The Securities Commission Malaysia continuously strives to safeguard the interests of Investors through its gate-keeping and rule-making functions.

It hopes to promote good conduct and governance among capital market intermediaries and listed corporations. In an effort to modernise and encourage a more dynamic capital market, the SC also endeavours to provide robust and flexible regulatory frameworks to facilitate alternative methods of capital-raising and investment opportunities.

In recent times, there has been a great deal of concern about the rising number of scams and unlicensed activities in the capital market.

SC’s recent publication entitled The Reporter seeks to offer information to alert investors of the different types of scams (including investment scams) and to expose the tactics or modus operandi used to prey on Malaysians.

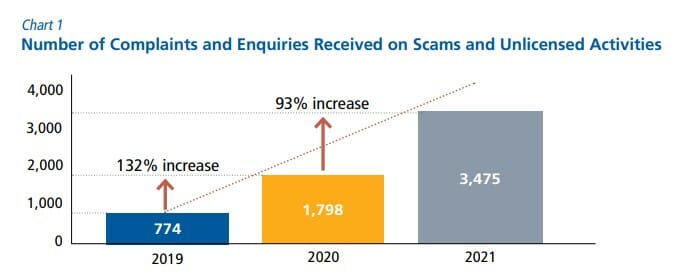

The SC has in recent years, and particularly since the COVID-19 pandemic, received an increasing number of complaints and enquiries on scams and unlicensed activities.

In 2021, the SC received 3,475 complaints and enquiries on scams and unlicensed activities. This represents an increase of 93% from 2020 to 2021, and a huge 132% increase from 2019 to 2022.

Categories Or Types Of Complaints Received

Complaints and enquiries have been received by the SC from the public on scams, which include investment scams involving the promotion of fake investment products.

Examples of such scams include those relating to e-commerce, purported loans, employment and investment opportunities, tax matters, and catphishing.

These scams are commonly promoted online through social media channels such as Facebook, Instagram, Telegram, WhatsApp, and various dating apps.

In most instances, the scams are perpetrated by scammers using mule bank accounts. A mule bank account is a bank account belonging to an individual or company that allows his or her bank account to be used and controlled by others, usually for a small fee.

The account holders will typically hand over their automatic teller machine (ATM) card and pin number or provide their online banking security details to another person, who may be the middleman to the scammers. The bank account will then be used by the scammers to receive, transfer and transact funds acquired illegally.

The regulator noted that The Commercial Crime Investigation Department of the Royal Malaysia Police has set up a portal (https://semakmule.rmp.gov.my/) where members of the public can search a bank account or telephone number that has been reported to the police for a possible scam.

Investment Scams

The SC is one of the authorities concerned with and responsible for handling investment-related scams as they may involve one or more potential breaches of securities laws which are administered by the SC.

Investment scams involve the promotion of non-existent investment products. This occurs when scammers make false claims that the investment will be made into capital market products such as shares or cryptocurrencies, when in fact there are no such investment opportunities or products.

The fraudulent investment would, in most cases, offer unusually extraordinary returns. In this regard, it is not uncommon, for example, for such investment schemes to promise up to 1,000% returns within 24 hours or even within a few hours.

Investment scams are usually designed to also offer various investment packages which can start from as low as RM300 to about RM1,000 only. In addition to the offer being seemingly legitimate, the low investment entry enables the scammers to defraud a wider pool of potential victims, including those from the low-income bracket.

Further, given that the investment would generally be seen to be less risky with their relatively small investment amount, the target victims may unfortunately also tend to be less risk averse.

An interested person may be asked to click on a WhatsApp link in a Facebook advertisement. This will redirect the target victim to communicate with an ‘agent’ or ‘broker’ via WhatsApp. In the case of Telegram, those interested may be asked to click on a link that will redirect them from the public Telegram group to an ’admin’ within the app.

The ’agent’, ’broker’, or ‘admin’ who is a scammer will then entice and persuade the victim to invest in the scheme by sharing untrue information and making false promises. In doing so, the scammers may use the following tactics to deceive the victims:

– Misuse of the SC, Bank Negara Malaysia (BNM) or other authorities’ name and logo on their promotional materials;

– Provide false certificates purportedly issued by the SC or BNM stating that their investment company is authorised or licensed by the authorities;

– Claim that the investment is ‘Shariah-compliant’. This is to make the investment appear legitimate and to appeal to Muslims. Sometimes the postings of such scams are accompanied by pictures and fake testimonies of well-known Malaysian religious personalities.

– Use fake testimonies of past successful investors with accompanying pictures of expensive items (e.g. gold, designer bags, luxury cars or smartphones) that were allegedly purchased from the profits that they had purportedly generated from the investment;

– Provide victims with ‘profits’ for their initial investments and lure them to make subsequent investments with higher capital.

Once the victim decides to invest, the scammer will provide details of a mule bank account for the investment to be made into and notify the victim very soon thereafter that his investment has made a ‘profit’. However, when the victim decides to withdraw the ‘profits’, the victim will be asked to make further payments guise as BNM charges, income tax charges, administrative fees, upfront deposits, etc.

The victim would typically then be asked to make such further payments through a different mule bank account. Normally, the victims will realise that they have been scammed when something is amiss i.e. when the victim does not receive any returns despite making a number of payments to different bank accounts. By this time, the scammer would have successfully made off with a decent sum of money.

The SC’s investigations show that the monies in the mule bank accounts will be transacted almost immediately after being deposited. The deposited sum is either withdrawn or transferred out to other mule bank accounts. The purpose for the transfer will usually be described as not related to any investment to avoid suspicion e.g. remarks will be made of famous brand and merchandise names, etc.

Also, it is notable that most of the mule bank accounts will only be used by the scammers for a short span of time (a few months at most) and after that, the account will either be closed or left inactive. This is a deliberate tactic to impede or frustrate the successful tracing of the money trail or investigations by the authorities.