Boost

While most eWallets give out reward points and the occasional promo code, Boost treats every transaction like a lottery ticket. Aside from earning Boost coins with every purchase, their loyalty programme BoostUp gives users a Shake per transaction to earn surprise rewards.

GrabPay

GrabPay, arguably Malaysia’s most popular eWallet, excels in terms of convenience and popularity. If you don’t want to deal with multiple apps, Grab’s all-in-one digital ecosystem simplifies your life.

You can earn GrabPoints for every transaction you make – be it paying your phone bills, ‘tapau-ing’ food at the ‘mamak’, or shopping on Shein. With GrabPoints, you will be able to redeem free rides, discounted food, and even vouchers for thousands on stores!

Touch ‘n Go eWallet

The PayDirect and RFID features of TNG eWallet are the most appealing to most users. PayDirect requires you to use your Touch ‘n Go card at the toll, but the fares are deducted directly from your TNG eWallet.

This means that users don’t have to worry about running out of balance and having to switch lanes in public.

If your vehicle is RFID-enabled, your tolls will be deducted from your TNG eWallet as well.

Unlike many other eWallets, TNG eWallet also allows you to link your debit/credit card, which eliminates a common problem with many eWallets in which users are ready to pay at the counter only to have to top up at the last minute.

BigPay

BigPay works on the basis of a physical card that users can use in the same way they would a debit or credit card. Of course, this does not limit users to only physical transactions – but it is a useful feature to have.

BigPay’s affordable international bank transfers are what set it apart. Users can send money to India, Indonesia, Bangladesh, Nepal, Thailand, the Philippines, Vietnam, and Bangladesh for a fixed fee ranging from RM5.00 to RM13.00.

BigPay does not charge any markup fees on currency exchange, unlike banks, which typically charge 2-3%. However, expect to pay a fee of RM6.00 for local ATM withdrawals with your BigPay card.

Maybank’s MAE

The eWallet is primarily useful to non-Maybank users because it provides the same access to Maybank’s QRPay feature. In other words, it’s a very basic version of an eWallet.

MAE, on the other hand, is a conventional network-based eWallet. Users must deposit funds from their bank account into their MAE eWallet before spending.

Maybank markets this as a budgeting feature, in which users can deposit their monthly budget into MAE and spend from there. Any remaining balance can be deposited into their Maybank savings account.

Setel

Setel makes it simple to pay for gasoline at Petronas stations. Users can skip the queue and pay for petrol at Petronas with no pre-authorization charge (which credit/debit cards are subject to) and redeem Mesra points via the app without having to leave their car except to pump petrol.

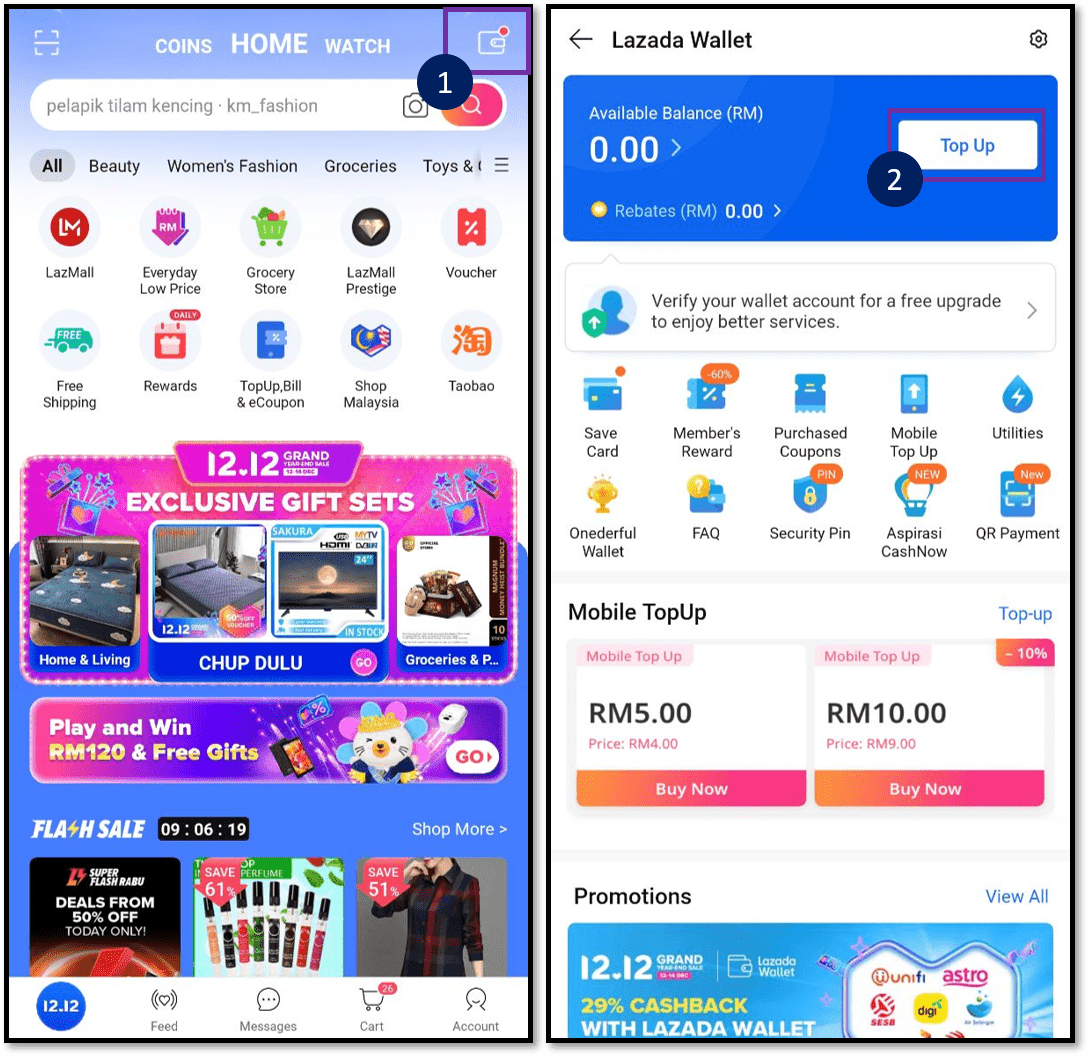

Lazada Wallet

Lazada Wallet, like Setel, operates on a closed-loop basis.

In other words, you can only use Lazada Wallet to make purchases on the Lazada platform.

If you make a lot of purchases on Lazada for personal or business reasons, using Lazada eWallet means you not only get faster, easier checkouts, but you also get more rebates as and when Lazada offers them.

ShopeePay

ShopeePay is the Shopee’s equivalent of the Lazada eWallet.

The same logic applies – faster checkout, simpler refunds, and more rebates. Users will no longer be required to log in to their online banking portal and wait for the one-time password (OTP).

GoPayz

Rather than being a traditional eWallet, GoPayz is more of a multi-purpose lifestyle app. It still works in the same way.

Users can still shop, pay bills, and earn rewards points. There’s even a Shake rewards system similar to Boost’s.

RazerPay

RazerPay is an eWallet primarily for gamers that is the result of a collaboration between Razer and Berjaya Corp. RazerPay is currently available in Malaysia and Singapore.

Users can top up their RazerPay at any 7-11 location or through their online banking account.

Other features are standard eWallet features, such as topping up telco accounts and transferring money to friends and family.