our expectation for a continuous earnings recovery in 2022F, which is the potential re-rating catalyst for our overweight call on banks.

It said that it expects the OPR hike to be positive for banks as their total floating-rate loan is larger than their total fixed deposits (both of which would be repriced upward during the OPR hike).

It said that it has factored in an OPR hike of 25bp in 2022F in our earnings forecasts for banks. “Every additional 25bp OPR hike would increase our net profit forecasts for banks by an estimated 2.4% on a full-year basis (for FY23F for HLB, AMMB and Alliance Bank, and FY22F for the rest), CGS CIMB said.