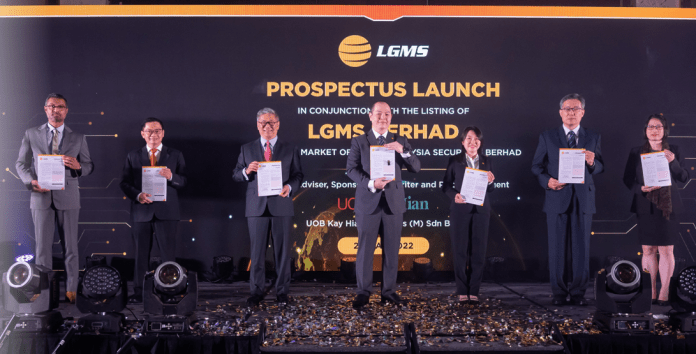

LGMS Bhd, an independent provider of professional cybersecurity services, is advancing closer to becoming a public listed entity with the launch of its prospectus in conjunction with the Company’s upcoming listing on the ACE Market of Bursa Malaysia Securities Berhad.

The prospectus launch marks the opening of applications for LGMS’ initial public offering (“IPO”) of 136.995 million shares. The IPO applications open today and will close on 26th May 2022 and the listing will take place on 8th June 2022.

LGMS and its subsidiaries and associate company are primarily involved in cyber risk prevention services, cyber risk management and compliance, and the provision of digital forensics and incident response services.

LGMS Group has a unique value proposition as a trusted service provider, built on a foundation of independence and integrity with disassociations from any brands, products, or solutions. With this, LGMS Group is able to deliver objective and impartial security advisory to its clients (comprising major financial institutions and insurance companies, multinational companies and government agencies). Its top priority is to deliver comprehensive, independent, and best-in-class professional cybersecurity services to clients in Malaysia and abroad.

The senior management holds various key internationally recognised cybersecurity related certifications, which are highly regarded in the cybersecurity market.

For the financial year ended 31 December 2021 (“FY2021”), LGMS Group recorded revenue of RM28.3 million, of which 79% was derived from Malaysia and 21% from the overseas market. Profit after tax (“PAT”) for FY2021 was approximately RM10.3 million, recording an impressive operating profit margin and PAT margin of 50% and 36% respectively.

The bulk of its revenue was derived from cyber risk prevention services encompassing vulnerability assessment and penetration testing which identify vulnerabilities and cyber threats to accordingly prescribe the relevant recommendations or actions to be taken to fix loopholes and address security weaknesses.

At the IPO price of RM0.50 per IPO share, LGMS will have a market capitalisation of RM228.0 million upon listing and raise gross proceeds of up to RM45.7 million.

With the expected growth in cybersecurity demand, more than 80% of the total gross IPO proceeds amounting to RM38.2 million will be utilised towards business expansion including the purchase of a new office with larger space, workforce expansion, capital expenditure and strategic regional expansion into fast-growing markets such as Singapore, Vietnam and Cambodia.

The remaining RM7.5 million has been set aside for working capital purposes and defrayment of listing expenses.

Speaking at the prospectus launch ceremony today, Executive Chairman Mr. Fong Choong Fook said: “Cybercrime is a global threat that has been dominating the news recently. It poses a menace to individual security and an extensive disorder to large multinational companies, financial institutions, regulators and governments.

Today’s organized cybercrimes operate on a scale and sophistication that far outpaces the lone hackers of the past, and often employ highly trained developers to innovate online attacks relentlessly. With cybercriminals casting their dark shadows at every corner, the market needs what we have to offer.

This IPO will be another accomplishment for LGMS. We intend to raise proceeds of RM45.7 million which will supercharge our growth plans.

The bulk of the proceeds will be used towards business expansion in Southeast Asia, including expanding our current operations in Malaysia. The cybersecurity market will be spurred by digital transformation, the proliferation of digital touchpoints and applications, the need for digital privacy, increasing broadband penetration rates & supportive government policies. I believe LGMS is in the right space to seize this opportunity.

With our market position, the IPO is a new beginning that provides us the platform to move forward with greater velocity and enable us to generate value for our stakeholders in years to come.”

The IPO comprises a total of 136.995 million shares wherein 22.800 million shares will be made available to the Malaysian public via balloting, 12.500 million shares will be set aside for eligible directors, employees and persons who have contributed to the success of LGMS Group, 44.695 million shares will be offered via private placement to institutional and/or selected investors and the remaining 57.000 million shares for Bumiputera in

IPO Timetable DATES Issuance of Prospectus / Opening of application 20th May 2022 Closing date of application 26th May 2022 Balloting of application 30th May 2022 Listing date 8th June 2022