BusinessToday interviewed Loob Holding CEO Bryan Loo the man behind the popular boba tea brand Tealive on his expansion for the company and what he has in store for Malaysians after boba?

BT: Share with us the pre and post pandemic journey? So how did you walk through the difficult days? And what are the most important lessons that you read from the journey?

Bryan Loo: Now we are at an endemic stage. For Loob Holding (the holding company of bubble tea brand Tealive), we’ve done quite well throughout the COVID period. We expanded over 100 stores throughout the COVID period. We are still on track with our expansion plan which targets about 130 stores for Tealive per year in Malaysia alone, simultaneously expanding to several regional markets, including the Philippines, Cambodia and Mauritius.

One of the advantages of Tealive’s business model is our scalability and flexibility. By this we mean the size of our stores can be as small as 200 square feet all the way to 4,000 – 5,000 square feet for drive-through outlets.

In fact, our drive-through stores, of which there were about 20 then, were thriving during the pandemic. We now plan to expand to another 10 to 15 drive-throughs a year. In order to survive through the pandemic, Loob Holding’s used various models to help us cruise through the period well. For instance, we are one of the largest bubble tea players in the world which uses the ‘retail at petrol stations model’ with 250 outlets, thus far, across 5 brands – PETRONAS, Petron, Shell, Caltex and BHP. Many prefer this retail channel as its far more convenient. In summary, I would say it’s the convenience for consumers coupled with the scalability and flexibility of business models across our wide network of outlets that has us to weather the storm of the pandemic well.

BT: Could you share your plans with us in moving into the Philippines as well as Mauritius, especially when Mauritius wasn’t mentioned before?

Bryan Loo: Yeah sure, we setting up the very first Tealive store in Mauritius in mid-July.

Tealive was honoured to be endorsed by Frost and Sullivan back in 2020 as the largest bubble tea brand in Southeast Asia.

Today, we have slightly more than 800 stores across nine different markets, and are the dominant player in our industry with most of our outlets in Southeast Asia. We also have outlets as far as Australia, United Kingdom with the latest addition being the outlet in Mauritius.

The Philippines is really an exciting market for us as they are one of the fastest growing regional markets. Interestingly, it is the market which began during the COVID period but yet it rises up to be one of the top performing markets for us amongst these nine markets. We at Loob Holding are excited about the potential of the Philippine market as it is poised to be the second largest market for us. Our intention is to grow and double the store count annually, hopefully to have some 300 stores in the Philippines by 2024.

BT: Why you chose Mauritius of all the markets?

Bryan Loo: We are lucky as we already have established relationships with our operating partners i.e., the master franchisee in Mauritius. They are one of the largest traders or distributors in Mauritius and have been importing a lot of goods from Malaysia to Mauritius. They happened to know the Tealive brand as it is a household brand in Malaysia. They were interested in our brand and started to engage with us and we struck a deal during the pandemic period. A store is going to be set up next week (Mid-July 2022), hence our project and supporting teams are now in Mauritius to oversee birth of a new store in Mauritius. Tentatively, we are looking to kick start 3 outlets by end of the year.

BT: What is your growth forecast from these markets?

Bryan Loo: Mauritius has a relatively small market, smaller than Singapore even, with a population size of just over 2 million. So, I think on the maximum scale we’re prudently looking at around 20 outlets for Mauritius. That would pretty much serve the whole country.

