The property markets in Malaysia and Singapore underwent a myriad of trials, in keeping with global trends in 2022.

Externally, the oil shock in early 2022 escalated inflation to a decade high. Interest rates flared up to lower the blow of inflation.

On the other hand, the US recession scenario is threatening a looming recession in Singapore and Malaysia, though we are not there yet!

Singapore

Internally, in Dec 2021, the Singapore government-imposed cooling measures that affected the luxury segment significantly.

Following this in February this year, the government released its Budget 2022, announcing a substantial tax hike in upcoming years. This has a drastic implication for luxury property buyers. But before we go into that, let’s look at how luxury properties performed despite these foreboding factors.

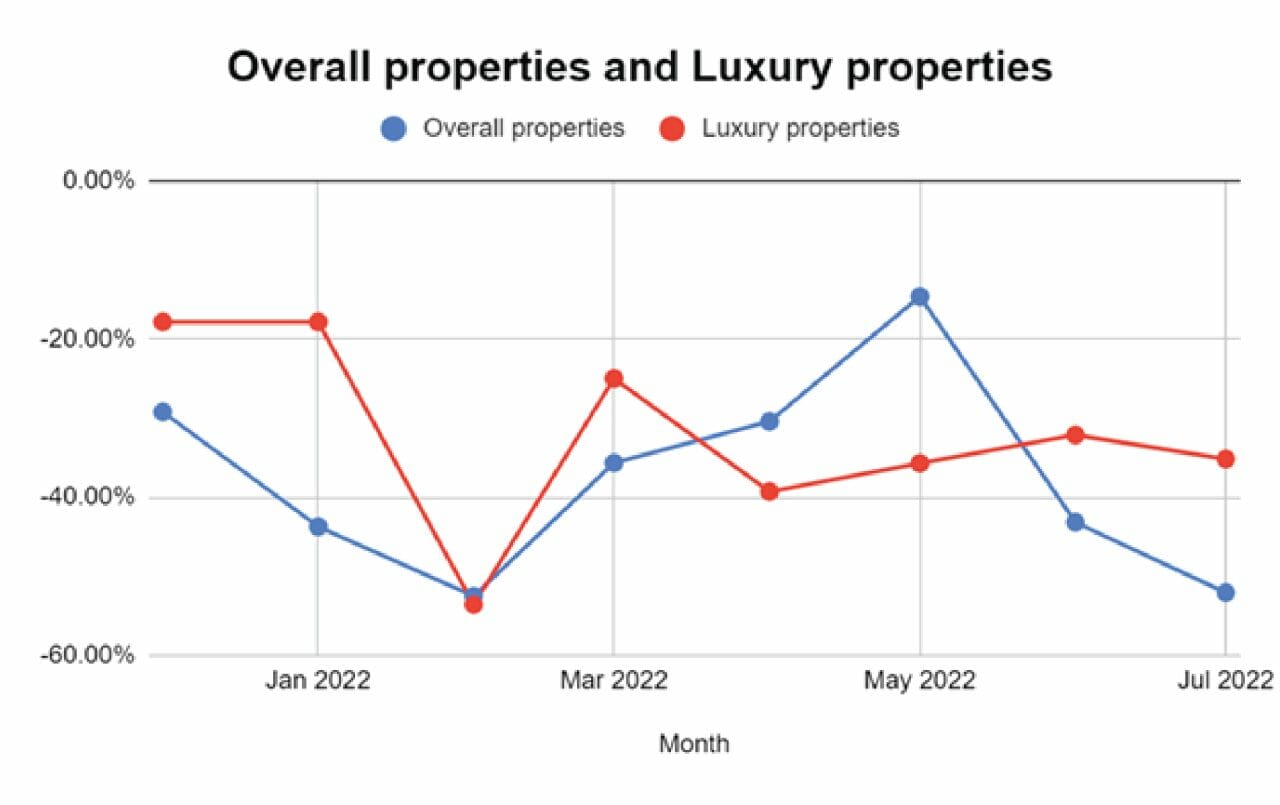

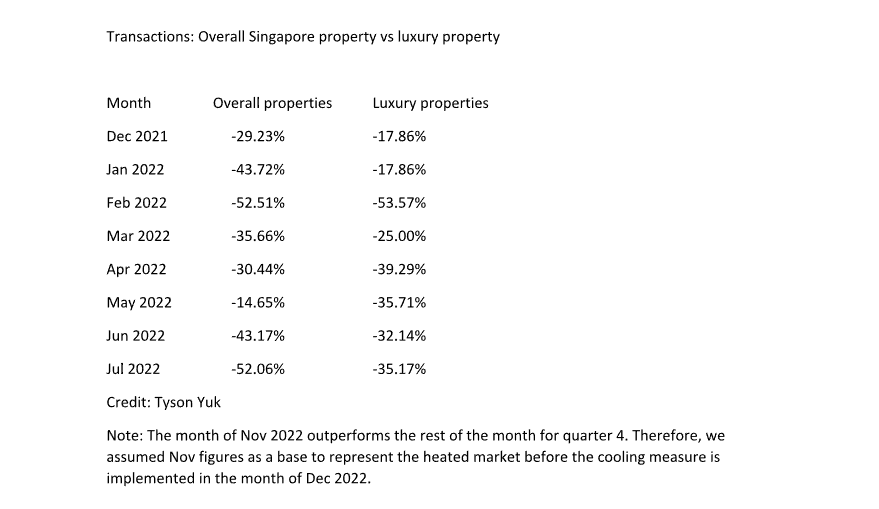

You can observe from the table and chart above that a comparison is drawn between how the luxury segment in Singapore performed compared to the overall property industry. For the reasons stated above, the overall property industry’s transaction volume has dropped since Nov 2021.

The first pullback in transactions was due to the latest cooling measures introduced by the Singapore government in Dec 2021. Property investors keenly feel the impact.

Singaporean property buyers now face higher Additional Buyers Stamp Duty (ABSD) of 17% and 25% for their second and third property purchases, respectively, compared to 12% and 15% before.

For those holding permanent residency status, they now have to pay 25% and 30% ABSD for their second and third private residential purchase from 15% previously.

In addition, the Total Debt Servicing Ratio (TDSR) for home loans was tightened from 60% to 55%. As a result, home buyers need to pay more upfront deposits to buy houses now.

Hence, overall property transactions dropped significantly in Dec 2021 and Jan 2022. However, compared to that, the luxury property transaction dropped relatively less to 17.86%.

However, the biggest shock for luxury property holders came about was when the Singapore Budget 2022 announced its latest taxation levy. The taxation rate for the luxury segment is set to almost double by 2024.

Taxation is based on the annual value of a property (AV). AV comprises the annual market rental value of a property minus the general maintenance cost and furniture rental cost (if any).

