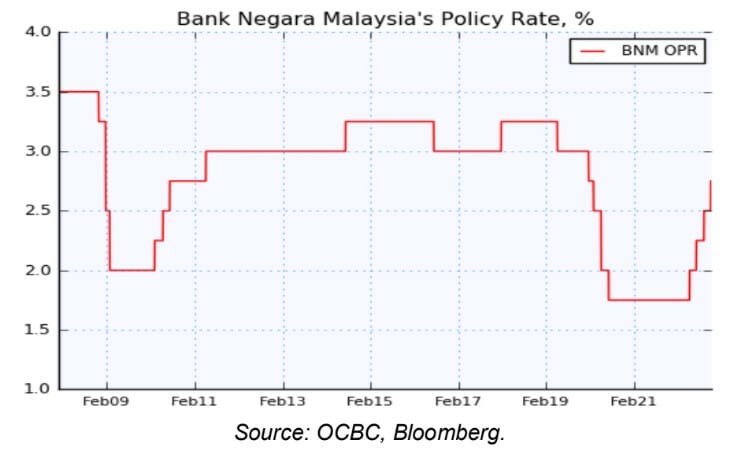

Bank Negara Malaysia’s (BNM) decision on Nov 3 to raise its OPR by another 25bps – for the 4th time running – is in line with broad market expectations but diverged from our view of a pause.

OCBC Treasury Research had assumed that a relative amelioration of inflation pressure would give them more room to focus on growth risk ahead. To be sure, the research house noted that the headline inflation is likely to have peaked in 3Q, 2022, but it continued to strike a wary tone, highlighting how the balance of risk is tilted to the upside.

“Moving into 2023,” it noted, “headline and core inflation are expected to remain elevated amid both demand and cost pressures, as well as changes to domestic policy measures.”

Meanwhile, it said that global growth will face headwinds.

BNM pointed out how downside factors such as “rising cost pressures, tighter global financial conditions, and strict containment measures in China” would “more than offset the support from positive labour market conditions, and the full reopening of most economies and international borders.”

Such global headwinds which BNM acknowledged in its statement, would cause a moderation in external demand, even as it continued to note how robust domestic demand will remain the key driver of Malaysia’s growth. In particular, household consumption “will continue to be underpinned by improvements in labour market conditions and income prospects.”

Overall, its decision today is another notch up in its recalibration drive to normalise the policy rate setting. Even as it tacitly warned of the need to manage the risk of excessive demand, however, we see it coming closer to the end of the tightening cycle than before. As much as inflation seems to weigh more than growth on the BNM’s mind now, the balance may well shift to the flip side in the coming months given the global uncertainties.

Having raised rates to 2.75% now, the runway to continue ratcheting up the OPR further is getting more limited, naturally. To us, it is likely to take just one more hike in early next year to 3.0%. Thereafter, we think BNM will perch at that level to survey the global landscape more carefully, to assess any need to move further, the research house cited.