RHB Research has once again maintained short positions on HSI futures.

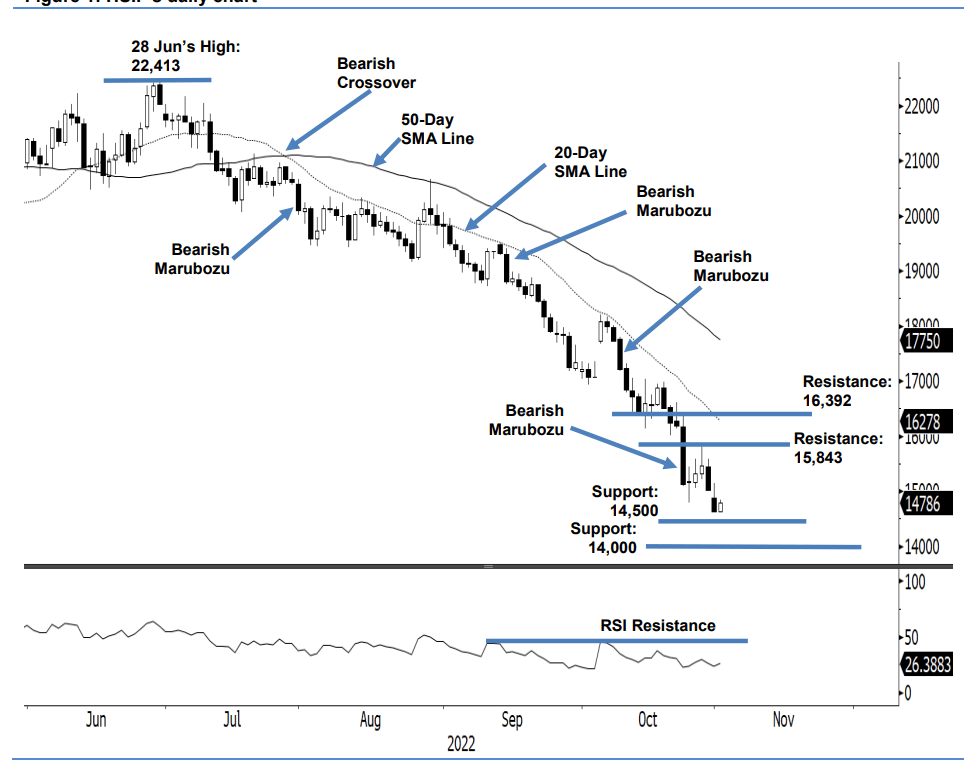

The HSIF extended its correction during October’s last trading session, declining 384 pts and closing weaker at 14,637 points. The index started off at 14,888 points. After touching the 15,144-point session high, it then progressed lower until it hit the 14,615-point session low before the close. In the evening, it recouped 149 points and last traded at 14,786 points. The latest negative price action saw the HSIF charting a fresh “lower high” with “lower low”, further strengthening the bearish structure. As the RSI is turning lower, the bearish momentum should accelerate in the coming sessions, heading southwards to 14,500 points and then 14,000 points. So far there are no signs of a technical rebound yet. In the event the index stages a rebound, it will test the 15,843-point immediate resistance. As the bears are gripping the HSIF stronger, the research house retains the negative bias.

Traders are advised to retain short positions initiated at 17,221 points or the close of 10 Oct. To manage the trading

risks, the stop-loss threshold is placed at 17,000 points.

The immediate support is revised to 14,500 points, followed by 14,000 points. On the upside, the nearest resistance is

pegged at 15,843 points – 27 Oct’s high – and followed by 16,392 points, ie the high of 24 Oct.