Main Market-listed EP Manufacturing (EPMB) is venturing into carbon credits by forming strategic partnerships with ESG-focused global funds, as it looks to fulfil its ESG vision.

EPMB inked an Investment Agreement with CIS Pride Fund SPC and China-based Sharkgulf Technologies Group Ltd on 16 September. The fund will be investing a minimum of USD50 million for the establishment of battery swapping infrastructure for the Blueshark-branded two-wheeled EVs.

CIS Pride ESG Fund will invest in EPMB’s EV business for its related financial leasing, supply chain and manufacturing. The fund is led by Mr. J. Ernst Lee, who is the representative director of the Auster Fund (with Assets under Management of USD1 billion) with the Rothschild family.

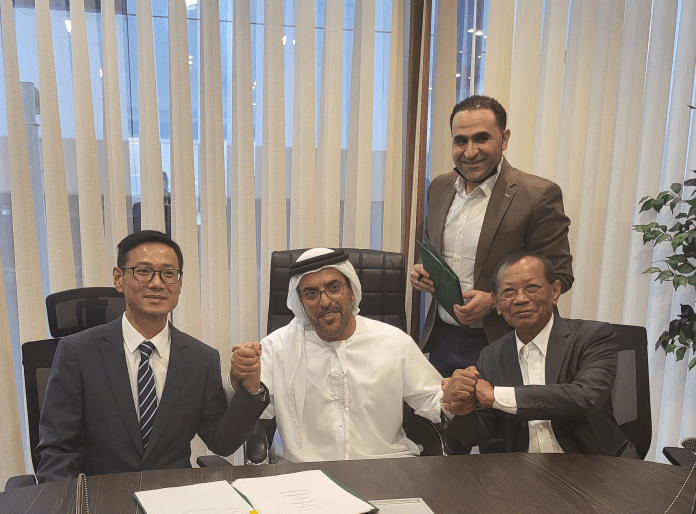

The company also signed another Investment Agreement with Abu Dhabi-based Siraj Holding LLC and Sharkgulf on September 16. Under the agreement, Siraj will invest stagewise a minimum USD50 million in procuring Blueshark-branded two-wheelers from EPMB, and leasing them to Malaysians from the B40 category, offering them gig employment opportunities for additional income. This programme will be rolled out before end-2022.

Siraj Holding LLC, an arm of the Al-Otaiba family, is based in Abu Dhabi, United Arab Emirates. This holding company has portfolio in banking, asset management, insurance, oil and gas interest, hospitality, property development, property and infrastructure investments, commodities trading, technology and others. Siraj holds a total asset base of approximately USD10 Billion.

EPMB also has entered into a Memorandum of Understanding (MoU) with Dubai-based SJQ Investments LLC and Sharkgulf to jointly explore the expansion and development of two-wheeled EVs for the Middle East and African markets. SJQ, led by Sheikh Saqer J. Al-Qassimi, seeks to establish a Manufacturing, Sales and Distribution Centre with EPMB in Ras Al-Khaimah, United Arab Emirates.

“Carbon-neutral solutions is where the world is going. EPMB shall continue to evaluate and to invest in this direction. The end result is that EPMB can, and will build its own share of Carbon Credits,” EP Manufacturing Berhad Executive Chairman Mr. Hamidon bin Abdullah said.

“We must note that with our recently signed collaborations, we certainly have the sum expertise, and the sum networking together with the financial resource, to explore and to bring this asset viz-a-viz carbon credits to the next level. We aspire, within these partnerships, that EPMB can mature into a platform for future Carbon Credit trading,” he added.

It is noteworthy that the National Committee for Vehicle Type Approval (VTA) and Homologation, Road Transport Department of Malaysia (RTD) had on 30 August 2022 approved the VTA for the “Blueshark R1” model under the Malaysia Road Transport Act 1987.

Whilst certificate for the VTA has been issued to EP Blueshark, a wholly owned subsidiary of EPMB.

The VTA Approval was secured about a month after EPMB received Conditional Approval from the government for the construction of its maiden manufacturing plant for electric two-wheelers.