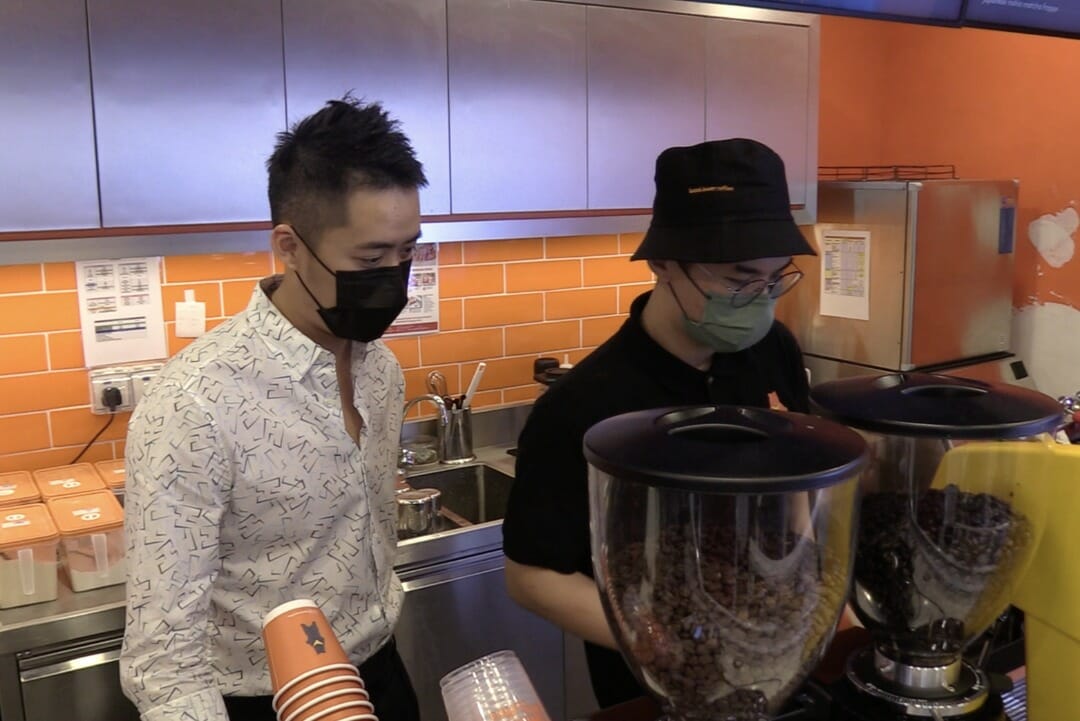

BT: While Tealive targets the tea-drinking segment, Bask Bear is basically to target the coffee drinking segment of the population, what is the value proposition behind the latter brand?

Bryan Loo: When you look at Loob Holding as a whole, it should immediately convey modernity. The company has 4 pillars of brands; namely, Tealive, Bask Bear, Wonder Brew and Soda Xpress.

Tealive, stands as the largest bubble tea chain store in Southeast Asia. Second to it is our coffee brand, Bask Bear Coffee. Wonder Brew, as a brand which focuses on kombucha, is the market leader of the drink in Malaysia currently. We had taken over a stake in the company about five months ago. Today, we are the largest kombucha player that has got more than 1000 touchpoints in Malaysia. Finally, the fourth brand or rather fourth pillar of the group is Soda Xpress. We own proprietary technology for Soda Xpress to produce sparkling water machines in Malaysia. It’s a B2B and B2C business model whereby we supply sparking water machines to independent operators spanning from event operators, cafés to bars. So, this forms one of our biggest portfolios.

Going back to Bask Bear Coffee, the original intention was to replicate the success of Tealive in the tea segment into the coffee segment but, we realised that the brand needed to be moulded and nurtured more. We then managed to bring up a signature product now being coffee and toasties. In fact, the numbers speak for themselves! The rate of contribution, in respect of revenue, for coffee and toasties compared to Tealive stands at a ratio of 50:50 now. So, if we can continue to own that path — to develop Bask Bear to be the leading coffee and toastie brand, or a chain brand (with many outlets) in Malaysia — we will have a formidable portfolio.

BT: One of the selling points for Bask Bear is the use of Palm Sugar or Aren sugar in the coffee. Share with us your thoughts on this.

Bryan Loo: Just before the pandemic, Loob Holding came across a plantation owner who produced alternative sugar, known as Aren Palm Sugar. We managed to strike a deal with the plantation owner to be the exclusive partner to supply Aren palm sugar to all our retail stores which carry Bask Bear Coffee.

In fact, Bask Bear Coffee is the first coffee brand to use Aren Palm Sugar. This type of sugar originates from Borneo. It is produced by a palm tree called Arenga Pinnata. Bask Bear Coffee is now unique as it uses the sugar which makes it — truly one the key value proposition of Bask Bear Coffee.

