Asia and the Middle East appear to have a more robust economic recovery than other parts of the world, providing an opportunity for countries to embed green transition in their economies rebuilding agenda.

However, climate finance faces challenges with government budgets under pressure and investment from the private sector will be necessary, according to the latest forecast presented at the ICAEW Economic Insight Forum Q3.

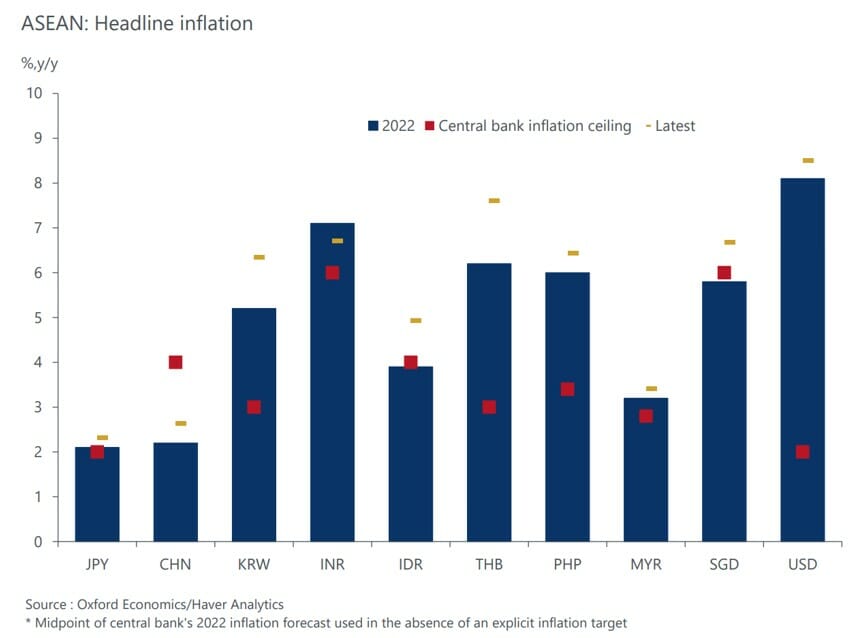

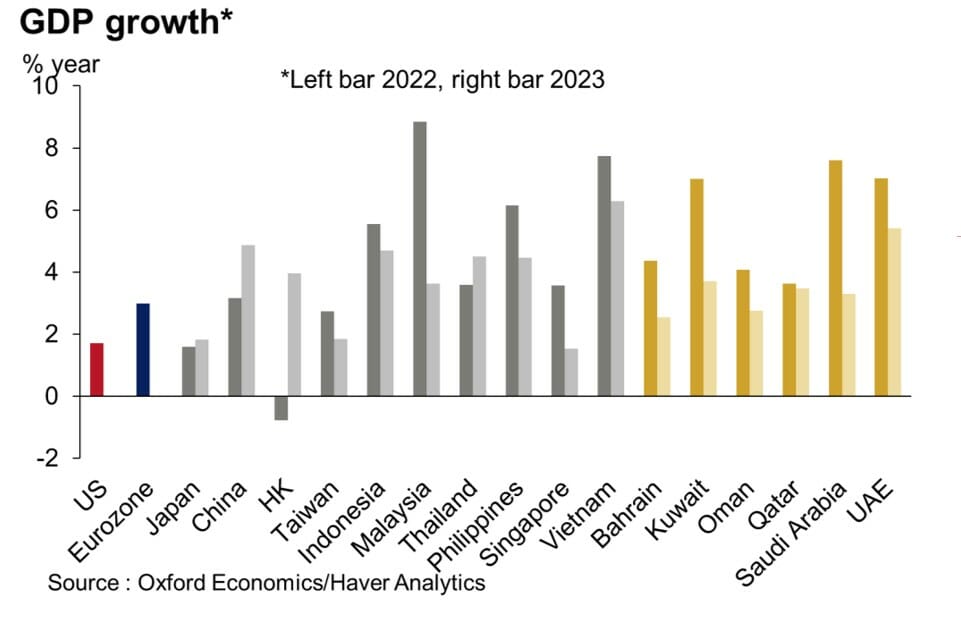

Global GDP contracted in Q2, due partly to the lockdowns in China, while inflation has risen across the world including in Asia and the Middle East, even though pressures are more subdued in the Gulf Cooperation Council (GCC) countries. Against this backdrop, monetary policy is thus expected to be tighter as the world continues to grapple with these external headwinds.

