The Small and Medium Enterprises (SMEs) Recapitalisation Fund worth RM600 million in the form of equity was officially launched today for entrepreneurs who have been severely affected by the COVID-19 pandemic.

The SME Recapitalisation Fund is part of the Vibrant Business Program introduced during the 2022 Budget, aimed at ensuring the regrowth of SMEs, encouraging business expansion and controlling their level of indebtedness through more innovative financing solutions.

Acting as the implementing agency, SME Bank allocated RM200 million for the SME Recapitalization Fund, the Bumiputera Agenda Leadership Unit (TERAJU) RM300 million while Bank Simpanan Nasional (BSN) contributed RM100 million.

Group President and CEO of SME Bank, Datuk Aria Putera Ismail, said through the SME Recapitalization Fund investment, SME entrepreneurs will be able to restructure their business financial needs and it is expected to benefit nearly 600 SMEs.

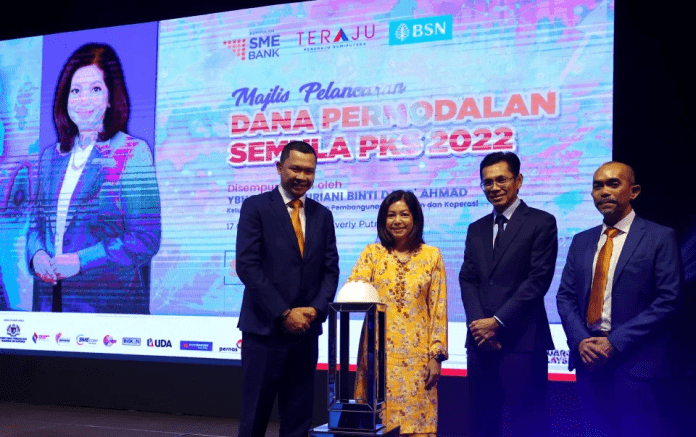

“This will allow entrepreneurs to focus on the aspect of product offering, improving services and helping to grow their business,” he said at a press conference after the launch of the fund here, today, which was completed by the Secretary General of the Ministry of Entrepreneurship and Cooperative Development, Datuk Suriani Ahmad.

Aria Putera said the fund offers equity investment of up to RM5 million for qualified entrepreneurs and it can be used for working capital needs with a repayment period of up to five years with an estimated dividend rate of six percent per annum.

As an added value, he said eligible entrepreneurs will participate in the Malaysian Equity Program which will be run by the Center for Entreprenur Development and Research Sdn Bhd (CEDAR), a subsidiary of SME Bank which is also the program’s implementing partner.

“CEDAR will use Artificial Intelligence which is Enterprise Life Cycle Scoring Assessment or ELSA to obtain a report on the business life cycle of the entrepreneurs involved to help them draw up the latest business plan and set company development targets,” he said.