RHB Research has maintained short positions on HSI futures despite the recent rebound.

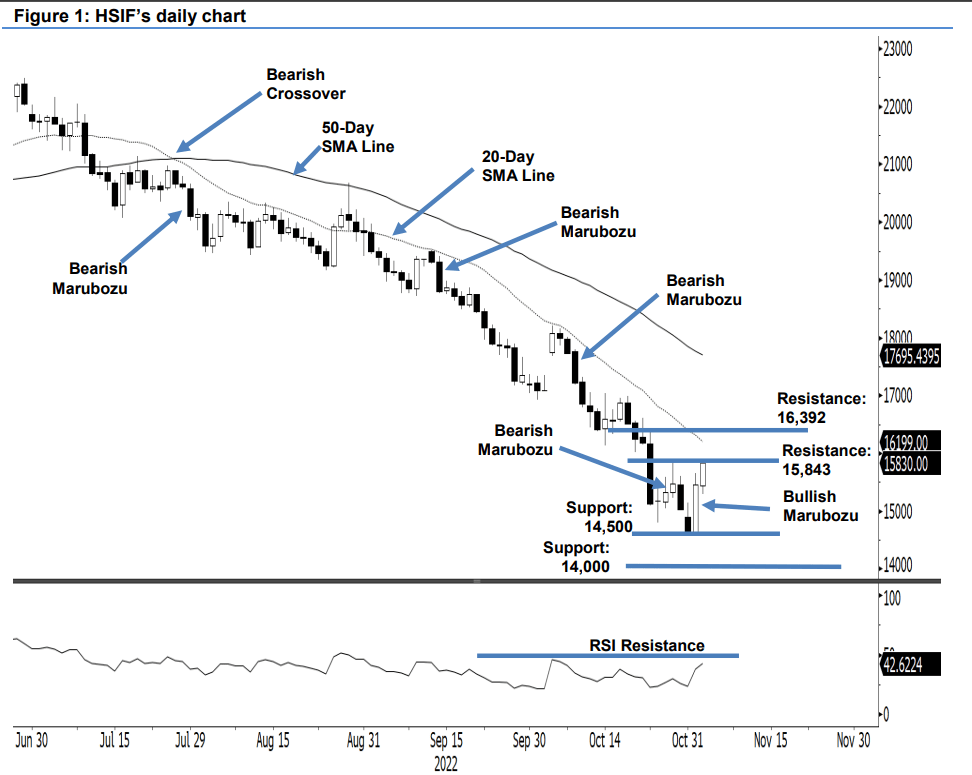

The HSIF extended its upside movement for a second consecutive session yesterday, climbing 374 points and closing at 15,830 points – just shy of the 15,843-point resistance. The index started off at 15,441 points and, after forming the day’s low at 15,284 points, rebounded to touch the day’s high at 15,888 points before the close.

Note: Due to weather conditions, the after-hours market was called off yesterday. We see the HSIF attempting to break past the immediate resistance to form a fresh “higher high”. If a breakout happens, it should scale higher towards the 20-day SMA line. It is observed the index trading below the moving average line since 30 Aug. Climbing above this line should attract further buying interest, suggesting an uptrend. Since the HSIF is trading below the 20-day SMA line for now, no change to negative bias until a bullish breakout happens.

We advise traders to hold on to the short positions initiated at 17,221 points or the close of 10 Oct. To manage the

trading risks, the stop-loss threshold is set at 16,392 points.

The immediate support is revised to 14,615 points – 31 Oct’s low – and followed by 14,000 points. Towards the upside, the nearest resistance is pegged at 15,843 points – 27 Oct’s high – and followed by 16,392 points, which was 24 Oct’s high.