Despite a headline stabilisation, plunging new orders point to a further slowdown in the global electronics sector, signalling a contraction in Asian tech shipments.

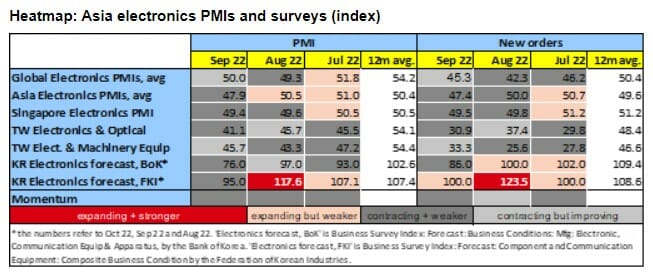

Globally, the electronics sector slowdown is broad-based, with both consumer and industrial new orders under water, and orders falling across Asian markets.

Although order backlogs have stabilized in September, shrinking delivery times and rising inventory suggest that supply chain bottlenecks continue to ease.

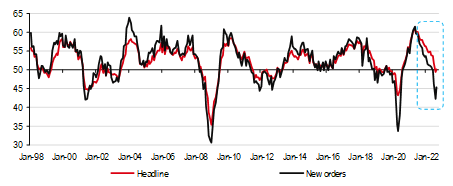

At the surface, things look a little less dire for September: after a precipitous fall, the headline PMI for the global manufacturing sector managed to hold just at the break-even level.

New orders, a more forward-looking indicator, even bounced (Chart 1).

There’s little to indicate, however, that we are about to head onto firmer ground.

New orders, for example, remain in deeply contractionary territory, being still at their lowest level outside the tech rout in the early 2000s, the Global Financial Crisis, and the start of the pandemic.

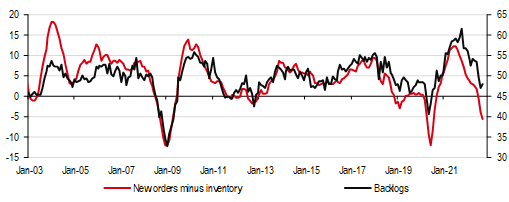

Chart 2 also shows that new orders remain depressed relative to inventory, suggesting that activity will slow further.

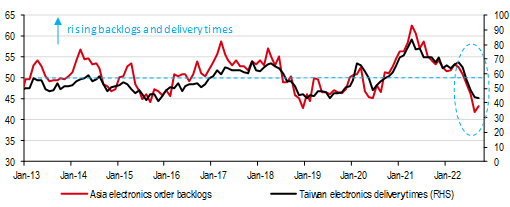

And while the order backlog measure ticked side-ways in September, it is well off its record high seen in October of last year, and now roughly at its average for 2019, when global electronics went through a major downturn.

The global electronics sector, and Asian exports along with it, look set to continue their relentless slide (see also, ‘Plop’, 15 August, and ‘Plonk’, 19 September).

The pull-back in electronics demand remains broad-based. While new orders for consumer items buckled first, orders for industrial electronics are now plummeting as well (Chart 3).

Our heatmap shows that the electronics sector has come under pressure in all major Asian markets. New orders, too, are mostly deeply under water, plunging especially in Taiwan.

The decline in electronics demand continues to alleviate supply chain pressures. While electronics order backlogs in the region (as globally) stabilized last month, the index is still close to its lowest level since the Global Financial Crisis. Taiwan’s electronic delivery times, are also falling at a rapid clip (lowest since 2015; Chart 4).

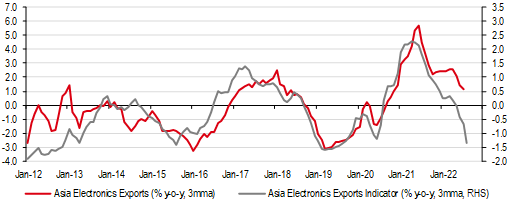

All of this points to a sharp drop in Asian electronics exports, and shipments more generally. As we discussed recently, a trade recession looms for Asia, compounding the headwinds to growth (see Asia’s export stumble, 29 September).

…our Asia electronics export indicator shows the direction of travel (Chart 5).

‘Splash’ indeed…alas, a ‘boing’ seems a long way off.

Global Research Asia Co-head, Chief Asia Economist Frederic Neumann