The taxation rate as of 2022 was up to 16% of the AV of a property generating more than 130,00 AV per year. However, the Budget 2022 states that AV that exceeds $100,000 would now be subject to tax up to 32% by 2024 for both owner-occupied and non-occupied residential properties.

For the luxury segment (property prices of S$10 million above), this change in the new tax rates will be a substantial addition to purchasing and holding onto their property. As such, purchases or property-based transactions have dropped for luxury properties compared to the overall property industry in Feb 2022.

However, with time, the luxury property segments embarked on a slight upward trend showing some recovery. Although transactions are still low for the overall property segment in July, the luxury segment has outperformed the other segments.

Malaysia

While Singapore’s luxury segment outperformed other property sectors, in Malaysia, it is not the primary go-to choose for ultra-high net worths in 2022.

In the previous year, luxury properties were seeing declining prices.

As per reports, this segment has carried the challenges faced in 2021 into this year. In addition, there are also no fiscal goodies announced in Budget 2022 to encourage luxury segment buyers. The oil shock, inflation hike, and the pandemic has not helped this sentiment.

But now, the Malaysian economy is showing a positive outlook with growing investment projects and the reopening of international borders. Hence, this downward price of luxury properties is expected to flatten out in 2022, with the prospect of upward growth in 2023.

Aside from this, Malaysia removed the Real Property Gains Tax (RPGT) if you sell your property from the sixth year of purchase, based one of the Budget’s announcements made.

RPGT is Malaysia’s version of cooling measures to curb speculation and balance the overheated property market. This exemption is a bonus for investors and second home buyers who do not intend to retain properties over a long term.

I am Tyson Yuk, the founder of the blog Commercial Realty Singapore. With over 15 years of experience, my forte is in the commercial and luxury property line. With my blog, I aim to educate, advise and share tips and tricks with potential property buyers and investors to help them make successful property ventures.