RHB Research has released its Market Strategy report on Shariah and ESG with research house reiterates its view that both Shariah and ESG investing principles are gaining momentum.

The pandemic has fast-tracked ESG investing and investments into the mainstream, as well as their effects on societies, the supply chain, and direct financial risks. Climate change is also becoming more apparent and will spur demand for more ESG investments, in the research house’s view, as investors and businesses look beyond mere profitability and consider their impacts on people and the planet. With asset under management (AUM) of Malaysia’s Islamic funds growing at a robust 11-year CAGR of 15%, this augurs well for shariah-ESG investing to grow exponentially.

For the second time, RHB – in collaboration with Bursa Malaysia – organised a thematic conference on 10 Nov with the topic When Shariah Meets ESG: The Next Level.

It was presented by Saturna Capital Vice President & Chief Investment Officer Scott Klimo, Kumpulan Wang Persaraan (KWAP) Vice President Rizal Mohamed Ali, Fitch Ratings Dubai Branch Global Head of Islamic Finance Bashar Al Natoor, and S&P Global Ratings Dubai Branch Senior Director Financial Services Dr Mohamed Damak.

Positive development led by the regulators. The good infrastructure, led by the regulators, has acted as catalysts to enable the environment in ESG to move forward in the industry. Among the examples are FTSE4Good ESG

ratings to encourage listed companies to adopt good ESG practices; ESG practices aligned to the United Nations’ Sustainable Development Goals or SDGs; Joint Committee on Climate Change by Bank Negara Malaysia and Securities Commission for sustainable finance; strengthening the roles and impact of Islamic banks on a sustainable financial ecosystem via Value-Based Intermediation or VBI.

Boosting ESG practices. The on-going incentives and growing awareness – via educating the community – have also been played well by the regulators for future sustainable growth developments. These can be observed from the: i) Fiscal and financial incentives given for businesses to obtain ESG ratings, ii) joint efforts between the public and private sectors (including matching funds) to develop best practices, and iii) annual national awareness campaigns to increase the adoption of ESG and SDG principles.

The push factors. The investee firms owned by institutional investors with ESG mandates need to adhere to the policies and guidelines in line with the ESG practices – failing which they need to consider divestment risks.

The next level. The growth drivers for the ESG-shariah investment would mature from regulator- to investor-driven as demanded by the large institutional funds with ESG mandates. The growing number of listed companies in the Bursa FTSE4Good Bursa Malaysia Shariah Index should also drive the listed entities to be part of the component members.

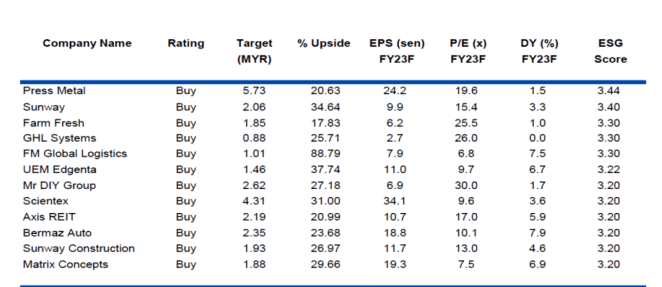

The table below shows the shariah Top Picks with the highest ESG scores under the research house’s coverage.