However, the world is beginning to see positive signs of recovery.

Since large supply shocks have caused inflation to peak, it can now only start improving. Even though trade shocks caused by the Russo-Ukraine war have exposed emerging markets to spiking food prices, overall commodity prices are expected to decline in 2023.

As for interest rates, they are expected to be rising back to pre-COVID levels as emergency COVID policy settings start to unwind in Asia by the end of 2022, with Malaysia showing headline inflation slightly beyond the central bank’s inflation ceiling but among the lowest in the region.

Despite Asia’s strong post-pandemic performance, it will nonetheless be affected by China’s growth as it is predicted to remain slow at just under 5% in 2023 from a slight excess of 3% in 2022.

This high exposure to China’s weak growth and supply disruptions still poses risks for South-East Asia’s growth, with Malaysia’s intermediate exports to China making up the highest percentage of national GPD in the region and its exports towards China’s domestic demand only behind Vietnam’s.

This exposure also resulted in a more muted growth outlook across the region for 2023.

South-East Asia, including Singapore, rated with low ambitions in climate action, investment from private sector required

Eurasia and Middle East are more energy intensive than most as electricity generated from renewables are lagging in many countries in the region.

Shifting reliance from polluting fuels such as coal to renewable energy will be a major challenge in achieving Net Zero. As such, energy repricing to reflect the cost of environmental damage has been suggested as a market driven incentive to persuade more businesses in using renewable energy in place of polluting fuels.

Climate policies and actions from China, South-East Asia (Indonesia, Singapore, Thailand, Vietnam) and the Middle East (Saudi Arabia, United Arab Emirates) are considered highly insufficient or not ambitious enough, according to the Climate Action Tracker.

It is observed that not all countries are ready for transition and more ambitious targets are encouraged to be set.

Climate finance has fallen short of what is necessary to achieve climate goals. Investment on infrastructure in renewable energy, electrification technologies and energy efficiency are required, and the gross investment on these infrastructure as estimated by the climate policy initiatives cost approximately 4.5 to 5 trillion US dollars annually.

As government budgets were stretched when they were responding to the pandemic, the significant amount of financing needed to meet these goals will require support from the private sector.

Governments can, however, help de-risk climate investments through blended finance initiatives.

ICAEW Chief Executive Michael Izza said: “The transition from the pandemic provides an opportunity for countries to rebuild their economies in a greener way. Fast-growing cities in Asia and the Middle East are increasingly exposed to physical risks such as droughts, floods, and tropical storms, and so investment in mitigation and adaption is necessary for resilience. A green recovery can strengthen the long-term competitiveness of Asia and the Middle East in key global markets that require green practices.”

Key findings from the Economic Forecast were presented by Scott Livermore, Chief Economist and Managing Director at Oxford Economics of Middle East at the ICAEW Economic Insight Forum Q3 2022 on 14 September 2022.

He was joined by other panellists namely, Ali Amer Al Hashimi, CFO and Head of Strategy at Dubai Financial Market, Tim Yu, FCA, Partner of Financial Advisory Services at Mazars China, and Zoë Knight, Group Head of HSBC Centre of Sustainable Finance and Head of Climate Change at MENAT, in an insightful discussion on the challenges faced by markets to rebuild their economies sustainably, future priorities on green development, and rising interest rates and inflation.

Other findings from the Economic Insight Forum Q3 include:

- Growth outlook in the Middle East region remains positive

Even though market rates in the GCC have risen sharply, growth outlook in the Middle East region remains positive as the oil sector is driving growth and facilitating higher government spending in the Gulf such as public investment associated with growth, diversification plans, and climate transitioning.

- 1% of world GDP every year from now to 2050 required to limit global warming to 1.5 degrees

Limiting global warming to 1.5 degrees requires phasing out the carbon-based capital stock by 2050. The Intergovernmental Panel on Climate Change (IPCC) estimates that the needed additional investment to do this will amount to 1% of world GDP every year from now to 2050.

The Institute of Chartered Accountants in England and Wales (ICAEW) is the first major professional body to be carbon neutral, demonstrating its commitment to tackle climate change and supporting UN Sustainable Development Goal 13. ICAEW is a founding member of Chartered Accountants Worldwide (CAW), a global family that connects over 1.8m chartered accountants and students in more than 190 countries.