The Malaysian Economic Statistics Review (MESR), Volume 10/2022 presents the latest economic scenario based on the official macroeconomic statistics released by DOSM for August and September 2022.

The main aim of this study, released by The Department of Statistics Malaysia on Oct 28 is to analyse the difference in the happiness index between the youth and the elderly in Malaysia in 2021.

The report cited IMF forecasts of global Gross Domestic Product (GDP) growth to slow to 3.2 per cent this year, from 6.0 per cent in 2021, before further declining to 2.7 per cent in 2023. This is due to global economic activity experiencing a slowdown on a broader basis, especially in China.

Based on the Economic Outlook 2023 published by the Ministry of Finance in October 2022, Malaysia’s GDP forecast for this year has been revised upward in the range of 6.5 per cent to 7.0 per cent.

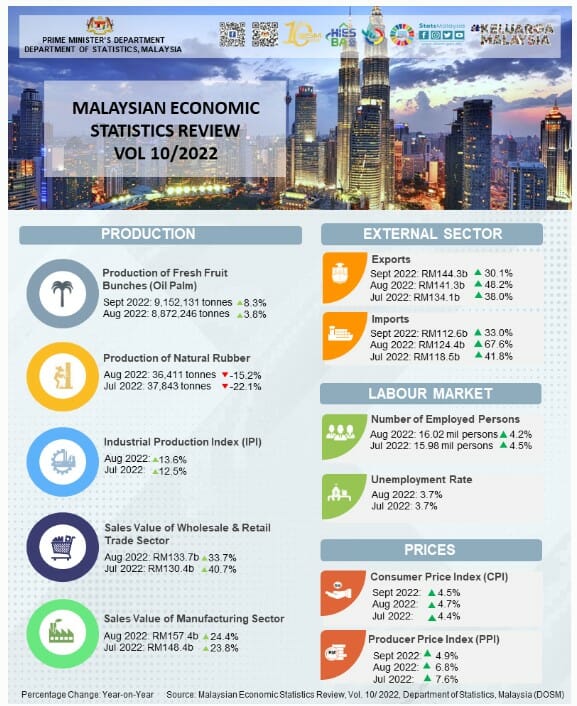

Malaysia’s natural rubber production in August 2022 showed a decrease of 15.2 per cent or 36,411 tonnes, as against 42,942 tonnes in the same month in 2021.

On monthly basis, natural rubber production decreased by 3.8 per cent as compared to 37,843 tonnes in July 2022. In September 2022, the production of fresh palm oil fruit bunches produced showed an increase of 8.3 per cent to 9,152,131 tonnes, as compared to September 2021 (8,447,586 tonnes).

The month-on-month comparison also showed an increased by 3.2 per cent as compared to August 2022 (8,872,246 tonnes).

The Industrial Production Index (IPI) in August 2022 jumped by 13.6 per cent as compared to the same month of the previous year. The uptick in the IPI was contributed by the Manufacturing, Electricity and Mining sectors, with the increment of 15.2 per cent, 10.0 per cent and 8.0 per cent respectively.

In the meantime, Malaysia’s Manufacturing sales in August 2022 stood at RM157.4 billion, surged by 24.4 per cent (July 2022: 23.8%) as compared to the same month in 2021. The growth in sales value was driven by Electrical & electronic products (25.8%), Petroleum, chemical, rubber & plastic products (27.6%) and Food, beverages & tobacco products (18.4%).

The Wholesale & retail trade jumped 33.7 per cent year-on-year to register RM133.7 billion, spearheaded by Retail trade (34.5%), Motor vehicles (185.3%) and Wholesale trade (16.0%).

In term of prices, Malaysia’s inflation increased by 4.7 per cent to 128.2 in August 2022 as against 122.5 in the same month of the preceding year. The Food index increased by 7.2 per cent and remained the main contributor to the rise in inflation for this month.

In September 2022, Malaysia’s inflation rate was recorded at 4.5 per cent. The Producer Price Index also recorded a 6.8 per cent year-on-year increase in August 2022 as compared to 7.6 per cent in July 2022. The increase was attributed to Manufacturing index with 9.4 per cent, followed by Mining index (5.8%) and Electricity & gas supply indices (0.9%).

As for September 2022, PPI registered an increase of 4.9 per cent.

As for Malaysia’s trade performance, total trade was valued at RM265.7 billion, up 56.7 per cent from RM169.6 billion in August 2021. Exports recorded a strong year-on-year growth of 48.2 per cent to RM141.3 billion, underpinned by the increases in domestic exports (+34.8%) and re-exports (+112.5%).

Meanwhile, import growth continued to outpace export growth, recording the highest growth of 67.6 per cent to reach a new high value of RM124.4 billion. The Malaysia’s total trade in September 2022 maintained a notable momentum, expanding 31.4 per cent to RM256.9 billion from RM195.5 billion in September 2021.

In August 2022, employed persons remained stable and continued to grow by 0.2 per cent or equivalent to 39.3 thousand persons to record 16.02 million persons (July 2022: 15.98 million persons). The employment-to-population ratio was recorded at 67.1 per cent and the unemployment rate was unchanged at 3.7 per cent.

The Leading Index (LI) in August 2022 reached 111.3 points, registering an increase of 4.0 per cent as compared to the same month of the previous year. Taken together with the smooth long-term trend index performance, it is seen that Malaysia will continue to uphold its growth momentum in the near term.