The timing of Malaysia’s next elections remains uncertain, but the country’s recent strong economic performance may facilitate fiscal consolidation following the ballot, says Fitch Ratings.

The likelihood of robust fiscal consolidation over the next parliamentary term could increase if the election delivers a large majority to a government committed to improving public finances.

A general election is due by July 2023 at the latest. However, a confidence and supply agreement with the opposition that stipulated the government would not seek a dissolution of parliament before 31 July 2022 has expired, increasing the likelihood of early elections.

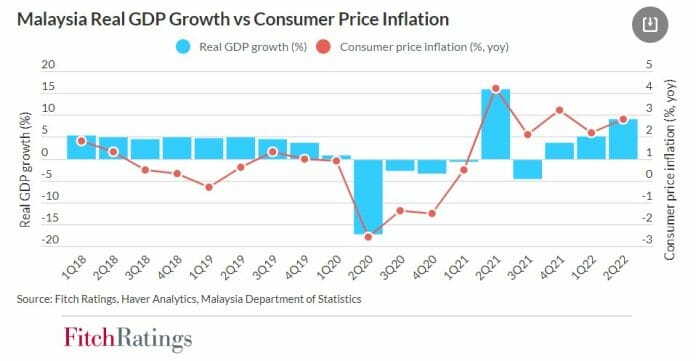

Some within the United Malays National Organisation (UMNO), the dominant party within the government, have advocated for an early vote. Malaysia’s strong economic growth of 8.9% yoy in 2Q22 may bolster such calls.

However, Prime Minister Ismail Sabri Yaakob of UMNO appears keen to pass more of his agenda before dissolving parliament.

The current administration has already passed a law that requires a recall election to be held if a member of parliament opts to switch parties, although the law allows for party blocs to collectively change their allegiance.

This could improve longer-term political stability. Other proposed reforms that have yet to be passed include a measure to limit prime ministerial terms and a Fiscal Responsibility Act that lays out a longer-term fiscal strategy.

Political instability has been reflected by a series of governments since 2018, most with thin majorities. However, this has not prevented these governments from implementing policies and budgets, which in turn has partly mitigated the impact of political uncertainty on Malaysia’s creditworthiness.

This could reflect the underlying strength of Malaysia’s ministries and institutions. Nonetheless, successive changes in government have decreased visibility over the long-term direction of policy and appear to have reduced the scope for fiscal consolidation.

Moreover, there is a risk that government effectiveness could weaken if political volatility is sustained.

The next government’s medium-term fiscal strategy will be important from a rating perspective. When we affirmed Malaysia’s ratings at ‘BBB+’ with a Stable Outlook in February 2022, we stated that a reduction in general government debt/GDP, bringing the ratio closer to peer medians, for instance, through implementation of a strong fiscal consolidation strategy, could lead to positive rating action.

We think a shift to a more targeted subsidy regime is likely, whatever the election outcome. The next government could also seek to reintroduce the Goods and Services Tax, which might improve fiscal consolidation prospects. However, such a move would be politically controversial.

We also said in the rating affirmation that a deterioration in governance standards, for example, indicated by a significantly lower score for the World Bank Governance Indicators, could result in negative rating action. UMNO’s president, Ahmad Zahid Hamidi, faces a number of corruption charges, but will reportedly not stand in the upcoming election.

If we assess that accountability has weakened under the next government, this would weigh against any potential improvements in political stability.

Malaysia’s recent strong economic performance points to upside potential to our 6% forecast for economic growth in 2022. Higher GDP will help to reduce government debt/GDP, albeit moderately.

Subsidies to mitigate the rising cost of living and associated with higher commodity prices could amount to MYR71 billion (around 4.2% of GDP) in 2022, but we expect the overrun-on spending to be offset by higher oil revenue, a windfall corporate tax and a recently approved sales tax on imported online goods. Overall, we still expect the federal government deficit this year to be in line with the budget’s forecast, at around 6% of GDP.