The FBM KLCI opened at 1,457.64 as compared to yesterday’s closing, 1,460.38.

At the time of writing, the main index oscillated between the range of 1,452.38 – 1,457.64.

The FBM KLCI eased at the opening following negative cue of Wall Street overnight and on cautious mood ahead of the US Federal Open Market Committee meeting tomorrow.

Technical Analysis on KLCI Futures

RHB Research has maintained long positions on KLCI futures.

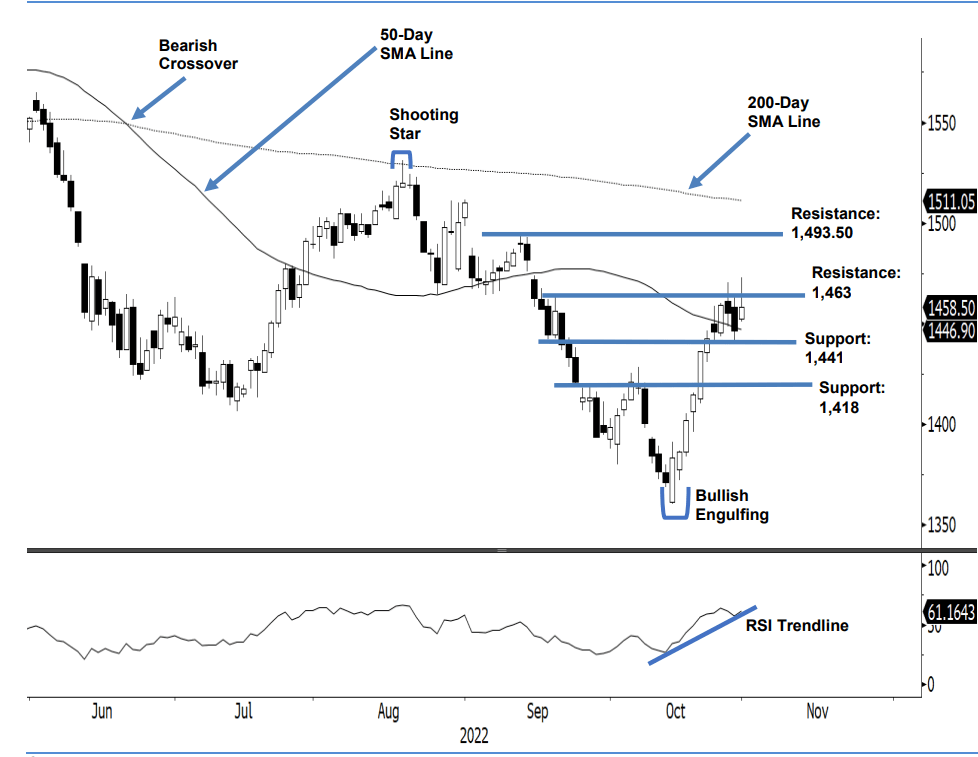

After strong profit taking last Friday, the FKLI bounced off the 50-day average line as it inched 12 points higher to settle at 1,458.5 points – re-attempting to cross the immediate resistance level. Yesterday, it opened higher at 1,452.5 points (from the previous close of 1,446.5 points) and whipsawed between the low of 1,451 points and high of 1,473 points, which saw strong profit taking from the day’s peak towards the close – still within the positive territory. The latest positive candlestick following the recent pullback suggests that strong buying interest above the 1,441-point support and the strong intraday selling pressure at the 1,463-point resistance will see the index oscillating between the two levels in the coming sessions. Since the positive momentum has reclaimed above the 50-day SMA line, the bullish bias is getting stronger and is expected to persist in the medium term – negating the previous bearish candlestick during the pullback. As such, no change to positive bias, unless the momentum reverses.

Traders should maintain the long positions initiated at 1,436.50 points, or the closing level of 20 Oct. To protect the downside risks, the stop-loss is set at 1,418 points.

The immediate support is at 1,441 points – 25 Oct’s low –followed by 1,418 points, which was the high of 26 Sep. The

immediate resistance is pegged at 1,463 points, or 20 Sep’s high, followed by 1,493.50 points ie the high of 12 Sep.