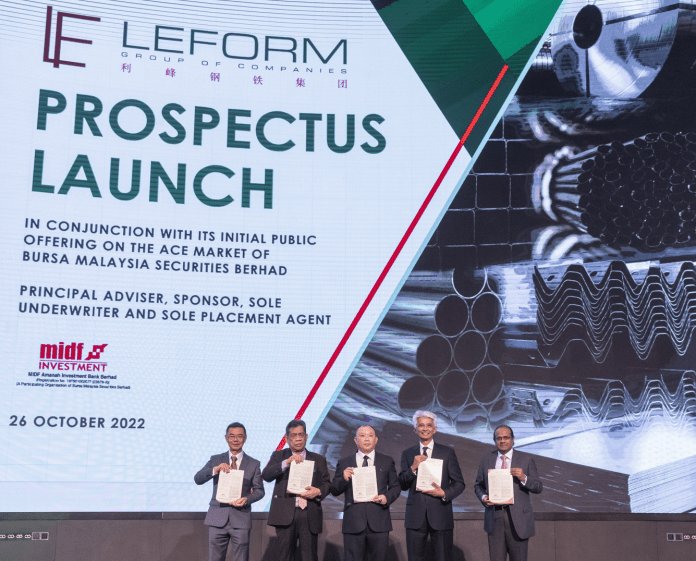

Leform has successfully launched its prospectus in conjunction with its upcoming listing via an initial public offering (IPO) exercise on the ACE Market of Bursa Securities.

Leform and its subsidiaries (the Group) are based in Serendah, Selangor.

The group is principally involved in the manufacturing of and trading in steel pipes, guardrails and flat steel products such as slitted steel coils and sheets and has integrated operations in producing steel pipes, from the production of materials to the delivery of finished products.

“With the launch of our prospectus, Leform is now one step closer to being a public listed company. We believe this is an opportune time to be listed. Amidst the challenges to our Group as a result of the recent fall of global steel prices, we are still upbeat on the outlook of our business moving ahead with the expected rising steel consumption on the back of recovery in manufacturing and construction industries,” Managing Director of Leform Berhad, Mr. Law Kok Thye said.

“As such, we are allocating the bulk of our expected proceeds, that is RM30.0 million out of RM71.5 million, to construct our new headquarters, warehouse storage facility and workers’ accommodation to expand our operations. The proposed new facility will be a one-stop centre that would allow for higher operational efficiency. In addition, our storage capacity will increase by 93.2%, allowing us to cater for the anticipated increase in production volume and widen our product range,” he added.

“Alongside our expansion plan, another RM21.9 million or 30.6% of the IPO proceeds are earmarked for working capital purposes to purchase raw materials to support our growing business activities. All in all, the IPO proceeds are anticipated to accelerate our growth trajectory,” Mr. Law remarked.

The breakdown of the usage of the expected RM71.5 million proceeds: 42.0% to be utilised for construction of new headquarters, warehouse storage facility and workers’ accommodation; 20.1% for Repayment of bank borrowings; 30.6% for working capital; and 7.3% for estimated listing expenses.

As disclosed in the prospectus, Leform shall endeavour to maintain a dividend payout ratio of not less than 20% of its annual audited net earnings.

Following the prospectus launch, applications for the public issue are open from today and will close on 11 November 2022 at 5:00 p.m.

The Group is scheduled to be listed on the ACE Market of Bursa Securities on 22 November 2022.

MIDF Amanah Investment Bank is appointed as the Principal Adviser, Sponsor, Sole Underwriter and Sole Placement Agent for Leform’s IPO exercise.