BT: Since every corporation, even SMEs, are talking about the ESG principles and have jumped on the bandwagon of ESG-compliance, do you see yourself as promoting the concept of ESG through this Aren Palm Sugar?

Bryan Loo: Many people don’t know that Aren palm sugar is the best alternative when compared to refined sugar, brown sugar or even honey. Because Aren Palm Sugar has the lowest GI index as compared to all these three sugar components. Specifically, it has a much lower GI index (glycaemic index (GI) is a rating system for foods containing carbohydrates) compared to others which have a higher GI Index of 50/60. So, I certainly think that this is one of the key selling points or a better option for consumers. With this, we address the S (Social) aspects of ESG. Number two, we also support the local plantations in the Sarawak interior area. We are able to support the local planters and community who have been planting Aren Palm Sugar for many years through an exclusive partnership with these plantations. With this initiative, we have also addressed the ‘Social’ and ‘Environment’ aspects of ESG.

BT: I did read that Aren Palm Sugar was facing the possibility of going extinct some years ago as it’s a commodity which is labour intensive and time-consuming resulting in its high price when compared to the mass-produced refined sugar. As such, do you see yourself as a catalyst or having the need to create better awareness for consumers on Aren palm sugar and in turn, helping it be widely accepted, making Aren palm sugar thrive once again?

Bryan Loo: The Aren palm tree has been planted in the local communities of Sarawak for many years, but they faced many hurdles to commercialise it. We managed to get a distributor to help them distribute Aren Palm Sugar to smaller cafes in Kuching. That was not enough… then need was to introduce this sugar to a larger consumer base. That’s first and foremost. The next step was to introduced Aren palm sugar into Bask Bear Coffee. This then will later be replicated across our Tealive network. Moving forward, there will be a lot more consumers who will start to appreciate what Aren Palm Sugar is.

On the International front, we introduced Aren Palm Sugar into Tealive in the Philippines. I must highlight the fact that we are the first one to introduce Aren Palm Sugar into the Philippine market. So today, all Tealive outlets in the Philippines serve Aren Palm Sugar as the key value proposition for Tealive Philippines. We believe that if we can continue to leverage all the networks we have, to promote the sugar as a valuable commodity while elevating the livelihoods of palm sugar workers.

BT: Having said that, do you see yourself moving downstream in the future of this trade, as there are many instances where businesses start off mid-stream and expand downstream. Do you see yourself investing or buying land to go into this particular commodity?

Bryan Loo: Although we are a beverage company, we keep an open mind to all kinds of possibilities. We take heed of any possibility which we believe can add value to the supply chain. But we have to acknowledge that plantations have a very different business model compared to the retail industry. It is a good business but it is heavily dependent on total output. Hence, at this point, we are not ready because we don’t have the expertise on the relevant subject matter yet. But as we continue to contribute to this particular industry, we will see whether we could do more to support it downstream.

BT: Bask Bear derives contribution in the ratio of 50:50 with coffee and toasties, could you see yourself going into more offerings besides toasties in future?

Bryan Loo: Definitely. We also have spin-off products starting with our Bask Bear Supreme. The new line comes with the present offerings of toasties and now with an upgrade using Sourdough. This move places the product on the premium shelf. On top of that, we have introduced different types of tasty, hot meals. So, you can expect many different variations like mac and cheese. In addition, Bask Bear will introduce a new exciting alliance beginning next month. For now, we need to keep mum on this.

We are always keenly looking for active partners in trying to produce products which really excite Malaysians; that is what we stand for as a company – it’s always been that way. And, we’ll continue to do that. But Bask Bear is definitely not a coffee chain, it’s a coffee and toasties chain that will continue to introduce a lot of innovations and excitement.

BT: How many Bask Bear outlets do you plan to have in 2 years?

Bryan: We now have 35 physical outlets and we aim to cross 200 outlets by 2024.

BT: How much would be invested in this venture?

Bryan: It is difficult to quantify the total investment. There are different types of outlets carrying different formats, and with different locations. These all have very different cost outlays.

BT: Lastly, any plan to go for an IPO?

Bryan: We will look at this possibility at a later stage as we want to realise our regional expansion across Southeast Asia first.