The global banking sector is bracing for tougher tests as economic growth weakens and higher-for-longer inflation affects borrowers.

“The optimism at the start of 2022 is evaporating,” said S&P Global Ratings credit analyst Gavin Gunning.

“For major economies, S&P Global Ratings has lowered its economic forecasts four times since the onset of the Russia-Ukraine conflict. The growth outlook for 2022 is now much weaker compared with expectations six months ago, and with 2021.”

Inflation is taking center stage in many jurisdictions and muting the post-COVID rebound. The challenge for central banks is whether they can harness inflation expectations without causing a recession.

For most banks the immediate effect of higher interest rates is positive because it will benefit their net interest income.

“The compounding effects on banks from weaker growth and higher interest rates over the next six to 18 months are much less certain; they could be profound in a downside scenario,” said Mr. Gunning.

Under base-case conditions, the corporate sector appears relatively resilient in a moderate stress environment.” The significant build-up of capital and other buffers over the past decade will allow the global banking sector to show some resilience at current rating levels,” said S&P Global Ratings credit analyst Alexandre Birry.

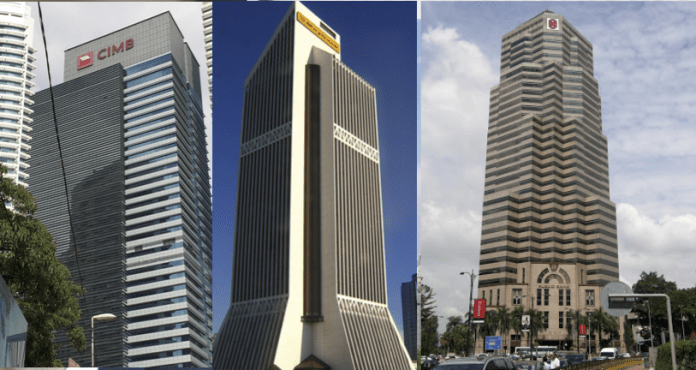

For Malaysia, S&P Principal Credit Analysts Nikita Anand says asset quality risks could weigh on the banks’ recovery. She highlights key credit drivers for the economy with recovery under way, with base case suggesting sector loan growth will rebound to 6.0% in 2022 from 4.5% in 2021, supported by improving macroeconomic conditions. S&P forecast GDP growth of 6.1% in 2022 compared with 3.1% in 2021. Malaysia she adds is well positioned to weather higher energy prices as a net energy exporter, primarily of gas. However, energy price increases may not pass through to domestic consumers, potentially offsetting some of the benefit to producers.

Solid capital and prudent dividend policies are key strengths. Nikita believes Malaysian banks’ solid capital buffers (15.2% common equity Tier-1 ratios as of Dec. 31, 2021) and prudent dividend payouts are key strengths that support a stable credit standing and ratings on the banks.

Key assumptions

Asset quality will deteriorate with the expiry of moratorium programs. The industry NPL ratio will likely rise to 2.5%-3.0% by end-2022 from 1.6% as of end-April. 2022. Credit costs will decline to 40-50 basis points (bps) but stay higher than pre-pandemic levels due to uneven recovery of loans under the moratorium. Given the banks’ high provisioning buffers on non-impaired loans, the need for additional provisioning should be lower despite rising NPLs. For most large banks, loans that require further repayment assistance have fallen sharply to 5%-6% (from 25%-30% earlier) upon the expiry of the moratorium, which indicates that the majority of customers have started repayments. That said, the underlying strength of affected borrowers remains to be seen and the initial recovery of repayments could prove fragile. It will take longer for consumers and small and midsize enterprises (SME) to recover. This is a result of the magnitude of the SME stress throughout COVID-19, higher inflation, and already-elevated household indebtedness.

Margins she said will improve but the prosperity tax limits earnings upside. There could also be some upside for sector net interest margins (NIMs) since we forecast that Bank Negara Malaysia will raise interest rates by at least 75 bps in 2022. Higher credit growth and moderating credit costs will support earnings. However, upside to net profits is limited due to a one-off prosperity tax in the 2022 budget and higher write-offs.

What to look for over the next year

Rising interest rates. Higher inflation and a rising interest rate environment can dampen credit demand, push some low-income consumers to the edge of default, and pressurize SMEs that are still healing from the impact of the pandemic. We view these risks as manageable. Banks’ asset quality also hinges critically on employment in the country, given that 59% of the system’s loan book is exposed to the household sector. We expect the unemployment rate to improve in 2022 but stay higher than pre-pandemic level.

New digital bank launches.

The central bank awarded five digital bank licenses earlier this year. Successful applicants will still have to prove their operational readiness before they can commence operations, which could take 12-24 months. While we believe large banks will retain their market shares, it will be interesting to see how the business models of incumbent banks evolve in response to the digital competition.